31

May

2023

31

May

2023

ISET Economist Blog

Saturday,

12

May,

2018

Saturday,

12

May,

2018

Saturday,

12

May,

2018

Saturday,

12

May,

2018

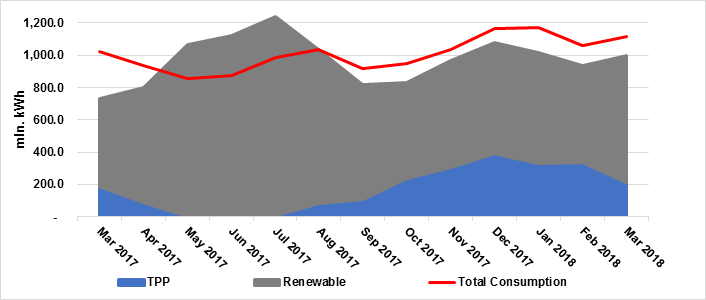

In March 2018, Georgian power plants generated 997 mln. KWh of electricity (+35% compared to March 2017, and + 7% compared to February 2018). Nearly a quarter (24 %) of this electricity was produced by the Enguri and Vardnili hydropower plants, which produced 188 mln. kWh and 49 mln. kWh, respectively. Consumption of electricity on the local market was 1,116 mln. kWh (+9% compared to March 2017, and +5% compared to February 2018). Around 19% of this electricity was consumed by Abkhazia (207 mln. kWh).

The Enguri and Vardnili HPPs represent nearly the only source of electricity for the Abkhazian region, which is consuming about 60% of the annual generation of these two plants (87% of total generation in March 2018). Interestingly, Abkhazia, with a population of roughly 250,000 people, annually consumes nearly as much electricity as Tbilisi (population 1.15 mln.)

Figure 1. Electricity Consumption and Generation (mln. kWh)

Over the past several months, ISET-PI was approached several times with questions regarding the consumption of electricity in Abkhazia. A quick look at the numbers provides some food for thought.

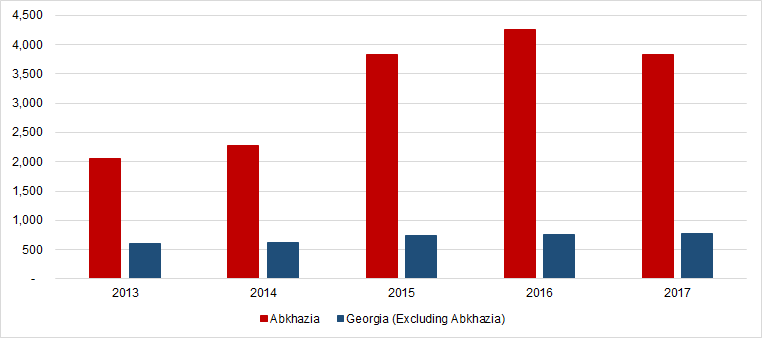

Power consumption per capita in Abkhazia is three times larger than in the rest of the country and dwarfs the same indicator for many Eastern European states. Such a large consumption of electricity is not a new characteristic for Abkhazia. Although, over the last 11 years, Abkhazia and the rest of the country had a similar trend of 5% growth in total electricity consumption. Seasonality in consumption between Abkhazia and the rest of the country is similar. Power consumption is highest in the winter and lowest in the summer months.

Table 1. Electric Power Consumption per capita (kWh)

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Abkhazia | 6,613 | 6,738 | 7,379 | 7,899 | 8,206 |

| Tbilisi | 1,761 | 1,916 | 2,168 | 2,463 | 2,562 |

| Georgia (excluding Abkhazia) | 2,172 | 2,292 | 2,307 | 2,441 | 2,650 |

| Czech Republic | 5,980 | 5,975 | 6,111 | 6,184 | 6,315 |

| Estonia | 6,238 | 6,277 | 6,188 | 6,522 | 6,838 |

| Latvia | 3,535 | 3,522 | 3,481 | 3,543 | 3,649 |

| Poland | 3,824 | 3,877 | 3,956 | 4,068 | 4,182 |

| Turkey | 3,110 | 3,192 | 3,267 | 3,376 | 3,530 |

Source: ESCO, IEA, EuroStat, www.ugsra.org

Looking at the economic output, we see another interesting characteristic. Per thousand dollars of GDP, the Abkhazian region consumes nearly six times more electricity (3,824 kWh) than the rest of the country (651 kWh). This potentially underlines the very inefficient consumption of electricity in the region, considering that there are nearly no electricity-intensive industries developed, with the exception of the production of polymers (plastics). The composition of gross value added in Abkhazia shows that around 80% of the economy is comprised of trade (27%), construction (16%), industry (11%), governance (13%), agriculture (7%), and health (7%). Industry includes: wood and construction materials, agricultural processing, and the production of polymers.

Figure 2. Electricity Consumed per 1,000 USD of Gross Domestic Product

So who is consuming so much electricity?

Looking at the output numbers, there is no electricity-intensive industry consuming a lot of electricity. One of the concerns raised when discussing electricity consumption growth is that mining cryptocurrencies are becoming a significant source of electricity consumption within the occupied territory. This theory is not coming out of anywhere. According to some articles, Abkhazia intends to create a national cryptocurrency to avoid international sanctions on investments. However, cryptocurrency mining is not necessarily taking place on a large scale. First, according to the statistics office of the de facto regime, the IT industry accounts for just a tiny part of the gross value added in the region (roughly 300,000 USD in 2016). Second, electricity supplied from the rest of the country to the occupied region has not been increasing significantly over the past year (only 4% annual growth in 2017). Although this does not totally eliminate the possibility of growing cryptocurrency mining, for now, the data shows that there are still “business as usual” conditions in place.

Thus, discarding other possibilities, the large electricity consumption seems to come from household consumption patterns. Considering the very large per capita electricity consumption, households are probably utilizing electricity for most of their energy demands, due to the low tariffs paid on electricity. According to the website of local distribution company Chernomorenergo, electricity tariffs in Abkhazia are very low: 0.4 Rubles (1.6 Tetri - 0.7 US cents) per kWh for households, and 0.85 Rubles (3.3 Tetri - 1.3 US cents) per kWh for legal entities. These tariffs make electricity nearly free for residents of Abkhazia, while in the rest of the country, electricity costs are nearly 14 times higher for households (14 to 23 tetri) and six times higher for legal entities (14 to 21 tetri).

Demand for electricity from Abkhazia has been increasing steadily over the past 11 years. Should this be cause for concern? Maybe, considering that even with the “business as usual” growth demand from Abkhazia requires larger shares of generation from Enguri and Vardnili HPPs every year. At least during the winter season, Abkhazia may soon regularly require more electricity than the combined generation capacity of both of the plants - a situation that already occurred a few times in the past. If this happens, it will be a serious challenge for Georgian policy-makers. Some of the questions that will have to be asked as the first order of business are:

• Is Georgia going to supply the occupied territory with electricity after the generation capacity of Enguri and Vardnili is fully utilized?

• How should the electricity market of the rest of the country internalize the costs of supplying electricity to Abkhazia for free?

• What is the optimal strategy to address such a problem?

Answering these questions is a multidisciplinary task that requires an analysis of political conditions, political economy, and energy economics. What is sure is that, unless the conflict with Abkhazia is resolved, Georgia will soon need to develop a clear-cut policy about how to treat this specific demand for electricity. There is no easy recipe for how to do it.