10

July

2023

10

July

2023

ISET Economist Blog

Tuesday,

13

December,

2016

Tuesday,

13

December,

2016

Tuesday,

13

December,

2016

Tuesday,

13

December,

2016

Citizens of Georgia’s capital recently witnessed the luxurious Biltmore Hotel Tbilisi grand opening. A $140 million investment by the Dhabi Group supplied the market with 214 luxury rooms and suites. The $2 million opening, huge building, and central location (right on Rustaveli Avenue) made the appearance of this hotel on the market very noticeable. However, with much less lavish ceremonies, in total 37 hotels were opened in Georgia just this year, as reported by the Georgian National Tourism Agency (GNTA), which amounts to an additional 1,472 rooms.

Even more impressive is the pipeline of hotels for upcoming years (2016-2018): 84 more hotels, with 9,060 rooms and 10,525 beds (source: GNTA). And these numbers do not include hostels, Airbnb offerings, and some smaller properties, which are mushrooming all around the country. World-renowned brands such as the Intercontinental, the Hyatt, Pullman Hotels and Resorts (Axis), and the Marriott Autograph Collection will soon enter the Georgian hospitality market.

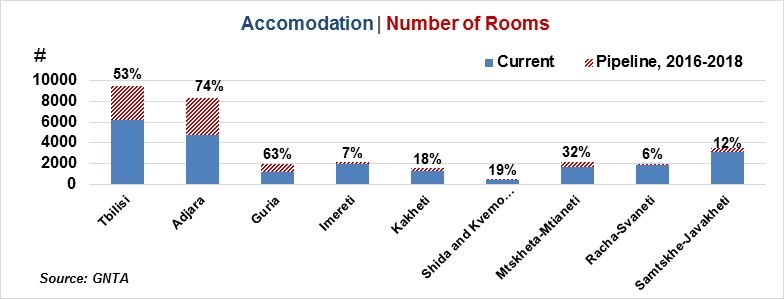

The graph below shows the number of rooms available in Tbilisi and the regions, the pipeline, and the percentage increase. Tbilisi is leading in the number of rooms available, and will have about 9,500 by the end of 2018 (a 53% increase); the Adjara region, although in second place by the number of rooms available in the country, will experience the highest increase at 74%. Guria, which currently offers only local low-scale hotels and guest houses, will experience a 63% increase in the number of rooms. The most noticeable will be the arrival of the Marriott Autograph Collection - Hotel & Spa Resort in Shekvetili, Guria. Opening a high-class international hotel in this location will attract domestic and international tourists.

The recent surge in the number of hotels and hotel rooms is a very good indicator of economic progress and the confidence of international and domestic investors in the future of the country. On the other hand, an excessive supply of hotel accommodation can have a significant negative effect on hoteliers if internal and external economic conditions turn out to lag behind expectations. According to an influential piece of work by Abel (1983), “Optimal Investment under Uncertainty,” in a competitive environment with uncertain output prices, businesses with high adjustment costs will tend to increase their capacity relative to complete information setting. In the hospitality business, this means that at the investment stage, investors will rationally decide to provide excess supply, so that if it turns out that market conditions are very good, they can increase supply relatively easily, but this also means that in an economic downturn, excessive supply will further exacerbate the consequences of adverse economic shocks. Balancing between demand and supply in an environment with uncertain prices is, therefore, an important challenge faced by investors and policymakers.

To understand demand conditions in the market, hospitality business investors and management professionals often refer to indicators such as Occupancy1 and Average Daily Rates (ADR)2. As reported by Colliers International, the average occupancy rate in Tbilisi is 68% for international upscale brands, which is high in comparison with cities in Eastern European countries (58% on average by STR Global). Occupancy rates for other classes of hotels are also relatively high. According to Nikoloz Kevkhishvili, the Head of Evaluation and Advisory Department of Colliers International, an occupancy rate higher than 60% is one of the indicators for high demand and undersupply. ADR is also significantly high: $109 (average for upscale, midscale, economy class, international and local) in Tbilisi and $75 in Eastern European cities.

| Performance Indicators/Occupancy Rates | Tbilisi | Batumi | Kutaisi | |||

| 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | |

| International Upscale Brands | 66% | 68% | 40% | 45% | N/A | N/A |

| International Midscale Brands | 72% | 65% | N/A | N/A | ||

| Local Upscale and Middle Class | 59% | 65% | 54% | 43% | 46% | 50% |

| Local budget/economy class | 57% | 49% | 30% | 33% | 38% | 44% |

Source: Colliers International (2016)

Leah Rusia Beselidze, Head of the Consultancy Team of Cushman & Wakefield, explains that the hotel pipeline consists of a number of midscale international brands (4 and 3-star hotels). Currently, this class of hotels is underrepresented in the Tbilisi market, which creates additional pressure on demand for upscale 5-star hotels. The upcoming supply of new accommodation units should lower the occupancy rate and ADR in Tbilisi.

In general, the hospitality industry in Georgia will become more balanced, with quite a wide choice of different types of accommodations. The entrance of foreign brands into the local market will put Georgia on the touristic map for new customers, and will further enhance the country’s image as a touristic destination.

While the above performance indicators are quite strong, albeit showing a weakening trend, they hold true mostly for Tbilisi. For example, the occupancy rate in Batumi for international upscale and midscale brands stands at 45%, which is well below the 60% rate which guarantees that the upcoming supply in Batumi will not hurt existing hoteliers significantly. Occupancy rates for other classes of hotels are even weaker. The hospitality business in Adjara is strongly seasonal, which means that during peak seasons, hotels in Batumi are quite busy, but remain relatively idle during the off-season, which creates additional vulnerabilities for other markets.

The increasing trend in supply, despite relatively weak or weakening demand conditions, to some extent can be explained by the increasing inflow of tourists to Georgia. With a 26.6% cumulative average growth rate in the period 2005-2015, tourist inflow has steadily continued its rise and is expected to reach 8 million tourists by 2020, assuming the same growth rate in the number of tourist arrivals. However, this is not guaranteed unless backed up by an adequate economic and policy environment, which according to the World Economic Forum (WEF) is not very favorable.

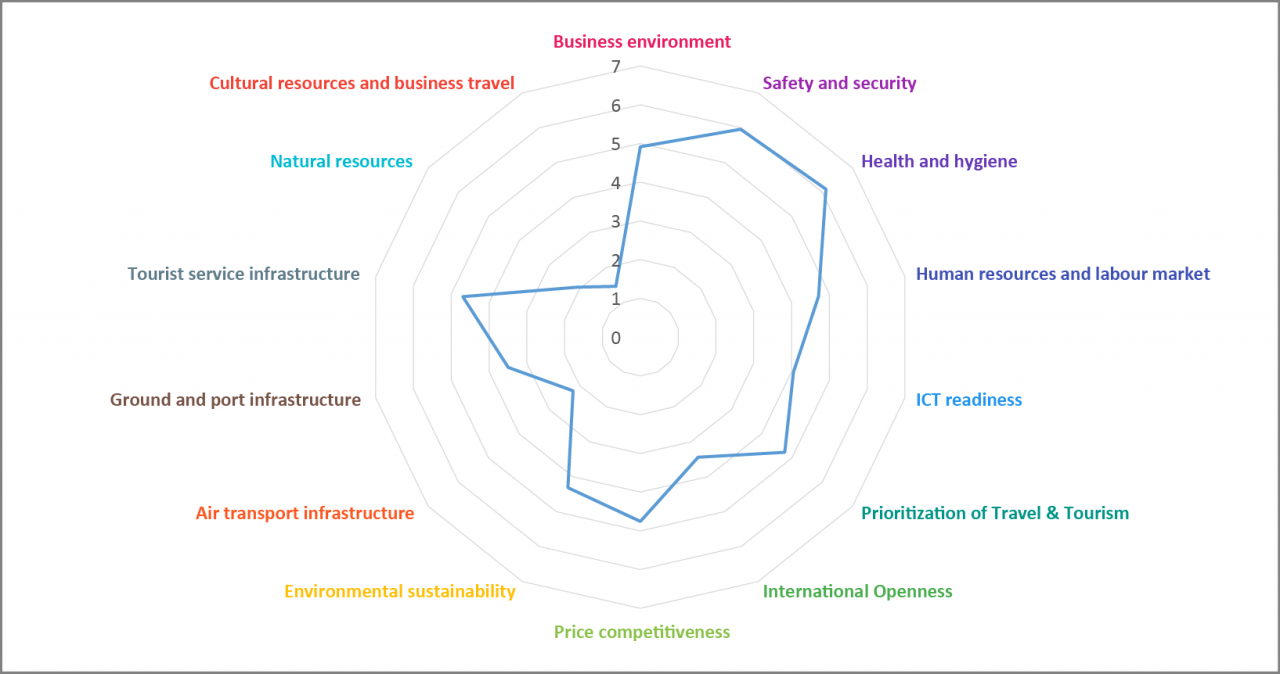

According to the WEF Travel & Tourism Competitiveness Index for 2015, Georgia stands at 71 out of 141 countries. The Index is divided into 14 pillars, with 1-7 (best) scores in each (see the graph).

The Index indicates the weak points of the Georgian tourism sector and indicates the direction for further development. While Georgia gets high scores on some pillars like Safety and Security and Health and Hygiene, some other pillars are scored quite low, 1-2. Transportation and better connections are still one of the biggest issues. One of the lowest-ranked pillars, Air transport infrastructure (score 2), includes sub-indices such as the number of operating airlines, available seat kilometers, aircraft departures and etc. With three international airports in the country, a very low number of direct flights are available, with a high portion of flights scheduled in the night to early morning time. The development of this pillar will positively affect the number of tourists arriving from non-neighbor countries.

The lowest ranking pillar is Cultural Resources and Business Travelers, which includes: number of international association meetings, number of sports stadiums, and number of World Heritage cultural sites. The latter sub-index is rather hard to improve, though with a better promotion strategy it is doable. The first two, on the other hand, should be considered more actively. A higher number of international meetings will help to address the problem of seasonality, which is peculiar to winter and summer resorts of Georgia. So-called MICE (Meetings, Initiatives, Conferences, and Events) tourism will help to attract tourists throughout the whole year. Even more, MICE tourism has the potential to become a new Georgian niche at the regional level. However, this type of tourism is highly dependent on the previously discussed pillar of better air connections.

The policy for further development of the tourism industry should be expanded to cover other tourism supporting sectors. Improvements implemented in low-ranked pillars will lead to better enhancement of the net benefits of investments to date in the hospitality sector. Better air connections and diversified tourism segments will help keep demand-side increasing.

To go back to the title of this article, the answer is probably no, not yet at least, but Georgia needs to keep upgrading policies and infrastructure faster than the growth in tourists and hotel numbers to keep both the investors and tourists happy and satisfied.

ISET-PI would like to express its gratitude to GNTA, Cushman & Wakefield, and Colliers International for the interviews and information provided.

1 Occupancy rate is the ratio of rented or used rooms to the total amount of available rooms. This rate is calculated as average for the whole year.

2 Average Daily Rate (ADR) is the average rental income per paid occupied room in a given time period.