15

November

2021

15

November

2021

ISET Economist Blog

Tuesday,

29

January,

2013

Tuesday,

29

January,

2013

Tuesday,

29

January,

2013

Tuesday,

29

January,

2013

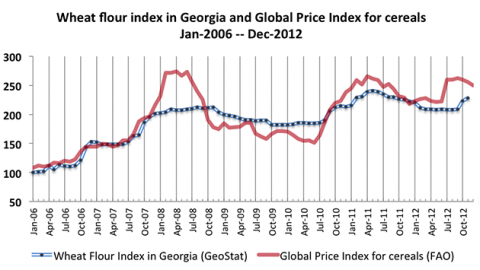

According to data provided by the Food and Agriculture Organization of the United Nations (FAO), in the last five years, there were two hikes in global food prices. The first hike was in 2008 when the global food price index reached 224.4 points (up by 46% in year-on-year terms). The second wave started in late 2010, reaching a peak in February 2011 (237.9 points).

More recently, the FAO Food Price Index averaged 209.3 points in December 2012, down 2.4 points (1.1%) from November. The downward movement was mostly driven by decreasing cereals prices and oil/fat prices. One of the index’s components, the FAO Cereal Price Index, averaged 249.6 points in December, down 6 points (2.3%) from November. The decline resulted from sharp declines in rice and maize prices. Despite these developments, the FAO Cereal Price Index is still 15% higher than in December 2011, though it is 9% below the peak of 274 points registered in April 2008. The FAO comments: “After surging over the July to September 2012 period, on production uncertainties and tightening supplies, cereal export quotations dropped because of weaker demand for feed and industrial uses. In December, maize prices fell sharply, as large export supplies in South America relieved pressure from tight availabilities in the United States. Rice prices also dipped in December, on the expectation of good harvests, but wheat values changed little under subdued trade activity.“

In most countries can be observed that the price transmission from international to domestic markets occurs with a lag of several months. For example, the transmission of international cereal prices to local markets in developing countries on average takes about 6-7 months. Likewise, in most countries, roughly three-quarters of the domestic price dynamic is determined by changes in world market prices. Georgia, however, breaks with these rules (see the chart). The prices of wheat flour on local markets follow the FAO Cereal Price Index with a lag of typically just 1-2 months. The reason is that Georgia covers around 80 percent of its domestic cereal consumption by imports, mainly wheat, from Kazakhstan and the Russian Federation. Due to this heavy dependence on food imports, world market price movements are faster and more directly transmitted to the domestic markets than elsewhere.

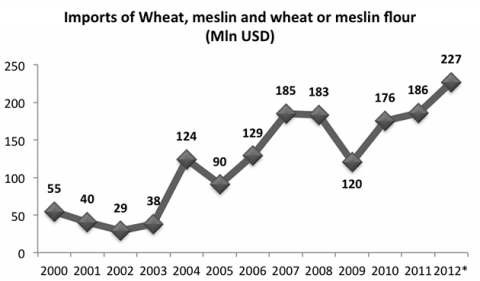

The high international prices may lead to a release of wheat reserves which Georgia has built up in the last year. Therefore, it is likely that cereal imports have declined in the ongoing marketing year, which started in July 2012 and ends in June 2013. Yet despite the expected reduction in imported quantities, Georgia may have to pay more for its imports due to the higher international prices. In 2012, Georgia paid US $227 mln for imports of wheat and meslin (raw or flour), which is the all-time peak. Interestingly, Georgia moves towards importing wheat instead of importing wheat flour. For example, in 2003 Georgia spent the US $28 mln on wheat imports and the US $9 mln on flour imports, while in 2011 the corresponding numbers were US $184 mln and US $2 mln, respectively. This indicates enhanced processing capacities in the Georgian food industry compared to 2003.