02

July

2024

02

July

2024

ISET Economist Blog

Friday,

01

March,

2013

Friday,

01

March,

2013

Friday,

01

March,

2013

Friday,

01

March,

2013

Georgia is flooded with cheap Turkish products: tasteless winter tomatoes, clothes, construction materials, you name it. Turkish goods are everywhere – in specialized shops in central Tbilisi, supermarkets, and the Eliava Bazroba. Is this happening because Turkey is our neighbor because Georgian people love Turkish products, or what?

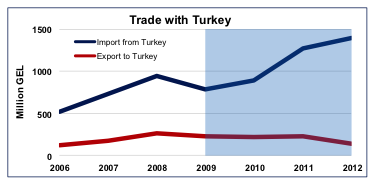

Turkish exports to Georgia have been growing very fast since the Rose Revolution but they received an additional push in 2009, following the signing of a bilateral free trade agreement (FTA) between the two countries in November 2008. At $1.4bln (17% of total imports), Turkey was by far the largest source of imported goods to Georgia in 2012, with Azerbaijan, Ukraine, China, Germany, and Russia trailing far behind. Conversely, the FTA had no visible impact on the Georgian exports to Turkey. In 2012, Georgia’s exports to Turkey amounted to a meager $142mln, significantly less than in 2008.

Now, while the availability of cheap Turkish goods does undoubtedly benefit the majority of Georgian consumers, the same cannot be said of many Georgian producers and those consumers who lost their jobs or had their wages cut due to competition with Turkish imports. Thus, an argument could be made in favor of revoking the FTA or offering selective protection or subsidies to specific sectors of the Georgian economy.

There are different viewpoints on whether the protection of domestic industries is desirable in the first place. Before the rise of modern economics, most countries stuck to a policy of promoting exports and discouraging imports. This was the doctrine of mercantilism, personified in Jean-Baptiste Colbert (1619-1683), the famous minister of finance under the French king Louis XIV. Then, in the 19th century, liberal economists pointed out the advantages of open markets and free trade. The politically most influential ideas in this respect were due to David Ricardo (1772-1823), a London businessman who wanted to convince his government to reduce trade barriers. He invented the Ricardo Model, a benchmark of trade economics still today.

While in the 19th century most economists agreed that free trade was beneficial in general, thinkers like Friedrich List (1789-1846) claimed that there were benefits from temporarily protecting the so-called infant industries. The infant industry argument applies to those sectors of the economy that are capable of competing internationally if allowed to grow and reach critical size and maturity. According to this line of thought, protective measures should be abolished once an infant industry matures and reaches productivity levels that allow it to compete internationally. If exposed to international competition at an early stage of development, such an industry would be doomed to extinction. While more nuanced and mathematically sophisticated, much of the debate in modern international economics still oscillates between Ricardo and List, i.e. free trade and infant industry protection.

Protectionist policies could be supported for other reasons as well. For instance, a large country (or customs union) may want to protect its domestic market in order to create the incentives for foreign producers to locate their own production or assembly plants in that market. This has been the rationale for the massive Japanese and Korean Foreign Direct Investment in the US and EU automotive industries. Protection-induced technology-intensive FDI created hundreds of thousands of jobs and provided for technological spillovers to other sectors of the economy.

Before we subscribe to the protectionist view, it is important to realize that a) this argument does not apply to Georgia given the small capacity of its domestic market and b) because Georgia is small, it can only receive FDI by lowering the cost of trading and gaining access to large neighboring markets such as Turkey, Azerbaijan and, eventually, Russia. Already today, the FTAs that Georgia has with Turkey and Azerbaijan (the major destination for Georgian exports) provide incentives for Turkish and Azeri businesses to locate production in Georgia so as to export – at a very low cost and no customs tariffs charged – back to their domestic markets. This, for instance, has been the rationale for Turkish investment in the Georgian light industry (mostly in Batumi and Ajara). As a result, Georgian exports of “women’s blouses” (according to GeoStat) to Turkey reached $7.3mln in 2012, up more than 20% compared with 2011. Hopefully, this is just the beginning.

Given Georgia’s renewed commitment to developing and modernizing its agriculture, it may want to review its trade policy with respect to certain branches of agricultural production (winter tomatoes, for example). Since Georgia is a WTO member, however, its policy choices are limited. If Turkey is bending or breaking the rules to block imports from Georgia, then the dispute settlement mechanism is the way to go. It takes time, but this is how civilized countries are supposed to solve these sorts of disputes. While Georgia may not be able to reinstall border tariffs, it could provide selective protection through measures included in the so-called “green box support” such as subsidies and government programs that are deemed to be minimally or non-distortive. For example, included in this category are government expenditures on research and development, infrastructure, decoupled payments to farmers, etc. They all cost money, unlike an import tariff that actually raises revenue, so they may not present an attractive alternative. Insurance schemes for farmers (a price or income insurance, for example) are also “green box”, although they can clearly distort incentives.

Finally, a word of warning. When considering protective measures in agriculture, the government should not lose sight of consumer interests. International commodity prices have been very high in recent years, forcing many governments to block exports or lower import tariffs so as to reduce domestic prices and gain political stability. The latter is not something the new Georgian government would want to risk.