10

July

2023

10

July

2023

ISET Economist Blog

Monday,

08

February,

2016

Monday,

08

February,

2016

Monday,

08

February,

2016

Monday,

08

February,

2016

There is a lot of affinity among Estonia and Georgia, two tiny nations for centuries caught between the Russian rock and the German or Ottoman/Persian hard place. Common fate may be, indeed, the reason for Georgia’s topping the list of Estonian development cooperation priorities. Georgia is the largest recipient of Estonia’s bilateral aid, most of which is about sharing the Estonian experience of establishing itself as a new European democracy and a unique place to do business.

Uniqueness is a huge asset for small countries trying to carve out their niche in the global competition for talent and capital. The small bottles of wine foreigners receive upon entering Georgia are, in fact, all about signaling uniqueness. Estonia has no claims to be the world’s cradle of wine. Neither is it known for its mountains, pristine landscapes, exuberant hospitality, or polyphonic singing. It is the birthplace of Skype, but otherwise, it is flat and boringly clean and green.

Left with few other options to impress foreigners, Estonia has been utterly innovative and unique when it comes to economic policy. In 1992, Estonia was the only country in the entire transition universe to peg its new currency, the Kroon, to a European currency through a rigid arrangement known as the currency board. The goal was to ensure the country’s unique position as an island of relative macroeconomic stability in the hyperinflationary post-Soviet environment. Estonia did not abandon its currency board and did not evaluate Kroon even in the face of the global financial crisis of 2008. Instead of printing money and devaluating, it found the political strength to cut salaries and undertake painful restructuring measures.

|

In 2000, Estonia came up with another bold policy move, this time abolishing the conventional corporate tax on profit. The essence of this reform was to shift corporate taxation from the moment of earning the profits to the moment of their distribution – either in the form of explicit dividends or implicitly, through fringe benefits, nice meals, gifts, donations, etc. The tax rate for any of these distribution methods was fixed at 21%.

The innovative element of this reform was not so much about the treatment of fringe benefits, etc. (Such business expenses would not be considered deductible for the purpose of profit calculation in any normal tax environment.) What Estonia did was provide businesses with the incentives to retain or reinvest undistributed profits. As far as reinvestment is concerned, the new rules were equivalent to allowing businesses to immediately write off the entire value of investment under a conventional corporate tax system. This, and the fact that retained profits were no longer taxed, had a positive impact on business cash flows, enabling Estonian corporations to save for the rainy day.

Accounting for the fact that reinvestment is contributing to the value of businesses, Estonia imposed a 21% tax on capital gains from the sale of property or securities. In early 2011, however, it agreed to further relax its tax code. Accordingly, capital gains transferred to a special investment account for reinvestment purposes were not be taxed until taken out of the investment account.

Since the object of corporate taxation in Estonia is not business revenue in a particular period (a fiscal year), but payments transferred to natural persons (either in the form of dividends, fringe benefits, or capital gains), Estonian corporations are paying their taxes on a monthly basis, smoothening the seasonal tax collection cycle. Additional – and very important – benefits of this cost-based taxation method are simplified tax accounting and audit procedures.

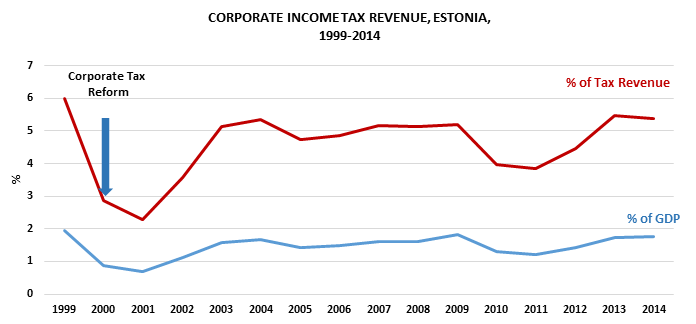

At the same time, when introduced in 2000, the reform resulted in an abrupt reduction in the amount of corporate tax collected. Compared to 1999, total corporate income tax revenues almost halved in value, dropping from 1,638.8mln (2% of GDP) to 854.5mln Kroon (0.92% of GDP). Corporate tax collection rebounded in subsequent years, however, reaching 2,522mln Kroon (1.78% of GDP) in 2004.

In 2000-2004, Estonia has seen a considerable increase in FDI inflows: from €284mln in 1999 to €424mln in 2000, and a further tripling by 2004. Yet, as shown by Bellak & Leibrecht (2009), it is impossible to attribute this entire increase to the tax reform. During this period, Estonia was on the receiving end of FDI for reasons that mainly had to do with its market size, labor costs, and other relevant factors.

A study by Masso, Merikull & Vahter (2011) shows that Estonia’s corporate tax reform resulted in the increased holding of liquid assets and lower use of debt financing by Estonian corporations. It also finds a positive effect on investment and labor productivity. According to the authors, these developments have contributed to firms' resilience and survival during the 2008 global economic crisis.

While promising, Estonia’s tax model carries considerable implementation risks in Georgia. Also, given that Georgia already has fairly liberal tax legislation, the advantages of adopting the Estonian system would be relatively modest.

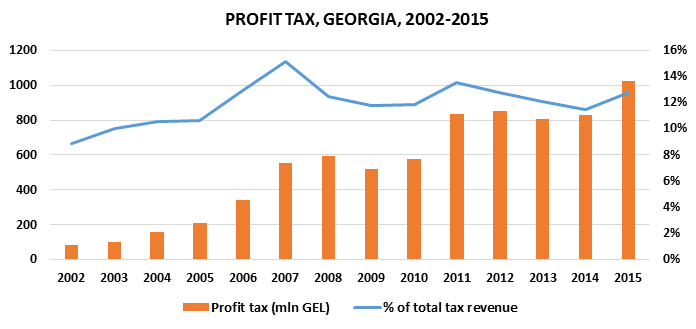

First, unlike Estonia, Georgia greatly depends on corporate profits as a source of budget revenue. Currently set at 15% (if retained) or 20% (if distributed in the form of dividends), the corporate income tax is the third-largest contributor to the Georgian budget (after VAT and income tax on physical persons) – amounting to about 12% of total tax revenues and 10% of budget expenditures.

It is thus clear that abolishing the corporate tax would strain the Georgian budget far beyond anything experienced by Estonia back in 2000 (in 1999, the corporate profit tax accounted for about 6% of Estonia’s total budget revenues). One way to minimize this risk would be to stagger the corporate tax reform over a number of years. While helping avert the danger of a fiscal crisis, such a gradual approach would defer the benefits of the simplified tax accounting and auditing procedures, which Estonia’s cost-based tax model is all about. Even a 1% corporate profit tax would force businesses and the Georgian Revenues Service to maintain the current, rather cumbersome model of tax administration.

A preferred approach might be to move ahead with immediate implementation of the Estonian model while cutting budget expenditures and/or temporarily increasing other taxes, such as the VAT. Allowed by the Economic Freedom Act, a 3-year increase in VAT would help close the revenue gap. (Apparently, such a strategy is already being proposed by the Georgian Parliament’s Budget Office.)

While moving ahead with the corporate tax reform it would be important for the Georgian government to manage its own expectations and dispel any illusions associated with this reform.

• First, Georgia’s current corporate tax regime already allows corporations to write off the entire cost of investment in fixed assets in the year in which they are first put to use. (This provision is particularly effective in incentivizing capital intensive companies with heavy depreciable assets, as opposed to trading and service companies that have insignificant assets to depreciate.) Thus, the proposed reform will NOT provide additional incentives for reinvestment. It will, however, incentivize corporations to retain profits, i.e., potentially reducing their dependence on expensive debt financing.

• Second, if anything, not facing a rigid deadline for writing off capital expenditures in a given fiscal year Georgian businesses will have the incentives to DECELERATE INVESTMENT DECISIONS. Sounds bad? Not necessarily. The kind of “investment” businesses undertake at fiscal gunpoint, by December 31 of each year – such as luxury cars and Italian office furniture – are not of the most productive type. While showing as an investment on the books of Georgian corporations, such expenditures do not bring Georgia an inch closer to the goal of becoming a developed economy. With the Estonian system in place, businesses will have the ability to retain profits, rationalize capital expenditures and avoid hasty decisions.

• Third, contrary to what one may hear from enthusiastic supporters, the fact that profits are not taxed under the Estonian tax model does NOT abolish the need for corporations to account for their expenses. If anything, the entire focus of tax reporting and auditing will be on scrutinizing expenditures in order to make sure that dividends are not disguised as payments to offshore consulting firms, etc.

• Finally, there is NO reason to fear that the proposed reform will encourage businesses to spend on consultants, fringe benefits, and perks beyond what is already the case in Georgia. In fact, the new corporate tax law may provide a clearer definition of allowable business-related expenses, closing whatever loopholes there are in the existing tax code.

* * *

For small countries like Georgia and Estonia, bold policy experiments – such as Estonia’s currency board and 0% corporate tax, or radical deregulation reforms of the early Saakashvili period – are wonderful attention grabbers. Their immediate and direct effect is equivalent to opening the door for investors and shouting out loud: YOU ARE MOST WELCOME! Whether investors will come in and stay for the long haul will, of course, depend on fundamental factors such as market size, labor cost and quality, and locational advantages that are beyond any government’s immediate control.

“When small men begin to cast big shadows,” a Chinese proverb goes, “it means that the sun is about to set.” When small countries cast big shadows, it may mean that their sun is about to rise.

* * *

Eric Livny is president of the International School of Economics at Tbilisi State University (ISET). Maya Grigolia is an ISET graduate and senior researcher with the ISET Policy Institute