31

May

2023

31

May

2023

ISET Economist Blog

Friday,

30

November,

2018

Friday,

30

November,

2018

Friday,

30

November,

2018

Friday,

30

November,

2018

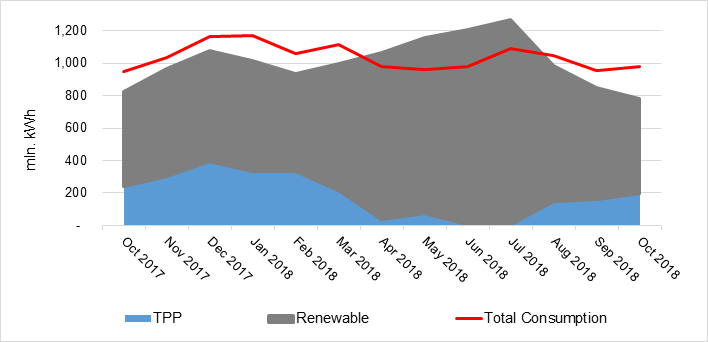

After the generation deficit of September, the decreasing trend in generation continues, while the gap between consumption and generation keeps widening. Chiefly, compared to September, total electricity generation has decreased by 8% in October 2018, while in contrast with the previous October 2017, electricity generation has decreased by 5%. This reduction in generation on a yearly basis is specifically due to the decrease in hydropower (-1%) and thermal power generation (-17%), which more than offsets the increase in WPP generation (+4%). Whereas, the monthly decline in a total generation was due to a reduction in electricity produced by renewable sources (-15%), more than offsetting the increase of thermal power generation (+23%). Georgian power plants generated 783 mln. kWh of electricity, while consumption of electricity on the local market was 978 mln. kWh. It should be noted that electricity consumption has increased by 2% from September of this year (2018), whereas compared to October 2017, electricity consumption has increased by 3%.

Figure 1. Electricity Consumption and Generation (mln. kWh)

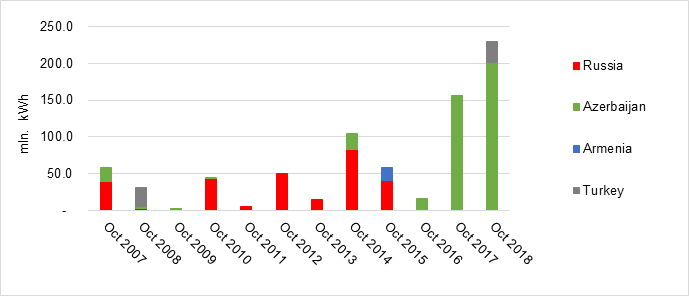

In order to satisfy the demand for electricity, and close the gap between generation and consumption, Georgia had to increase the amount of imported electricity. The volume of imported electricity amounted to 230 mln. kWh, of which 88% was imported from Azerbaijan and the remaining 12% from Turkey. According to Geostat data, imports in October 2018 revealed the highest value observed over the last eleven years.

Figure 2. Imports (mln. kWh)

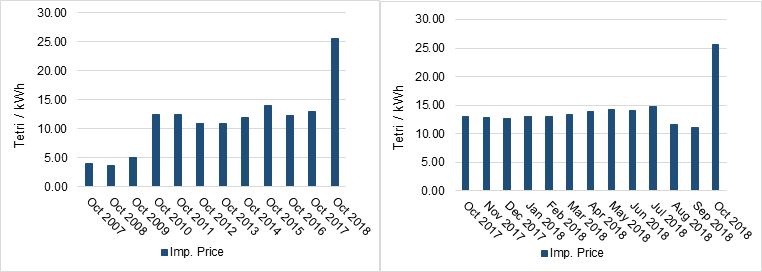

Based on Geostat’s imported volumes and total payments, the import prices in October seem to have increased dramatically since September (over two times greater, from 4¢-11 tetri to 9.6¢ - 25.65 tetri). A significant element of this increase in the national currency seems to be due to the real dollar value of electricity, combined with GEL depreciation against the dollar (a reduction of 2% since September1). In order to consider seasonal effects on electricity rates, we should compare the prices from October over the years. In October 2018, import prices exhibited their highest historical value (Figure 3). Moreover, if we compare estimated prices, only within the last two years (using the methodology), the prices of imported electricity in October 2018 seem to have almost doubled (from 5¢-13 tetri to 9.6¢ - 25.65 tetri). In this instance, prices in the national currency increased by 97%, mostly due to a real increase in the dollar price (+92%) and additional currency depreciation against the dollar.

Figure 3. Prices Import in October (tetri/kWh)2 Figure 4. Prices Import (tetri/kWh)

A few questions arise from analyzing the data. Firstly, if the jump in price was real, why would Georgia have increased imports rather than intensifying generation from thermal power plants, which throughout October were generating at less than half their potential capacity? Secondly, simply put, was the jump real? Finally, what can one say, based on the data, about the evolution of the Georgian electricity market?

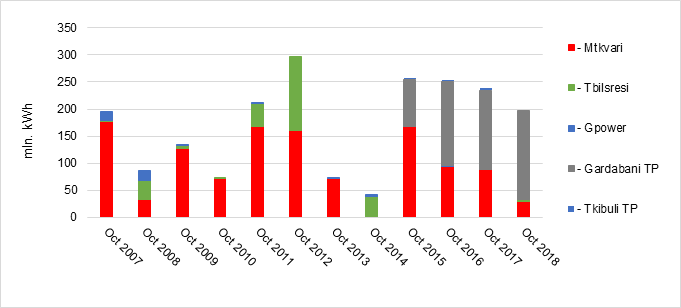

Let’s first have a look at the historical trend of thermal power plant (TPP) generation in the month of October. From 2007 to 2015, three TPPs, Mtkvari, Tbilsresi, and Gpower3 were operating on the Georgian electricity market. From 2015 onwards, Gardabani TP and Tkibuli TP joined the system. While, since its entry Tkibuli has been providing a negligible amount of electricity to the system, during the month of October at least, Gardabani TP has always produced a substantial share of total TPP generation and has remained in the lead position since 2016 (Figure 5).

Over the last four years, in the month of October, we can observe a decreasing trend in TPP generation. While Gardabani TP has increased its generation, this is offset by a substantial decrease in generation by Mtkvari (Figure 5).

Figure 5. Thermal Power Generation (mln. kWh)

Why did TPPs, and in particular Mtkvari, cut down generation in October, despite the continuous increase in demand? This is puzzling, particularly as import prices seem to have skyrocketed in the month of October. One possibility may be underscored by the existence of technical problems. However, according to the representatives of Mtkvari TPP that we managed to contact, there were no technical problems causing a reduction in electricity generation and the decreased electivity provision can be entirely attributed to low demand.

Why then was the gap filled with (apparently) expensive electricity imports? Could it be due to the fact that the generation costs associated with TPPs increased so much that electricity imports remained cheaper? The main determinant of the cost of electricity generated by TPPs is the price of their main input - natural gas. So, theoretically, an increase in natural gas prices could lead to an equivalent increase in TPP-generated electricity. However, there is currently a social gas tariff for thermal power generation. Specifically, thermal power plants are paying the GEL equivalent of $143 per thousand cubic meters of gas. Moreover, TPP tariffs for electricity generation are defined each year in the national currency. Consequently, we should in no case expect a short-term spike in the price of electricity generated by TPPs. And, as TPPs are obliged to supply electricity to the system,4 this pattern seems to be incompatible with rational behavior (if the import prices really were as high as they appear in Geostat data).

An alternative explanation would be that the Geostat data is wrong, and significantly. The unofficial sources contacted have pointed us in that direction, suggesting that a more realistic price for imports over the month of October would be around 5.5¢ (14.63 tetri), with the highest prices, found nearer the end of the month. This information would be extremely helpful in explaining the observable patterns in the electricity market, with TPP generation increasing exactly as import prices peak. Therefore, the trend of import prices seems to be increasing (an October price of 14.63 tetri, while dramatically lower than our estimates based on Geostat data, would still be one of the highest on record), though nowhere near the extent of 25.65 tetri per kWh. This would call for Geostat to carefully reexamine its data on electricity imports to find the source of the (likely) glitch and to make sure its statistics remain accurate.

And what can be said of Georgia’s increasing trend in electricity imports? They continue, probably because import prices while increasing, are still lower than the price of internally-generated TPP-electricity. While in the short-term Georgian consumers may see a positive trend, with importing cheaper electricity potentially lowering their electricity bills. This, however, raises questions about the long-term energy security of the country. There is little incentive to invest in new generation capacity if, even in the presence of a gap between internal generation and domestic consumption, the current capacity is only partly utilized (and this might reflect in greater dependence and vulnerability from international shocks in the future).

1 Comparing official monthly average exchange rates published by the National Bank of Georgia (NBG).

2 Data is provided in US dollars and is converted to GEL using the average monthly exchange rate as reported by NBG.

3 From 2007-2011 Energy Invest was in operation, in December 2010, Gpower purchased Energy Invest and now operates on the market with its new name.

4 www.esco.ge