10

July

2023

10

July

2023

ISET Economist Blog

Saturday,

01

April,

2017

Saturday,

01

April,

2017

Saturday,

01

April,

2017

Saturday,

01

April,

2017

Vake has always been one of the most prestigious districts in Tbilisi and being a “Vakeli” has been associated with high social status for no obvious reasons. In the picture: Vake Park, one of a few green places in Tbilisi and thus a big asset for the Vake district. Maybe having an opportunity to walk every day in this park makes people living in Vake so special.

The recent publication of the Real Estate Laboratory (REM Lab), a joint project of ISET, TBC Bank, and JumpStart, reports a remarkable growth in the real estate market in 2016. The growth was observed in the number of new properties supplied, as well as in the number of transactions registered. Compared to 2015, last year the residential real property supply in Tbilisi grew by 54.3% (in units) and 86.8% (in the area), while the number of transactions registered by the public registry increased by 37.5%. Prices, on the other hand, remain relatively stable, with no indication of decreasing any time soon.

These developments in the real estate market are evidence that not only supply but also demand for real estate is on the rise. New buildings have appeared all around the capital, indicating that investors anticipate a significant return from this market. Buyers in return seem to be active enough to support this market growth, but it is less clear how affordable and inclusive the current real estate market is for an average Georgian.

|

Housing affordability is one of the key factors that can indicate the socioeconomic stability and development of a country. Because housing is a big part of many Georgians’ financial well-being, the ability to access homeownership – housing affordability – is an important topic. The HAI is a great way to understand how affordable the housing market is or isn’t for the typical Georgian, and how that compares over time. HAI can capture changes that take place in a real estate market, such as housing prices, market interest rates on the mortgage loan, as well as changes in the incomes of the population.

In the primary source of methodology, the index measures median household income relative to the income needed to purchase a median-priced house. We adapted this index to Georgia based on the availability of data. In our exercise, HAI measures the average income (which is typically higher than the median income) of a typical household relative to the income needed to purchase a typical apartment in Tbilisi.

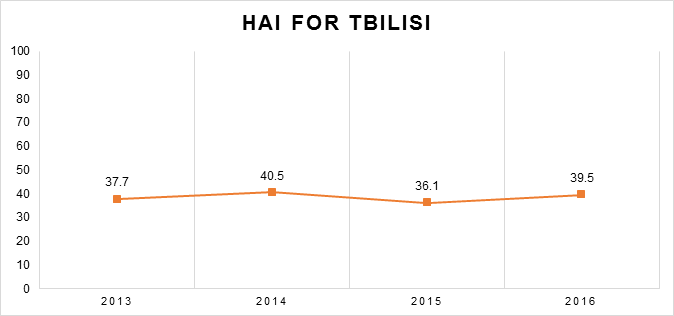

On the graph, we show the HAI for the last four years. With relevant variables for 20161, HAI equals 39.5, which indicates that the average Georgian household income from employment is only 39.5% of what a household should receive to be able to take out a mortgage loan for a typical apartment in Tbilisi. The index has remained relatively stable and far below 100 for all four years observed.

It is probably more interesting to understand how much monthly income your family should have to afford a mortgage loan on a typical apartment in Tbilisi and still have money available for a decent life. The aspect of a decent life in our calculations is guaranteed by the assumption that the monthly payment on a mortgage loan should not exceed 30% of a household's monthly income. However, this assumption maybe not be totally true for Georgians. The purchase of real estate is one of the main instruments of savings in the country, thus a family may be willing to dedicate a higher portion of their monthly incomes to mortgage loan payments. Taking this into account, we calculate qualifying incomes for the burden of mortgage loans in the range of 30-50%.

The map below shows the range of qualifying incomes required to afford an apartment in each district of Tbilisi. For this calculation, we used a typical apartment of 80 square meters, the average price per square meter for indicated districts, and the average interest rate for a 10-year mortgage loan in foreign currency for 2016. According to our estimates, a family should earn between 3,251 and 5,418 GEL per month on average to afford a house or apartment in Tbilisi. However, some districts allow for a lower-income range, such as Gldani, Samgori, Nadzaladevi, and Isani – between 2,079 and 4,299 GEL. To afford a house in the most prestigious districts of Tbilisi, such as Mtatsminda or Vake, your family income should fall in the range of 3,164 to 6,594 GEL per month! That is how much it takes to become “Vakeli,” the most sought-after status according to the REMlab – the highest increase in 2016, 60.0% in the number of transactions, was registered in Vake.

Income ranges that make “Vakeloba” or in general, “Tbiliseloba” affordable are remarkably high, on average four times higher than the average income of a typical Georgian household with two working adults. Without discussing details of socioeconomic consequences, it is a clear signal that we have a long way to go to reach a thriving and inclusive real estate market in Georgia.

1 In 2016, the price of a typical apartment of 80 square meters averaged $865 per square meter, the interest rate on a 10-year mortgage loan in foreign currency was 9.2%, and the average monthly salary of a family amounted to 1,937 GEL.