24

May

2023

24

May

2023

ISET Economist Blog

Monday,

10

July,

2023

Monday,

10

July,

2023

Monday,

10

July,

2023

Monday,

10

July,

2023

Acknowledgment: we would like to thank Zviad Pochkhua of The Financial for his valuable comments and feedback.

* * *

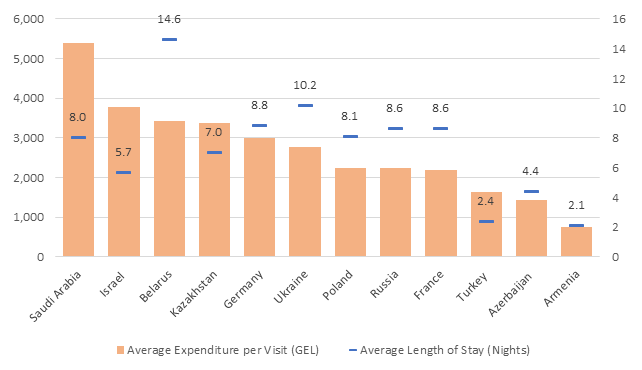

In 2022, Georgia’s tourism sector still heavily relied on visitors from neighboring countries. The combined share of Russia, Turkey, Armenia, and Azerbaijan accounted for 62% of the total international visitors' trips. It is important to note that these countries had relatively low levels of expenditure per visit. On average, visitors from Russia spent 2,240 Gel per visit, visitors from Turkey spent 1,636 Gel, visitors from Armenia spent 757 Gel, and visitors from Azerbaijan had an average expenditure of 1,447 Gel per visit. In comparison, among the top tourism source markets in 2022, Saudi Arabia, Israel, and Kazakhstan had the highest average expenditure per visit. Saudi Arabian visitors spent an average of 5,391 Gel per trip, visitors from Israel spent 3,781 Gel, and visitors from Kazakhstan spent 3,387 Gel. However, despite their higher spending, these countries accounted for only 10% of the total international visits. Accordingly, one of the main challenges in attracting high-spending tourists to Georgia lies in diversifying the international tourism source markets.

Attracting high-spending international tourists and diversifying target markets are Georgia's top tourism development priorities. This objective is included in the Georgian Tourism Development Strategy 2025, the Government Program 2021-2024, and the framework for the planned Tourism Sector Reform. The aforementioned reform is aimed at enhancing the quality of tourist services, the protection of consumer rights, and the enforcement of safety standards in an effort to attract high-spending visitors to the country and increase the revenue generated from international visits.

With regard to the aforementioned, the purpose of this article is to assess Georgia's post-pandemic progress in attracting high-spending travelers and to analyze global trends in this direction. In order to identify source markets of the high-spending tourists, the countries with the highest outbound tourism expenditure and average spending per visit are determined.

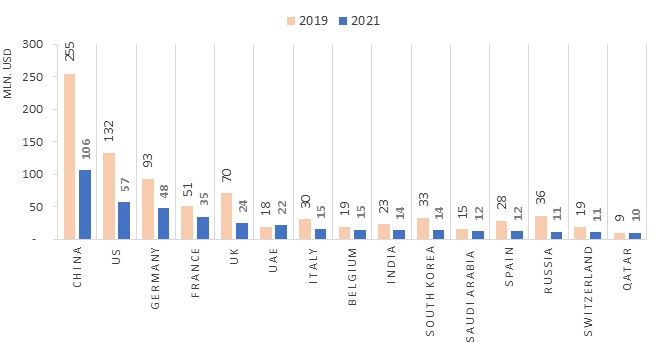

It should be highlighted that China is one of the world's fastest-growing markets for international tourism. Despite a 58% decrease in outbound tourism expenditure during the pandemic, in 2021, China still was the leading country in this regard. The United States is second, followed by Germany and France. Furthermore, the recovery rate of outbound tourism for China in 2019-2021 was 41%, 43% for the United States, and 51% and 69%, respectively, for Germany and France.

Among the top 15 countries by international tourism expenditure, the United Arab Emirates (118%), Qatar (106%), and Saudi Arabia (80%) have experienced the greatest recovery in the post-pandemic period. It is also worth noting that the EU countries rank high in terms of outbound tourism spending (5 of the top 15 countries are EU member states).

Overall, the evaluation of global tourism trends highlighted the growing significance and progress of Asian and Middle Eastern countries in international tourism, while indicating a relatively weakened standing for Western countries (USA, Germany, United Kingdom, France, Canada, and others) in 2021 compared to their positions in 2019.

Figure N1. International tourism expenditure by country, 2019-2021 (US$ billion)

Source: World Tourism Organization

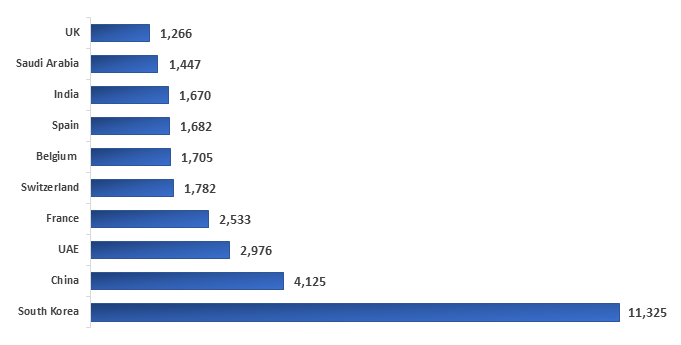

Based on the average expenditure per trip, South Korean tourists emerge as the highest spenders among international travelers. Also, China experienced a significant surge of 151% in its average outbound tourism expenditures between 2019 and 2021, securing the second position with a substantial amount of $4,125. Furthermore, notable increases in average expenditures were observed in the United Arab Emirates (198%), India (96%), and Saudi Arabia (82%) during this period. These rises in average spending by visitors from the Middle East and Asia align with a growing share of their expenditure in the global market. Among the top European countries, France ($2,533), Belgium ($1,705), and Spain ($1,688) stand out with the highest average expenditure per trip.

Figure N2. International tourism expenditure per trip, by country of origin, 2021 (US$)

Source: World Tourism Organization

Upon identifying the primary markets for high-spending tourists worldwide, it becomes compelling to delve into the specific trends within Georgia. Evaluating the issue of attracting high-spending travelers to Georgia requires a comprehensive examination of various indicators, including tourism recovery in the post-pandemic era, revenue generated from tourism, average expenses of international visitors per country, and the duration of their visits.

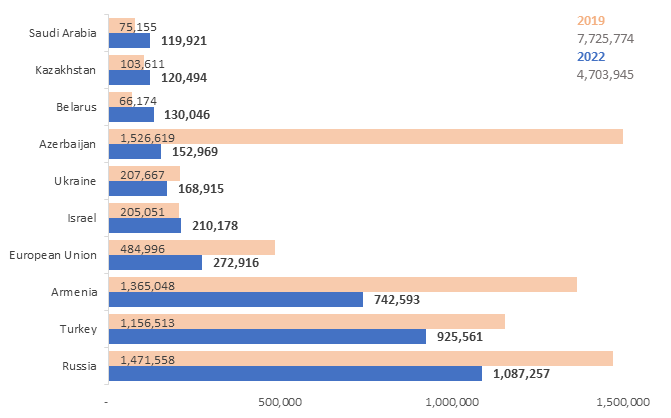

In 2019-2022, the number of international visits to Georgia recovered by 61% (2019: 7.7 million, 2021: 4.7 million). In addition, it should be emphasized that there is a strong positive trend in international tourism receipts. In 2022, the figure has increased to $3.5 billion, which is a 7% increase over the amount in 2019. During the same period, the average duration of international visits increased from 4 nights in 2019 to 6 nights in 2022. By 2022, the average expenditure per visit has been multiplied from 1,102 GEL in 2019 to 2,298 GEL. The rise in international travel receipts can also be attributed to the influence of the Russian-Ukrainian war and the influx of migrants coming to Georgia from Russia, Belarus, and Ukraine.

In regard to the diversification of the source markets of international visitors, it is crucial to highlight Georgia's heavy reliance on visitors from neighboring countries. According to Figure N3, approximately 60% to 70% of the total visits in 2019 and 2022 were attributed to neighboring countries. The share of visitors from EU countries remained unchanged, while the share of visits from other countries increased by 10%. The decline in the share of visitors from neighboring countries during 2019-2022 can be linked to a substantial decrease of 90% in the number of Azerbaijani tourists. The decline in tourist flows from Azerbaijan in 2020 can be attributed to the impact of the COVID-19 pandemic, specifically the closure of the land border by Azerbaijan with its neighboring countries. This closure resulted in a significant reduction in the number of tourists coming from Azerbaijan to Georgia. In terms of the rise in the share of visitors from other countries, notable increases have been observed in the number of visitors from Belarus (97% increase), Kazakhstan (16% increase), Saudi Arabia (60% increase), and Israel (3% increase). In addition, Following the onset of the war between Ukraine and Russia in 2022, there has been a significant surge in the number of visitors from Russia and Belarus.

Based on the data from 2022, the distribution of international visitors by country reveals that the top 10 countries account for 84% of the total international visitor trips.

Figure N3. International visitors trips by country, 2019-2022

Source: Georgian National Tourism Administration

To evaluate the country's current progress in attracting high-spending visitors, it is crucial to assess the average expenditures and length of stay of the visitors from main source markets and compare them with countries identified at the international level. Among the top 10 countries, visitors from Saudi Arabia (5,391 GEL), Israel (3,781 GEL), and Kazakhstan (3,387 GEL) have the highest average expenditures. In the case of visitors from Belarus and Ukraine, their higher spending patterns are related to a longer-than-average duration of visit. Germany's (2,996 GEL) expenditures were the highest among the three EU member states. It is worth noting that among the top source markets of international visitors in Georgia in 2021, countries such as Israel ($1,070), Belarus ($1,178), Saudi Arabia ($1,447), and EU member states (France - $2,543, Germany - $982) were in the category of high spending countries (high expenditure per trip) on an international level.

Figure N4. Average spending and length of stay, by country, 2022

Source: Georgian National Tourism Administration

In conclusion, it is evident that despite the gradual recovery of tourism during the post-pandemic period, accompanied by an increase in income from international tourism, average lengths of stay, and expenditures per trip, there are still challenges associated with diversifying the source markets of international visitors and a high dependence on visitors from neighboring countries. it is important to highlight that the planned reform in the tourism sector aims to diversify and enhance the quality of tourist services, with the goal of attracting a greater number of high-spending visitors to the country. Based on the evaluation of countries with high expenditure on international tourism on a global scale and considering Georgia's existing connections, it is crucial to attract high-spending tourists from target countries in the West, such as the United States and European countries, as well as capitalize on the growing outbound tourism markets of Asia.

* * *

DISCLAIMER: This blog article is made possible by the support of the American people through the United States Agency for International Development (USAID). The contents of this blog do not necessarily reflect the views of USAID or the United States Government.