31

May

2023

31

May

2023

ISET Economist Blog

Monday,

16

April,

2018

Monday,

16

April,

2018

Monday,

16

April,

2018

Monday,

16

April,

2018

In February 2017, Georgia experienced the largest gap between generation and consumption in the last decade. This was followed by an even greater gap in March 2017. The size of those gaps, and the fact that the historical trend was suggesting an increase in the electricity gap, prompted policy proposals emphasizing the need to encourage investments in power generation. The goal of such policies would be to avoid future energy security challenges due to electricity shortages and fast increasing electricity prices. Most of the strategies suggested stressed the importance of expanding the installed hydropower generation capacity of the country, emphasizing the need for the construction of the Namakhvani, Oni Cascade, and Nenskra hydropower dams.

Figure 1. Electricity Consumption and Generation (mln. kWh)

As can be seen in Figure 1, however, one year later (in February 2018), the gap between consumption and generation has shrunk to 126 mln kWh, down from 204 mln kWh a year earlier. This happened despite the fact that the newly built Shuakhevi HPP, with 178 MW installed capacity, is not yet operational, and the total power generation coming from TPPs decreased by 24% compared to February 2017, indicating growth in TPPs’ idle capacity. Overall, Georgian power plants generated 934 mln. KWh of electricity, corresponding to a 15% increase in total generation, compared to the previous year (in February 2017, total generation in was 809.2 mln. kWh). Consumption of electricity on the local market instead grew by a mere 5%, compared to February 2017, up to 1,060 mln. kWh.

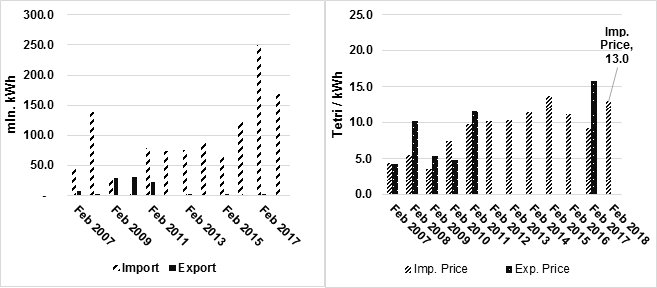

The reduction in the demand-generation gap led also to a reduction in imports (-33% with respect to February 2017). In February 2018, Georgia imported 168 mln. kWh of electricity. The average electricity import price in January 2018 increased to 5.3¢ (12.99 tetri) per kWh, compared to the same month in the previous year (an increase of 52%). All this electricity was imported from Azerbaijan (Figure 2). As in three out of four of the previous months, Georgia did not export any electricity.

Figure 2. Import/Export (mln. kWh) and Import/Export Prices (¢/kWh)

Should the year-on-year reduction in the demand-generation gap lead to relative optimism about the future of the Georgian electricity market, and take less seriously the frequent warnings that more investments in the sector are needed to avoid the electricity shortages and price increases associated with the growing demand? Not necessarily. In reality, despite the clear improvement, it would be premature to celebrate. The 2018 demand-generation gap remains the fourth largest over the past decade (Table 1), indicating that the trend is indeed towards a tighter market. While this will not necessarily lead to a crisis anytime soon, the trend highlights the need to closely monitor the evolution of the internal and international electricity markets, and to remain vigilant in order to avoid an increase in the energy security risk.

Table 1. Highest Gaps in the Electricity Production Since 2006

| Month | The gap in the production (mln. kWh) | Share of the gap in total production |

| March 2017 | 280 | 38% |

| February 2017 | 204 | 25% |

| January 2018 | 156 | 15% |

| January 2017 | 131 | 14% |

| February 2018 | 126 | 13% |

| October 2017 | 121 | 15% |

Source: Electricity System Commercial Operator (ESCO)

An additional note of caution comes from the fact that the large increase in generation, thanks to which the gap shrunk, was due mainly to two main (exceptional) factors. First, the increase in wind and hydropower generation was due to favorable weather conditions. With no new HPPs or wind farms having gone into operation since February 2017, the growth in generation was driven by a 37% increase in generation of seasonal HPPs, a 68% increase in small HPPs, and a 7% increase in wind power generation. The second factor is a technical one. In February 2017, the largest power plant cascade of Enguri and Vardnili was idle over a certain period to conduct technical work, while in February 2018, it was operating at full capacity. Therefore, while on one hand, the situation in 2017 looked direr than it was, it is unlikely that generation will keep growing at the high rate observed between 2017 and 2018.

At the same time, there are currently several potential critical factors that might lead to an acceleration in the growth of electricity demand. Among them are: the provision of subsidized electricity in some parts of the country1, which encourages excessive consumption of electricity (coupled with an increased interest in highly electricity-intensive economic activities such as bitcoin mining), and the potential increase in electricity demand from the occupied region of Abkhazia2 (currently already consuming – with a population of roughly 240,000 - as much electricity as Tbilisi). This situation may create tensions in the electricity market in the future, which might be more problematic, as the cost of imports seems again on the rise.

In this situation, a wise approach to energy security would be to take advantage of favorable short-term trends, making less urgent the adoption of emergency measures, and to reconsider current energy policies. In terms of investments in generation, this could mean rethinking the role of hydropower generation, especially in light of emerging opportunities for electricity generation. Back in 2013, Giorgi Kelbakiani was already writing in an ISET Economist Blog that it would have been wise for the Government of Georgia to reconsider its “obsession of hydropower,” as hydropower – despite its significant and increasing potential costs in environmental terms – did not really have the potential to close the increasing gap between demand and generation during dry months. Kelbakiani instead suggested paying more attention to alternative renewable resources such as wind, arguing that wind farms, located in carefully selected locations, could both act in a countercyclical way – achieving peak generation in periods when hydro generation is at its lowest – and be successfully combined with HPPs with reservoirs in a hybrid generation structure increasingly adopted around the world. While one might not agree with this particular solution (even though the adoption of hybrid generation plants combining HPPs with reservoirs and wind turbines is becoming increasingly popular), the impressive advances in the field of renewable energy generation, leading to a dramatic reduction in costs per kWh generated and a minimization of negative side effects, do provide a number of valid alternatives to a big push for the development of hydropower generation and would be worth considering.

On the demand side, it would also be worth considering a progressive shift away from subsidized tariffs towards tariffs more reflective of generation costs.

The reform of the electricity market, discussed in another recent piece published in the ISET Economist Blog, could (if done properly) support this process, both in terms of incentives to invest in the most efficient generation technologies, and saving electricity. In addition, the recent abolition of PPAs could prove useful, as doing so helps level the playing field on the generation side, and allows new generators to compete on the basis of true efficiency and profitability.

Overall, the main recommendations emerging from the analysis of the most recent electricity market data are the following: keep monitoring the evolution of the market; encourage market solutions that allow economic agents to react more quickly to changes in the market conditions, both on the demand side (with prices reflecting true generation costs) and on the supply side (eliminating provisions that create distortions in the generation segment); take greater care in analyzing the environmental impact of alternative generation technologies; and, make sure environmental costs are correctly priced and included in the evaluation of investment projects when deciding the best way to ensure energy security. While doing that, take a deep breath and remember there is no need to rush. February 2018 data suggests that there is no looming electricity crisis beyond the horizon.

1 According to the law of the “Development of High Mountain Regions” in Georgia, from January 2017, the Government of Georgia compensates 50% of electricity tariffs for the electricity consumers living in high mountain regions (subsidy covers 50% of the tariff only up to 100 mln. kWh of electricity consumption). Moreover, electricity is provided free of charge to the part of the Svaneti region.

2 We will be talking about the Abkhazian case in greater detail in a forthcoming article.