31

May

2023

31

May

2023

ISET Economist Blog

Friday,

08

November,

2019

Friday,

08

November,

2019

Friday,

08

November,

2019

Friday,

08

November,

2019

After facing a generation deficit during the month of August, Georgia continued to experience a decrease in power generation. In September 2019, generation decreased by 3% compared to September 2018 and by 19% compared to August 2019.

Georgian power plants generated 821 mln kWh of electricity while consumption of electricity in the local market was 972 mln kWh. Compared to August, electricity consumption decreased by 12%. Even though consumption decreased substantially during the month of September (at least partially due to lower demand for air conditioning and decreased tourist flows1), Georgia still had to import electricity from foreign power markets in order to satisfy local demand. The total amount of electricity imported in September increased by 56% compared to the previous month and by 33% compared to September 2018.

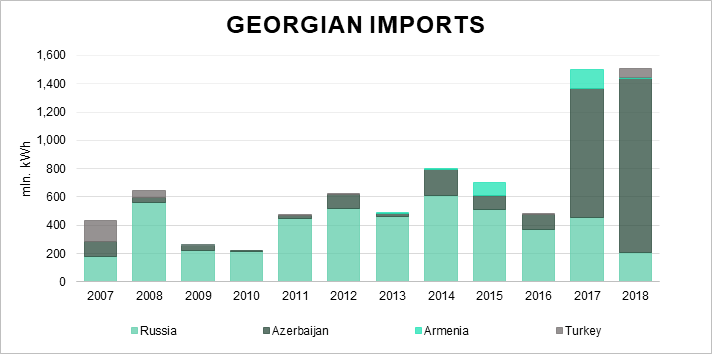

Azerbaijan and Russia remained the main providers. Until 2017 when Azerbaijan took the leading position, Russia was the major electricity supplier for Georgia. During the years 2017 and 2018, 61% and 82% of imported electricity came from Azerbaijan, while Russia provided 30% and 14% (Figure 1).

Figure 1. Georgian Imports (mln. kWh)

Examining Figure 2, it is obvious that the trend has continued in 2019 as well, since – most of the time – Azerbaijan provided the largest share of Georgian imports. However, just like in 2018, in September 2019 imports from Russia outpaced those from Azerbaijan. In this month, 67% of imported electricity was provided by Russia, with the remaining 33% supplied by Azerbaijan. It appears that, despite the decline in the market share of electricity imported from Russia (minus 30 percentage points compared to September 2018), the Georgian power market still depends on Russia during the month of September.

Figure 2. Georgian Imports over the year (mln. kWh)

Investigating the official website of Russia’s electricity system operator, we found that electricity generation and consumption have increased by 2% and 3% respectively in the month of September compared to the same month the previous year. Moreover, the positive generation-consumption gap has decreased by 17%. This implies that the amount of available resources for Russian exports has been declining since last year, causing a tightening of the Russian power market.

On the Azerbaijani side, we also observed some indications of market tightening during the month of September. This year, Azerbaijan transported 33 mln kWh of electricity to Turkey during the month of September, while in the same month of the previous year no transfer to Turkey took place.

From a broader perspective, increasing demand from Turkey and declining spare capacity in Russia — if these trends continue — might lead to a tightening of the regional power market, potentially causing an increase in electricity import prices and lower availability of electricity.

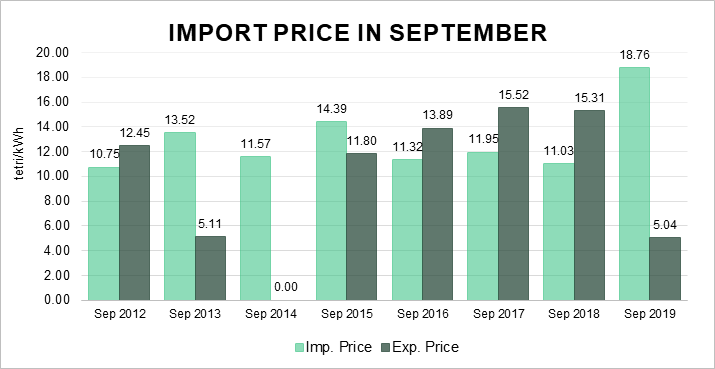

Even now, though not necessarily for this reason, import prices are on the rise. As can be seen in Figure 3, in September 2019 import prices for Georgia increased by 70% compared to the previous September, and by 24% compared to August 2019 (from 15.18 to 18.76 tetri/kWh).

Figure 3. Import Price in September (Tetri / kWh)

Since import prices could be affected by the currency utilized for settlement (USD), it is important to look at currency fluctuations.2 Compared to September 2018, the Georgian Lari has depreciated against the US Dollar by 14%3. At the same time, the Russian Ruble has appreciated by 4% against the US Dollar over the same period, according to the Central Bank of the Russian Federation.4 Currency volatility is, therefore, one of the factors which could potentially have contributed to the increased import price. However, even taking into account the price increase in US Dollar terms, a substantial share of the spike in import prices (about two-thirds) remains unexplained. This evidence supports the idea that factors other than exchange rate fluctuations (such as the tightening of the regional power market) might have contributed to the increased import price.

As internal generation struggles to keep up with increasing demand, the emergence of a tighter regional power market could constitute a threat to energy security for Georgia in the near future, both in terms of the availability of electricity and its affordability. The evidence presented calls for proactive measures to increase the country’s energy security. These measures may include supporting investments in diversified power generation sources, pursuing opportunities to create energy storage, and popularizing the adoption of energy-efficient technologies, together with attempts to increase the number of potential providers of electricity inside and outside the region.

1 According to the Georgian National Tourism Administration International Visitor Trips decreased by almost 28% in September compared to August 2019. Moreover, the average temperature decreased by 19% in September 2019 compared to August 2019, based on National Environmental Agency Data.

2 Since Azerbaijan has stabilized exchange rate arrangements with a margin of 2%, their currency hardly fluctuates.

3 Monthly exchange rates were compared based on NBG data.

4 The monthly exchange rate was calculated as the average daily rate based on data from the Central Bank of the Russian Federation.