31

May

2023

31

May

2023

ISET Economist Blog

Monday,

04

March,

2019

Monday,

04

March,

2019

Monday,

04

March,

2019

Monday,

04

March,

2019

Winter has always been a problem for the Georgian electricity system. Even though Georgia has plenty of hydropower, during this season several HPPs — seasonal and small — either stop or substantially reduce electricity generation. In this season, a significant share of hydropower generation comes from two large-scale state-owned pumped-storage HPPs: Enguri and Vardnili. However, exactly when the generation-consumption gap is the largest, most of the electricity produced is used to satisfy the consumption of the Abkhazia region, which on a yearly basis consumes as much electricity as Tbilisi, something we have mentioned in one of our previous articles. This is a costly arrangement for Georgia, as the cheap electricity produced by Enguri and Vardnili de facto cannot contribute to satisfying the demands of the Georgian electricity market and, therefore, lowering the cost of electricity bills paid by Georgian families. On the contrary, due to existing arrangements as well as to generation and consumption trends, it is likely that in the near future, Georgians will have to bear additional costs to continue providing free electricity to the separatist region.

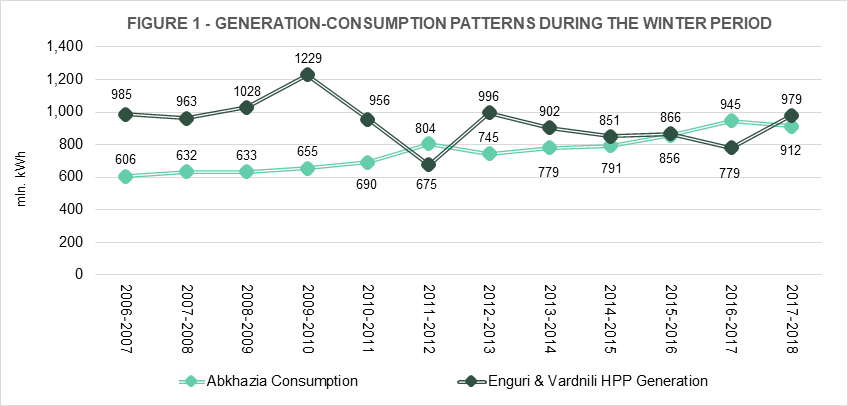

The share of Enguri and Vardnili in the total installed capacity of HPPs is 48 % (1520 MW out of 3148 MW). As for generation potential in the winter season, Enguri and Vardnili HPPs provided between 35% and 46% of the total HPP production over the 2006-2018 period. Historically, the lowest generation share (35%) occurred during the winter of 2015-2016, while the maximum generation share (46%) was seen four times during 2006-2009 and the winter of 2012-2013. In 2017-2018, the share of Enguri and Vardnili in total hydro generation was 36%, while their share in total electricity generated from regulatory HPPs was 73%.

Even though it seems that these two power plants have the capacity to satisfy a substantial share of Georgian demand, in winter most of their production goes to Abkhazia. There were even cases (winter 2011-2012 and winter 2016-2017) when Enguri and Vardnili’s generation was not sufficient to satisfy Abkhazian demand. In winter 2016-17, Abkhazia’s consumption exceeded generation by 166 mln kWh, requiring other sources to fill the gap. At this stage, therefore, Georgia provides Abkhazia with electricity free of charge even when Enguri and Vardnili HPPs generation does not generate enough electricity. In 2017-2018, despite a positive overall gap between Enguri and Vardnili generation and Abkhazian consumption, 93% of the electricity generated by these power plants was used to satisfy Abkhazian consumption.

The fluctuation of generation from Enguri and Vardnili between the winters of 2016 and 2017 was apparently determined by different meteorological patterns and by the choices regarding pumped storage in the reservoir. In fact, even though average precipitation in the winters of 2016-2017 and 2017-2018 was almost the same, average precipitation in the spring, summer, and autumn of 2016 was lower than in 2017 (according to precipitation statistics from the nearest meteorological station). While pumping back more water could have contributed to stabilizing generation (obviously at a cost), this did not happen. Consequently, the generation of Enguri and Vardnili in 2017-2018 was substantially higher.

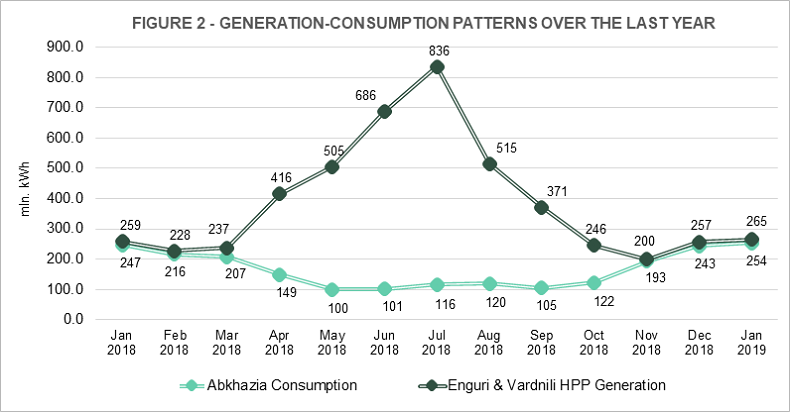

As we write this article, it is not clear whether Enguri and Vardnili’s generation will be enough to satisfy Abkhazia’s consumption this winter or if, instead, Georgia will need to buy the needed electricity from Thermal Power Plants (TPPs) or foreign sources. In January 2019, Enguri and Vardnili HPPs increased their generation by 2% compared to January 2018, while the monthly increase (with respect to December 2018) was 3%. This is associated with an increase in precipitation over the last months. During the last three months, including February, precipitation has been more than four times that of last year. However, precipitation in spring, summer, and autumn of 2018 was low compared to 2017. Moreover, as we do not have information about the water level in the Enguri and Vardnili HPPs’ reservoirs, an accurate prediction of total generation this winter season is currently impossible.

Figure 1. Generation-consumption patterns during the winter period

On the demand side, tariffs in Abkhazia remain low (0.4 rubles=1.6 tetri=0.6 US cents per kWh) for households and for legal entities2 (0.85 rubles=3.4 tetri=1.3 US cents per kWh). This, clearly, creates incentives to overconsume. Overall, consumption from Abkhazia has been increasing almost steadily over the 2007-2018 period, with only two temporary reductions in consumption, first in 2013 and, recently, in 2018 (a 3% decrease compared to the 2017 winter season). In January 2019, Abkhazia again increased its consumption by 3% compared to January 2018, while the monthly increase (with respect to December 2018) was 5%. Luckily (Figure 2), as we mentioned above, this winter the generation of the two HPPs also increased, matching (so far) the increase in demand.

Figure 2. Generation-consumption patterns over the last year

All in all, however, the margin seems to be narrow and a particularly dry winter or an acceleration in electricity demand from Abkhazia could quickly lead (once more) to the emergence of a negative gap. As mentioned early on, this would force Georgia to increase its imports or to increase the internal generation from TPPs, leading to additional costs and reducing the country’s energy security.

This aspect becomes even more concerning if we consider the existing trend in the Georgian electricity market toward increased reliance on relatively expensive imports and generation from TPPs (burning imported gas) to cover the gap between hydropower generation and electricity demand. The current situation, in our opinion, calls for a concerted effort to correct the distorted incentives faced by Abkhazian (and other Georgian) consumers and to allow for the employment of electricity generated by Enguri and Vardnili in a way that maximizes its contribution to the well-being of all Georgian citizens (especially in winter).

As the Georgian market is heading towards a major restructuring, leading in the government’s plans to a competitive wholesale (and, later, retail) electricity market, solving the Enguri-Vardnili-Abkhazia puzzle is becoming, therefore, an even greater priority.