Indexes

17

June

2015

17

June

2015

17

June

2015

17

June

2015

After relatively high GDP growth in February and March, the Georgian economy slowed down considerably in April. According to Geostat’s rapid estimates, GDP grew by only 0.9% annually in the reporting month. Consequently, in the first four months of 2015, the Georgian economy expanded by 2.6%. ISET’s GDP forecast for the second quarter of 2015 is 5.1%, which seems to be rather over-optimistic given the grim start of the quarter.

The IMF’s estimated GDP growth for 2015 stands at about 2%; however, risks of downward pressure have recently increased. Moreover, the Business Confidence Index (BCI), ISET-PI’s quarterly publication reporting business’ expectations, hit its historical minimum in the second quarter of 2015. Meanwhile, the Consumer Confidence Index (CCI), another ISET-PI publication, has remained at its minimum level for four consecutive months.

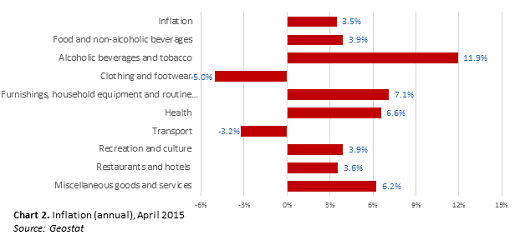

The annual inflation on consumption goods is still relatively low. In May, annual CPI inflation amounted to just 3.5%. Prices increased on food and non-alcoholic beverages by 3.9%, on alcoholic beverages by 11.9%, on furnishings and household equipment by 7.1%, and on healthcare by 6.6%. Prices decreased in annual terms on the clothing and footwear and transport groups. In monthly terms, average prices on consumer goods increased by 0.6% between April and May. The main driving factor of monthly inflation was the 3% price increase in the transport group. In April, annual PPI inflation amounted to 8.7%.

In the banking sector, the number of loans to both legal entities and households continued to grow. By the end of April, total bank loans to the economy amounted to 14.2 billion USD, of which 52% was given to legal entities and the rest to households. In April, loans to both legal entities and households increased by 36% annually and amounted to 7.4 and 6.8 billion USD respectively. As Chart 3 shows, there has been a prominent shift in the growth rate of loans to legal entities in 2015. One of the explanations for this shift is the currency composition of loans provided to legal entities. About 80% of bank loans to legal entities are denominated in foreign currencies, mainly in dollars, while only 53% of household loans are in foreign currency. The depreciation of the national currency thus “inflated” (in lari terms) the number of loans to legal entities much more than was the case with household loans.