10

July

2023

10

July

2023

ISET Economist Blog

Friday,

18

September,

2015

Friday,

18

September,

2015

Georgian consumer confidence suffered a major blow at the end of 2014, in the wake of the sharp Lari depreciation. Around February 2015, the Index found some support at the very low level of -35-30 points and has been slightly improving since then. In July 2015, this mildly positive trend was reversed, and in August, the Index dropped another 4.1 points to reach a new historical minimum of -38.4 points. Interestingly, this entire drop was driven by older respondents, those aged over 35. We will come back to this point later in the article.

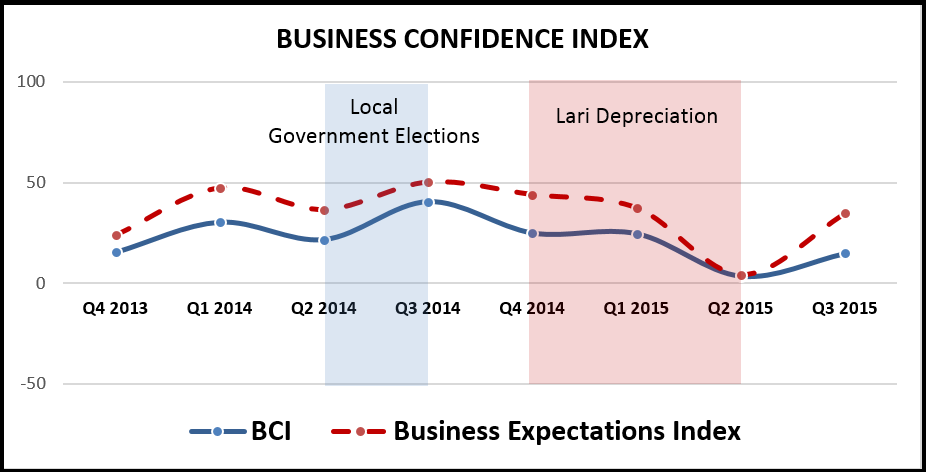

At the same time, Georgian business companies also appear to be rattled by the Lari depreciation. Coming with a lag, after seven months during which consumer demand and sales have been declining, the Georgian Business Confidence Index (BCI) took a major hit in the second quarter of 2015. The BCI dropped a whopping 24.5 points to an all-time low of 3.6 on a scale of [-100; 100] points. Conducted in April 2015, the survey, which included 168 firms, suggested that business confidence declined on all measures, across all sectors, and for all firm sizes. Moreover, a deep sense of pessimism was reflected in business perceptions concerning current performance as well as expectations concerning the future.

The third-quarter business confidence data drew a much rosier picture. About one-half of all 211 surveyed firms reported going through some difficulties in Q2 (reflected in low sales, turnover, or production numbers), confirming what we have already known from our previous survey. Yet, businesses are once again quite a bit more optimistic when it comes to the future. Business expectations went up by 30 index points, almost fully compensating for the loss of confidence in Q2 2015.

What can we learn from the recent ups and downs in the consumer and business confidence indices? And, more importantly, what shall we (as well as Georgia’s policymakers and politicians) do about them?

First, we should clarify that “confidence” measures, such as consumer and business indices, are not a matter of purely academic interest. People’s perceptions are shaped by their past and current experiences. Yet, – and this is an absolutely crucial point – perceptions also matter greatly for individual and business decisions that affect the future. One’s degree of optimism (or pessimism) affects both “microeconomic” behavior (to take a mortgage and buy an apartment or wait another few years; to invest today or tomorrow, and how much) and aggregate “macroeconomic” performance.

Economists have long recognized that economic decisions (and outcomes) are not independent of perceptions. Too much cautiousness on the part of, say, bankers can either deepen a downturn or put a brake on economic growth. For this reason, consumer and business confidences are part and parcel of various business cycle theories in economics. Business confidence is considered a supply-side factor, affecting investment, production, and pricing decisions. Likewise, consumer confidence is a demand factor, affecting people’s spending. (In Georgia, domestic consumers make up about 86% of total demand faced by Georgian producers, hence their importance for the economy.) By affecting both supply and demand conditions, business and consumer confidence ultimately impact all macroeconomic variables: the level of income, prices, and employment, among others.

Given that changes in perceptions, as measured by confidence surveys, are both a cause and effect of real economic developments, the academic literature abounds with conflicting empirical evidence on whether it is the confidence that drives the business cycles or the other way around. Some authors, such as Salmond (2009) argue that confidence measures are over-rated as a causal factor, and tend to over-estimate the impact of politics and media (major drivers of public perceptions). Others, such as Leduc and Still (2010) argue the opposite.

Academic researchers may remain forever divided on the relative strength of the causal mechanisms underlying business cycles. Yet, there is no arguing that public perceptions and expectations have at least some power in shaping economic developments. A case in point is the short-lived recession afflicting the US economy after Iraq’s invasion of Kuwait in the third quarter of 1990 (a textbook example in Olivier Blanchard’s Macroeconomics). Worried that the United States might get involved in a prolonged and costly war, consumers cut down on expenditures well before the Gulf War had actually started, bringing the economy into an unexpected two-quarter recession.

Now, if expectations and public opinion matter, more attention should be paid to those who shape them: policymakers, politicians, and the media.

Our expectations are shaped by our personal experiences (e.g. our sales performance and the treatment we get at the hands of the local tax inspector) as well as by what we hear about other developments in the economy, developments of which we have no first-hand knowledge. Few Georgians have an intimate understanding of the mandate and procedures used by the National Bank of Georgia or see any direct benefits related to, say, Georgia’s Association Agreement with the European Union. Likewise, few Georgian consumers are fully informed about (or see any immediate benefits in) the continuous improvement of Georgia’s sea, air, rail, and road transport infrastructure. Here is where the media (mostly TV, but, increasingly, social networks and online news portals) come into play. The media are in the business of filtering, repackaging, and amplifying political messages. They (and their owners and editors) can choose how much air time should be devoted to positive as opposed to negative news, and how to present information to the public.

The political process in any system is very much about control of media. Unlike oligarchies and totalitarian regimes, a democratic polity presupposes not only competitive elections but also competitive and diverse media, allowing people sufficient choice of (biased) information sources. Just how competitive are Georgian media is a matter of scrutiny by Georgian media experts, not economists. What we do observe in our data, however, is that Georgian consumers’ perceptions vary quite sharply depending on the type of media to which they are exposed.

Whereas all Georgian consumers (and businesses) were equally affected by the sharp Lari devaluation in late 2014, over the past 6 months, we observe a slow but steady improvement in the confidence of younger consumers. In August 2015, the CCI for the younger population (below 35) climbed to -30.3 points (up 1.2 points). The opposite movement was recorded for those above 35, bringing the gap in consumer confidence between these two age groups to 14 points. There may be many reasons for this divergence in perceptions. At least one of them, however, is likely to be related to the much higher TV dependence of older Georgians. It is quite likely that the older generation is more affected by the televised hysteria surrounding the ups and downs of the Lari and the supposed “failure” of the National Bank of Georgia to maintain exchange rate stability.

As Georgia enters an important elections year, we are likely to see more and more political bickering and mutual accusations that do little to improve anybody’s confidence in Georgian statehood, its economy, and politics. What could help the Georgian economy at a time like that is sober economic analysis, open and professional discussion of available options and dialog among the various parties. Unfortunately, little of this will happen in the coming 11 months, limiting the chances for a quick recovery in expectations and, consequently, economic growth.