27

მაისი

2022

27

მაისი

2022

ISET ეკონომისტი

ოთხშაბათი,

19

დეკემბერი,

2012

ოთხშაბათი,

19

დეკემბერი,

2012

ოთხშაბათი,

19

დეკემბერი,

2012

ოთხშაბათი,

19

დეკემბერი,

2012

Travel and Tourism Competitiveness Index of UN (T&T CI) ranked Georgia 73, in 2011. With this rank, Georgia topped the South Caucasus region nevertheless, maintaining the same rank as in 2009. This could mean that not much had improved during those three years in terms of the competitiveness of Georgia as a brand in the business of tourism.

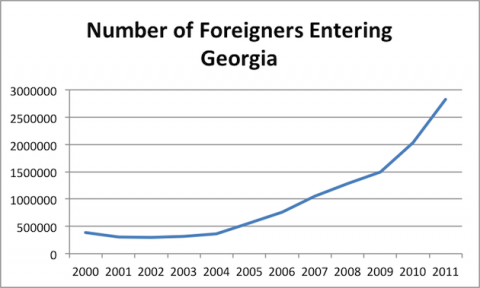

Looking at the data on international tourist arrivals and international tourism receipts – they both have been steadily increasing since 2000.

From the first glance, this upward trend seems promising. We have more tourists and more receipts. So, what is the problem?

Whatever the total volume of receipts and the total number of tourists, coming to Georgia for whatsoever reasons, another substantial fact is that receipts per tourist have been falling with the lowest level in 2009 (335 USD per tourist). This means that the marginal revenue from additional tourists is decreasing. For example, if we double the number of tourists then total receipts will less than double. This fact naturally makes us suspect that there are some bottlenecks that cause decreasing marginal revenue. I can think of three scenarios that might be explaining the phenomenon from which the first two concern problems with data and the last scenario proposes a possible bottleneck:

Another argument, strengthening our suspicion that decreasing marginal revenue is really a problem indicating at bottlenecks, would be to do a simple benchmarking exercise:

According to the insight from the data of T&T CI it turns out that each of the top 10 ranked countries exhibits increasing marginal revenue from additional tourists while among the lowest 10 ranked countries there is no clear trend. This means that increasing marginal revenue is a necessary condition for becoming competitive in tourism but not a sufficient one.

Once we look at the key indicators which are used to calculate the index, we see that Georgia is doing worst (a comparison made between indicators for Georgia) in international air transport network, quality, and availability; effectiveness of marketing and branding; property rights; openness of bilateral air service agreements; hotel rooms; ticket taxes and airport charges; hotel prices; quality of the educational system; local availability of research and training; staff quality; protected areas; the number of international fairs and exhibitions; creative industries exports. In the rest of the indicators we are doing pretty well – those indicators are mainly concerned with the country being a physically safe place for tourists; that tourists will be treated well by the local population and that they will be free of bureaucratic procedural burdens. Shortly, the bottlenecks are that there is a lack of exhibitions, fairs, entertainment, quality of protected areas, and also it is expensive to fly to Georgia and find good living conditions here. Indeed, this indicates that Georgia does not have to offer much to tourists. So, even if tourists come to Georgia, for what will they spend money here?