10

July

2023

10

July

2023

ISET Economist Blog

Monday,

09

October,

2017

Monday,

09

October,

2017

Monday,

09

October,

2017

Monday,

09

October,

2017

Just recently, a rare occurrence made the headlines in Georgia: Moody’s Investors Service upgraded the government of Georgia’s local and foreign currency issuer ratings first time in seven years, to Ba2 from Ba3, with commentary that the outlook remains stable. This news was met with great excitement, but was soon overshadowed by the unfortunate news of Georgia’s downgrade on the Global Competitiveness Indicators, without fully appreciating or understanding the significance of the Moody's upgrade.

Moody's Investors Service provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and the Fitch Group, is considered one of the Big Three credit rating agencies, occupying more than 90% of the market.

Credit ratings express an agency’s opinion about the ability and readiness of a bond issuers, such as governments and financial and non-financial institutions, to meet their financial obligations fully and in due time. The creditworthiness of borrowers is assessed using an extensive set of indicators, and is expressed using a standardized ratings scale. There are slight differences between the rating scales of the three agencies, but they mostly fall under two broad categories: investment and speculative grades. The investment grades by Moody’s range from Aaa, highest quality, to the lowest risk credit; Baa3 is medium quality moderate risk credit (see the table below). There are eight other notches between Aaa and Baa3. The speculative grade ratings, where Georgia currently falls, despite the upgrade, starts with Ba1. Ba1, Ba2 (current ranking), and Ba3 fall under the category of credit judged to have speculative elements and a significant credit risk. There are seven other notches before the lowest category of grade C, for issuers with a very high probability of default. The outlook provides information to lenders on the potential evolution of a rating, and thus increases the precision of the rating. A positive outlook means that a rating may be raised. A negative outlook means that a rating may be lowered, and stable means that a rating is not likely to change. Developing (or evolving) means that a rating may be raised or lowered.

Rationale for grade upgrade to Ba2 and stable outlook.

According to the Moody’s Investors Service report, the upgrade in the rating was driven by Georgia’s recent economic growth and demonstrated resilience, effective macroeconomic policy management, and strong banking supervision that allowed banks to support an economy facing significant economic, financial and exchange rate shocks.

Moody’s report underlines such significant ongoing processes such as diversification of trade, accessing new markets and building new investment relationships and the Association Agreement and Deep and Comprehensive Free Trade Agreement (DCFTA) with the European Union. In addition, recent and prospective trade agreements, such as those with a number of Commonwealth of Independent States members, Turkey, and the prospect of a free trade agreement with China, were relevant. The report emphasized that these agreements will help to maintain FDI levels at close to 10% of GDP, and will likely increase exports and economic growth in the medium term.

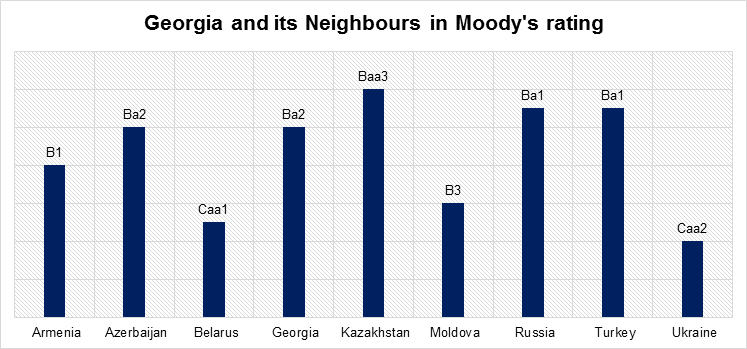

With this recent upgrade, Georgia becomes one of the best performing countries in the region; however, sovereign credit ratings, except the one for Kazakhstan, still fall within the speculative credit grade category, reflecting ongoing economic and political vulnerabilities in the region.

Credit rating agencies are extremely important for developing countries like Georgia for a number of reasons.

Sovereign credit ratings play an important part in determining countries' access to international capital markets, and the terms of that access, e.g. how much they can borrow and at what interest rate. Country sovereign ratings, which are widely available and comparable across countries, allow for savings on costs of information collecting and analysis. This is especially true for developing countries, and generally in countries with low levels of financial transparency. The sovereign ratings play an important role even if the governments do not issue bonds, as the sovereign rating often provides a ceiling for the private sector, and the absence of a credit rating usually deters its access to international capital markets.

Institutional investors in both the developed and developing world rely heavily on rating agencies in making investment decisions, or in the case of donors, in providing official development aid. A downgrade to speculative grade, or so-called to junk grade, forces some institutional investors, such as pension or insurance funds, to sell bonds or other financial instrument by the downgraded issuer, usually because of regulatory requirements. A recent study by the World Bank on the ratings of 20 developing countries between 1998 and 2015, found that a downgrade to junk raised the interest rates on a country’s short-term bonds by an average of 1.38 percentage points, which is considered to be a significant increase in cost of borrowing.

Empirical evidence also establishes a connection between sovereign credit ratings and FDI. Cai et al. (2016) studied the effect of sovereign credit ratings on FDI flows between 31 donor (OECD) and 72 recipient (non-OECD) countries during the period 1985 – 2012. Sovereign ratings were found to be significant drivers of bilateral FDI flow. The study also looked into the regional effect; more specifically, it showed that FDI tends to flow to countries located in high quality credit neighborhoods. Investors prefer to invest in high average credit rating region, compared to low average rating regions.

Second, sovereign ratings serve as an incentive for developing country governments to implement more prudent and sound monetary and fiscal policies, since performance on these policies constitutes a cornerstone of the rating methodologies. Analysis by Hanusch and Vaaler (2013) provides an interesting example as to how credit rating agencies contribute to fiscal discipline. The literature of political budget cycles predicts increases in government spending and fiscal deficit close to elections, allowing governments to appear competent in fiscal and economic affairs by providing additional public goods and services. The opposite is signaled through a public announcement of a credit downgrade, which is accessible to financial markets as well to constituents. According to the authors, this serves as a disciplining device for fiscal policy to not surrender to short-term political pressures, and rather to promote policies supporting long- term development objectives. They show that governments going into an election year immediately after a rating downgrade are 27% more likely to lose at the polls. Governments going into an election year with a negative rating outlook run smaller budget deficits compared to those with positive or stable outlooks.

Driven by Moody's upgrade of Georgia's government bond ratings, which indicates the government's improved capacity to provide needed support to commercial banks, Moody's has upgraded JSC Bank of Georgia's (BoG) and JSC TBC Bank's local-currency deposit ratings to Ba2 from Ba3, and their foreign-currency deposit ratings to Ba3 from B1. BoG's senior unsecured foreign-currency debt rating was also upgraded to Ba2 from Ba3. The ratings continue to carry a stable outlook. In other words, most immediately, two major financial institutions will be able to access international capital markets at a lower cost, albeit slightly, which could lead to positive developments for these institutions and subsequently for the whole Georgian economy.

Given the very strong similarity in credit rating methodologies of the three major agencies, it is very likely that the two other agencies, Standard & Poor's and Fitch Group, will also upgrade Georgia’s ranking, which will reinforce Georgia’s image as a one notch more secure place for lending and investment. However, one has to keep in mind that the market is more sensitive to negative news, compared to positive, and therefore this upgrade comes with increased responsibility for fiscal discipline and sound monetary policy.