31

May

2023

31

May

2023

ISET Economist Blog

Monday,

05

November,

2018

Monday,

05

November,

2018

Monday,

05

November,

2018

Monday,

05

November,

2018

After a generation deficit of August, Georgia continues to exhibit a decreasing trend in power generation; compared to August, total electricity generation has decreased by 14% in September 2018. Georgian power plants generated 849 mln. kWh of electricity, while consumption of electricity on the local market was 955 mln. kWh. It should be noted that compared to August, electricity consumption has decreased by 9%. Even though consumption decreased substantially during the month of September, Georgia had to import electricity from foreign power markets.

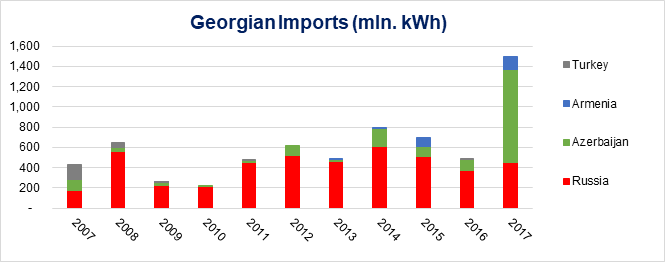

Over the last 11 years, Georgia had four partners in electricity trading, namely Turkey, Armenia, Azerbaijan, and Russia. However, only two of them are the main electricity exporters to Georgia. For years, Russia was the leading provider of electricity to the country. However, the situation changed in 2017, when imports from Azerbaijan outpaced those from Russia (Figure 1). This was good news for Georgians, who have had an unfavorable political relationship with their northern neighbors, as it was the first time since 2007 that Georgia managed to diversify its electricity imports and decrease the risk of energy dependence from Russia.

Figure 1. Georgian Imports (mln. kWh)

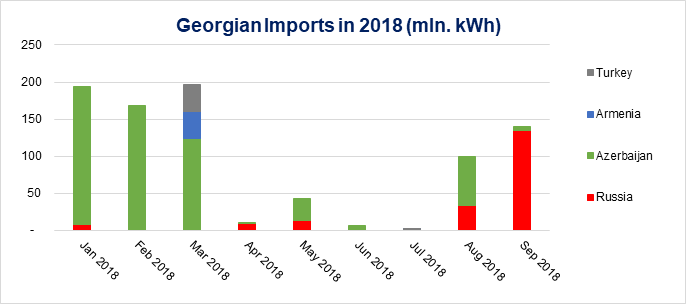

The trend continued in2018, when – most of the time – Azerbaijan maintained the largest share in total imports, with the exceptions of April and September. In April, 91% of imported electricity (11 mln kWh) came from Russia. In September, however, the share of electricity imported from Russia jumped to a whopping 97% of total imported electricity and, most importantly, grew substantially in absolute terms (139,46 mln kWh – 13.5 times more than in April). It is also worth noting that the amount of total imported electricity in September increased by 40% compared to the previous month. The increase came all from Russia (+297% with respect to August), while the imports from Azerbaijan dropped by 93 %. (Figure 2).

On a yearly basis, in September 2018 imports increased by 5% compared to the same period of the previous year. The increase in imports from Russia, however, was 258%, while imports from Azerbaijan decreased by 94%. (figure3)The crucial questions now are the following: is this just a one-time event or is Russia going to become once again the main provider of electricity to the Georgian electric system in the periods of electricity deficit, starting from the upcoming winter season? Is this bad for Georgia?

Figure 2. Georgian Imports in 2018 (mln. kWh)

Figure 3. Georgian Imports in September (mln. kWh)

To answer these questions, we explored the reasons behind the sudden surge in imports from Russia. According to ESCO data, over the years most of the imported electricity was purchased on the balancing market. The decision about where to purchase foreign electricity on the balancing market depends on the prices the providers are offering, with the lower price provider supplying balancing electricity to the country. If this rule has been followed also this month – which we think is the case – this means that Russian electricity prices were lower than the prices offered by Azerbaijan. Assuming relative stability in Azerbaijani export prices, this would imply an overall decline in import prices for Georgia. Indeed, in September 2018 import prices declined by 8% compared to the previous year (Figure 4), as of August 2018 import prices have decreased by 6% (Figure 5).

Figure 4. Import Price in 2018 (Tetri / kWh) Figure 5. Import Price in September (Tetri / kWh)

Investigating the official website of the electricity system operator of Russia, we found out that electricity generation and consumption have both increased by 2% in the month of September, compared to August. Moreover, in both months generation substantially exceeded consumption by 64423.29 MWh and 69192.67 MWh respectively. Hence, there was a 7% growth in the electricity available for exports, which might explain the price decrease.

Another factor affecting import prices could be the currency utilized for settlement. Currently, electricity is traded in dollars on the balancing market. Even though the Russian Ruble has depreciated by 2% against the USD dollar in September, compared to the previous month, according to the Central Bank of the Russian Federation.1 the Georgian Lari has depreciated by 3%2 against the USD dollar over the same period. This evidence supports, therefore, the idea that the decline in the price of imported electricity is likely due to a greater surplus of electricity in Russia.

More questions follow from this finding. Will Russia be able to increase generation even more and offer a lower price compared to Azerbaijan? Is this development positive or negative for Georgia? In the short term, Georgian consumers and firms can benefit from lower import prices. On the other hand, however, if this trend was to continue, it might imply lower incentives to invest in new generation capacity on the Georgian market and – as a result, a greater dependence on foreign electricity (potentially leading to energy security issues). What should be, in this case, the response of the Georgian government? These are all interesting questions that, in due time, will need an answer to. For the moment, what is certain is that the evolution of electricity imports should be monitored carefully in the months to come.

1 Monthly exchange rate was calculated as the average of the daily rate based on the data from the Central Bank of the Russian Federation

2 Monthly exchange rates were compared based on NBG data