10

July

2023

10

July

2023

ISET Economist Blog

Thursday,

22

October,

2015

Thursday,

22

October,

2015

Thursday,

22

October,

2015

Thursday,

22

October,

2015

As suggested by ISET’s most recent Consumer Confidence report, Georgian consumers are in no mood for shopping. And, yet, Tbilisi is abuzz with excitement about the recent lavish opening of East Point – a giant new shopping and entertainment center, the largest of its kind in the country. Thus, while consumer confidence is hitting new lows, the supply of retail space and world-class shopping malls continues to hit its highs. A natural question arises: is Georgia’s retail marketable to accommodate this surge in the supply of retail space?

The Georgian retail sector currently stands at approximately 11% of total turnover, representing the largest share in the economy. Moreover, growth in retail spending and retail space supply has been steadily exceeding Georgia’s economic growth performance in recent years.

Yet, there is still a long way to go. According to the Retail Market Report by Colliers International, the total amount of retail space in three main Georgian cities, Tbilisi, Kutaisi, and Batumi, reached around 1.1 million square meters in 2014, but only slightly more than a quarter of it is occupied by “shopping centers”. Moreover, about 80% of the total retail space is concentrated in the capital.

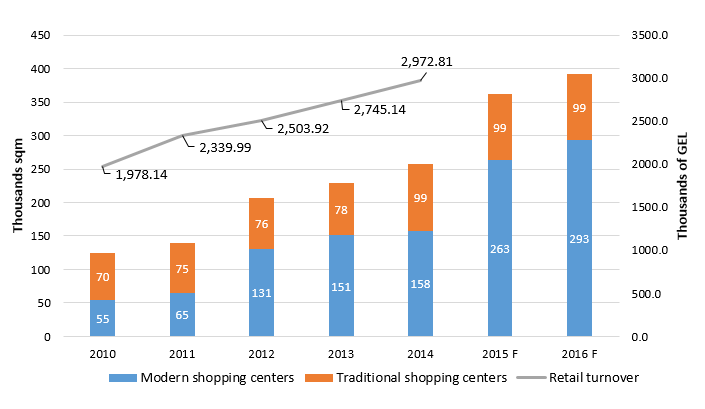

The opening of Tbilisi Mall in 2012 by Rakeen Development (a real-estate development company based in the United Arab Emirates) was a major breakthrough. Located on the northern end of Tbilisi, this shopping center was the first one to provide substantial space fully complying with the quality standard set by international retailers. The supply of modern shopping center space grew by around 28% in each of the following years, reaching 292,000 square meters by the end of 2014.

Sounds like a lot? Well, not quite. With only 79 sqm per 1000 inhabitants, Georgia still lags far behind the Western European average of 200 sqm per 1,000 inhabitants. The opening of East Point (an investment project by Quadrum, a global private equity investment, and advisory group) and a few smaller developments will increase Georgia’s stock of modern shopping center space by 42% till the end of 2015, and by another 10% in 2016.

This week, I went to see the movie “The Walk” with friends at East Point. We were the only ones in the theater and they wouldn’t have played the movie if we didn’t get tickets. Thus, we had a private screening for just 10 GEL.

|

Indeed, the Georgian public is yet to discover the concept of modern shopping centers. Yet, despite the fast increase in the supply of new space, the average vacancy rates at Georgia’s shopping centers have been gradually decreasing for the last couple of years. Moreover, East Point, the most recent addition to the retail real estate market, was around 70% pre-leased even before its opening in September. Thus, retailers clearly believe in Georgia’s potential.

The bulk of demand for shopping center space comes from fashion brands, supermarkets, fast-food chains, and consumer electronics. A big share of international retail is operated by franchisers managed by a handful of local and international companies.

Georgia's up-and-coming retail clothing sector is now populated by more than 40 international brands. One of the major players in Georgia’s fashion market is Retail Group Georgia, owned by Saudi Arabian Alhokair Fashion Retail. This group manages a variety of brands, including Zara, Marks & Spencer, Gap, Banana Republic, etc. Another big player in the Georgian fashion market is International Cooperation ICR representing major European brands, such as Ecco, Geox, Bata, Okaidi & Obaibi, etc. ADress LTD – representatives of Celio, Etam, Promod, and other international brands – also occupies a significant share of the fashion retail market. Finally, due to geographic proximity and the free trade agreement with Georgia, many Turkish retailers (both local and international, such as the Turkish franchiser of Burger King) are also present in the Georgian market.

Food retail has also experienced an influx of international players including: Majid al Futtaim Retail, a Dubai-based partner of Carrefour, SPAR Georgia, as well as local food retailers such as Smart and Fresco. Thanks to strong growth in tourism as well as healthy local demand for fast food, Georgia has seen the arrival of all the usual suspects: McDonald's, Subway, Wendy's, KFC, Dunkin Donuts, Burger King, and others.

And, of course, there are still plenty of open-air markets and bazaars that cater to Georgia’s traditional consumers.

This (at least potential) boom in consumerism is reflected in Georgia’s ranking in the 2015 Global Retail Development Index (GRDI) by A.T. Kearney's. GRDI ranks Georgia at number six among the top 30 developing countries for retail investment based on more than 20 macroeconomic and retail-specific variables. The higher the ranking, the more attractive is a country’s retail sector from the entry point of view.

Table 1: 2015 Global Retail Development Index (GRDI)

2015

|

Country

|

Market

|

Country

|

Market

|

Time

|

GRDI

|

| 1 | China | 66,7 | 55,7 | 42,3 | 96,6 | 65,3 |

| 2 | Uruguay | 93,3 | 60,4 | 68 | 38,9 | 65,1 |

| 3 | Chile | 98,2 | 100 | 13 | 37,9 | 62,3 |

| 4 | Qatar | 100 | 89,4 | 34,3 | 12,8 | 59,1 |

| 5 | Mongolia | 22,4 | 19,9 | 93,1 | 100 | 58,8 |

| 6 | Georgia | 36,5 | 39,1 | 78,8 | 79,2 | 58,4 |

| 7 | UAE | 97,6 | 84 | 16,5 | 33,9 | 58 |

| 8 | Brazil | 98 | 60,4 | 45,2 | 28 | 57,9 |

| 9 | Malaysia | 75,6 | 68,8 | 29,3 | 52,7 | 56,6 |

| 10 | Armenia | 35,4 | 37,1 | 82,1 | 66,3 | 55,2 |

Sources: Economist Intelligence Unit, Euromoney, International Monetary Fund, Planet retail, Population Reference Bureau, World Bank, World Economic Forum; A.T. Kearney analysis

Georgia is an Economic Oasis, according to GRDI, not so much on the current strength of its economy, but on the promise of its unsaturated and rapidly growing retail sector, as well as its achievements in creating a business-friendly environment. Despite the recent influx of international retailers, the share of modern retail (hypermarkets, supermarkets, department stores, etc.) in Georgia’s total remains quite low, well behind other Central and Eastern European countries. While Georgia does not score very highly on market attractiveness and country risk, it stands out on market saturation and time pressure.

According to Nino Kipiani, Country Director for Cushman & Wakefield (the biggest real estate consulting company in charge of Tbilisi Mall management), the ease of doing business in Georgia along with its robust macroeconomic performance were among the key factors in attracting prominent international retailers, such as the Alhokair Fashion Retail group. Other factors were Georgia’s strategic location, the presence of major international investors, and, of course, the well-educated but (still) cheap labor force.

A few international brands left the Georgian retail market in spring 2015, with some shopping centers seeing an increase in vacancy rates. This was reason enough for some media outlets and political opposition to start blaming the government for mismanaging the economy. While there is no arguing that this is not the best of times for the Georgian consumers, at least some of the exodus is due to healthy competition created by the entry of new high-quality shopping centers and better managed new brands. According to sources in the industry, stronger competition is a sign of growing maturity in Georgia’s retail sector, ultimately benefiting Georgian customers.

Though local consumer demand is currently at its lowest point, Georgia has the strategic location to serve the retail hub role for the broader region, provided its transparent and hassle-free business environment remains untainted. In particular, the steady surge in tourism is a major source of growth for Georgia’s retail market. According to Colliers International, the number of non-resident visitors that arrived for shopping in Georgia increased about 5(!) times after 2010, reaching almost half a million persons in 2014 (about 9% of total visitors).

Georgian consumers may have all the reasons in the world to be worried today. Yet, the outlook for the Georgian economy and its retail sector remains quite encouraging. To make good on its promise as a regional shopping bonanza, Georgia needs to sustain and further advance its reputation as a corruption-free, business-friendly, and hospitable environment. We hope this is not too much to be asked for in an election year.