27

May

2022

27

May

2022

ISET Economist Blog

Monday,

18

October,

2021

Monday,

18

October,

2021

Monday,

18

October,

2021

Monday,

18

October,

2021

In the past year and a half since the pandemic began, we’ve all become familiar with phrases such as “supply chain disruption,” “turbulence and volatility in international markets,” and “in these unprecedented times,” often used to preface news about pandemic-related food price increases across the globe.

Georgia has not been isolated from the trend, and consumers have seen drastic food price inflation. Food producers and suppliers in Georgia have struggled with disruptions in transportation and shortages in the labor force, both of which have caused food prices to rise.

Now, eighteen months into the pandemic, food prices in Georgia are far from stabilizing. Is there an end in sight to inflation?

Since February 2020, when the first case of COVID-19 was recorded in Georgia, YoY monthly prices for food and non-alcoholic beverages have increased on average by 9.3%. Annual prices increased for almost every major food commodity in 2020, as did the share of expenditure on food in total household consumption expenditure, from 43% in 2019 to 47.4% in 2020, according to GeoStat. In August 2021, prices for food and non-alcoholic beverages, as measured by the Food Price Index (FPI), drastically increased by 16.2% compared to August 2020, hitting its highest rate since July 2011 (Figure 1).

Figure 1. Annual Food Price Inflation (January 2010-August 2021)

Source: GeoStat, 2021

GeoStat’s analysis shows that prices increased for all sub-categories of food and non-alcoholic beverages in August 2021: oils and fats (+43.9%); vegetables (+42.2%); milk, cheese, and eggs (+17.3%); sugar, jam, honey, chocolate and confectionery (+16.9%); bread and cereals (+13%); fish (+11.9%); mineral waters, soft drinks, fruit and vegetable juices (+11.5%); meat (+8.3%); coffee, tea and cocoa (+6.8%); fruit and grapes (+5.4%).

Georgia is a net importer of food commodities and the share of imported food in the consumption basket is high – around 80% of the food products consumed in Georgia. In 2020, the self-sufficiency ratio for wheat was 15%, for meat 49%, for vegetables 63%, and for poultry 34%, according to GeoStat. High dependency on food imports makes food prices in Georgia more vulnerable to fluctuations in the exchange rate and international prices.

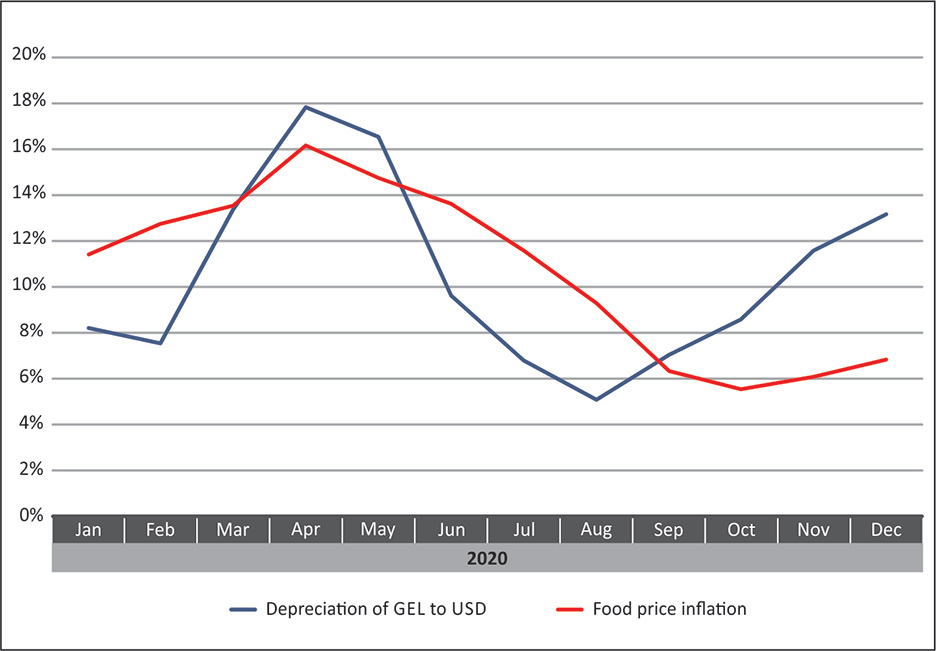

Dynamics of the exchange rate: the main driver of food price increases in the last couple of years was the depreciation of the Georgian lari against the US dollar. In 2020, the Georgian lari depreciated against the US dollar by 10.3% from 2.82 to 3.11 GEL/USD compared to 2019. The depreciation of the Georgian lari put upward pressure on the prices of imported food products and inputs, including chemicals and fertilizers, fuel, and milk powder.

Figure 2 shows the dynamics of the food price index and the monthly average US dollar to Georgian lari exchange rate. It is evident that the exchange rate is strongly setting the pace for food price inflation.

Figure 2. Dynamics of FPI and USD to GEL Monthly Average Exchange Rate

Source: GeoStat, NBG, 2021

Trends in the international markets: Given Georgia’s high dependency on food imports, global agricultural commodity markets have a great impact on the domestic prices of food products. The Food and Agriculture Organization (FAO) food price index shows that global food prices have been on the rise throughout 2020 and 2021, reflecting increased import demand in anticipation of a tightening in export availability from main exporter countries due to declined production (e.g., cereal, vegetable oil, sugar, meat, dairy). Though trends on the international markets generally need time to be transmitted to local markets, due to certain circumstances the upward trend of hikes in food prices were transmitted faster than usual onto local prices. For instance, price increases and export restrictions due to expectations of unfavorable weather conditions and reduced production on the Russian market, which serves as Georgia’s main import partner of wheat and sunflower oil, have contributed to the spike in Georgian prices for these particular products.

Even though 2020 was a good year for Georgian agriculture in terms of harvest yield, these positive trends in production were not enough to balance the effects of the exchange rate and COVID-19-related trade restrictions on food prices.

The political and economic situations related to the parliamentary elections in October 2020 in Georgia, as well as a slow vaccination rate, have increased uncertainty in the country and hit expectations as well, further increasing pressure on the exchange rate and thus on prices.

To examine upcoming trends for food prices in Georgia, let’s review some of the key factors that affect local prices and form expectations for the upcoming months.

As already mentioned, trends in international markets need time to be transmitted to local markets. With this in mind, as the FAO food price index has continued to increase on a YoY monthly basis from the beginning of 2021, local food prices may mimic the trend and continue to rise. However, the lengths of transmission differ by commodity. For example, research done by ISET-PI’s team suggests that a price change on the international market for wheat generally takes about seven months to be reflected in local prices. Therefore, while one can still expect an increase in international prices, the transmission period should allow the government of Georgia to adjust to those changes and plan its interventions accordingly.

The National Bank of Georgia’s (NBG) interventions may put downward pressure on inflation including food prices in the medium-term. To steer the country’s inflation rate back to a short-term target of 6%, as set by the NBG, the central bank has further tightened the refinancing rate over the spring and summer. In August 2020 the refinancing rate was at 8%. It was first increased in March 2021 by 0.5 percentage points, then by 1 percentage point in April; a final increase took place in August when the rate was raised from 9.5 to 10%. This is the highest value of the indicator seen in the last ten years. As the change in refinancing rate requires some time (approximately six months) to have an impact, prices are expected to go down in the next months.

Elevated fuel and oil prices may further contribute to inflationary pressure. Recent increases in fuel oil prices may increase transportation costs and therefore affect food prices. Since February 2021, annual prices in the category of transport have increased by 15% on average each month, hitting the highest rate of 22.5% in August 2021. Fuel prices not only increase the costs of transporting food from farm to table, but it also affects farming as well: oil byproducts are a significant component of fertilizers. The recent hike in oil prices will also be edging up food prices in Georgia.

Despite the stabilization of the Georgian lari exchange rate, the average GEL/USD exchange rate is still higher than before the pandemic. In June 2021, the Georgian lari started to appreciate relative to the USD, from the average GEL/USD exchange rate of 3.38 in May 2021 to 3.16 in June 2021. However, the average GEL/USD exchange rate is still higher (3.11 in August 2021) than it was before the pandemic (2.85 in February 2020). The exchange rate is still negatively affecting the prices of imported food commodities.

In addition to these factors, the elections of local self-governments are around the corner, which is usually linked to high government spending. An expansionary fiscal policy might create inflationary expectations in a country. Finally, according to the NBG forecast, the level of inflation should peak in the third quarter of 2021 and go slightly down by the fourth quarter, but it will remain around 10%. Inflationary expectations may also affect food prices. In addition, harvest yield and agricultural production will influence local food prices.

It looks like households are in for an extended rough patch as prices will continue to grow across key food commodities in the upcoming months. Poorer households, in particular, may have an even more difficult time as the holiday season approaches and prices rise. This could cause further strain on household budgets, which are already largely allocated for food purchases.

Some relief may be provided by subsidized farm inputs (fertilizers, pesticides, diesel, animal feed, etc.) to reduce the costs of production for farmers. Farming season in Georgia is already over, but this option is still valid for farmers with greenhouses and animal production. Furthermore, additional state support programs could mitigate disruptions and delays in food supply chains and logistics to avoid a further increase in food prices. A longer-term policy should consider not only an increase in domestic production of key food commodities but also a diversification of import markets to ensure low volatility in food supply and prices.

* * *

Disclaimer: This blog has been produced in collaboration with investor.ge.