10

July

2023

10

July

2023

ISET Economist Blog

Friday,

27

March,

2020

Friday,

27

March,

2020

Friday,

27

March,

2020

Friday,

27

March,

2020

The outbreak of the virus and the corresponding containment measures have started to severely affect the global economy. The Organization for Economic Co-operation and Development (OECD), in its Interim Economic Outlook Report (2020) on March 2nd downgraded 2020 real GDP growth projections for almost every country. The largest reduction in growth projections is seen for China (-0.8 percentage points) with a worldwide real GDP growth rate expected to decline from 2.9% (November 2019 forecast) to 2.4%. In their report on March 6th, Asian Development Bank (ADB) estimated up to a 0.4 percent fall in world GDP due to the COVID-19 virus. Just like the OECD, the ADB also emphasizes the impact coming from China, where the virus was concentrated at that time1. Meanwhile, as the situation in Europe and the United States is worsening day by day, forecasts of Global GDP are being downgraded significantly. “The outlook for global growth: for 2020 it is negative—a recession at least as bad as during the global financial crisis or worse” was noted by the International Monetary Fund Managing Director Kristalina Georgieva in her statement on March 23rd, 2020 following a G20 Ministerial Call on the Coronavirus Emergency. To summarize, there seems to be a consensus today that the scale of the economic and financial impact of the coronavirus may well be unprecedented and will depend highly on the management of the virus outbreak.

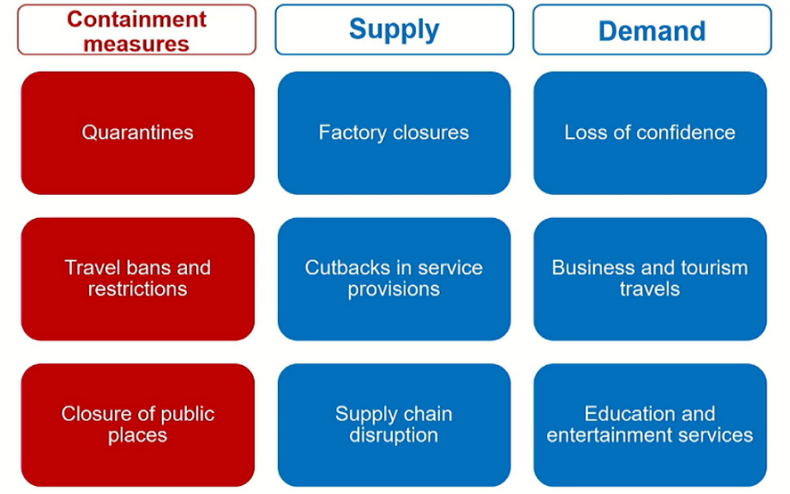

According to the above-mentioned OECD report, various containment measures introduced due to COVID-19 will impact economies via both supply and demand channels.

Illustration 1: Economic channels through which containment measures affect the economy

Though international and local organizations are forecasting the economic outcomes of coronavirus, high uncertainty still exists surrounding this topic.

In this note we will NOT try to estimate the extent of economic contraction in Georgia, we will rather focus on the HORECA (Hotels, Restaurants, Cafes) sector, which is expected to be the immediate recipient of the shock; analyze how its contraction will affect other industries in the short-term, and assess the distribution of the combined impact across regions of Georgia.

We focused on the Accommodation and Food Services (HORECA) industry for the following reasons: firstly, containment measures like travel bans, along with increasing fear of climbing numbers of coronavirus incidents throughout the world, have a direct effect on international tourism inflows, which immediately impact hotels, restaurants, and cafes along with tourist destinations, resorts, and various entertainment services; domestic tourism also adds to all of the above. Secondly, apart from tourism, the HORECA sector in Georgia is being affected by the government regulations on COVID-19 precautionary measures and subsequent declining local demand. Along with the announcement of the state of emergency on March 21, to limit the chances of exposure to the infection, the government has imposed restrictions on public gatherings and activities of restaurants, trade centers, public transport, sport and spa facilities, and cultural and sports events. Shops and trade centers are closing for an indefinite period, restaurants have recommendations to close down all operations that involve contact with people and only work through delivery services, and many hotels are choosing to close down for some period, even though they do not yet face official bans. The effects of coronavirus on the Georgian HORECA sector are already quite visible – according to the March report by TBC Capital payments with TBC Bank terminals in hotels have decreased by 40% compared to the previous year, moreover, payments in food service facilities by residents and non-residents have also gone down significantly2.

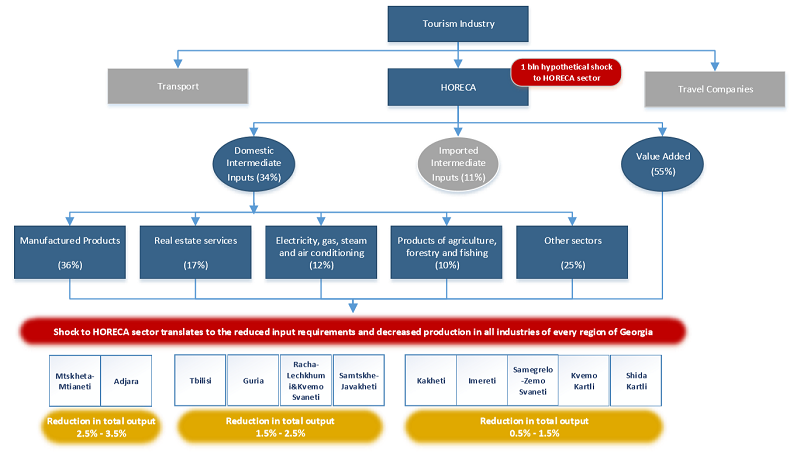

A shock to a given sector initially causes the level of output in that particular industry to change. This is just an immediate reaction to the shock by producers. A direct consequence of changes in the industry’s output is the adjustment of demand for inputs that are used in the production process of this particular industry. With these changes in intermediate input requirements, one can evaluate the impact of a shock, not only on accommodation and food service activities but on other industries in an economy as well. To observe these effects, we used Supply and Use Tables (SUTs) for 2018 provided by the National Statistics Office of Georgia (GeoStat).3 Finally, this note analyzes how these combined effects of a shock will be distributed throughout the regions of Georgia and how different industries contribute to the economic reduction in each region. The illustration below summarizes this analysis.

Illustration 2: Flow analysis of economic shock

First of all, we start with a hypothetical negative shock to the HORECA industry of 1 billion GEL, which equals about 27% of the total annual output in this sector. The accommodation and foodservice industry uses many different inputs in their production process, in fact, they use inputs/products from almost every other industry in the economy, including their own. Therefore, when demand decreases for services in the HORECA industry, other sectors also decrease their production, since their product is now less needed as an intermediate good. While there will be second and subsequent rounds of production reductions related to further changes in input requirements in economic industries linked with the HORECA sector, it should be noted that we focus on measuring only the direct effects of the shock-capturing the immediate responses in the first round of production processes.

As inputs from the (1) manufacturing, (2) real estate services, (3) electricity, gas, steam, and air conditioning, and (4) agriculture, forestry, and fishing industries are used the most in the HORECA sector as intermediate goods (see Illustration 2), these sectors will take the biggest consequential hit. Overall, we estimate that a 1 billion GEL shock to revenues in the HORECA sector will have an additional negative impact of 400 million GEL through the direct input use channel.

Further, we looked at the impacts on the regional level. Based on the distribution of economic activity, we investigate the impact of the decline in HORECA and other sectors across different regions of Georgia (See Illustration 2).

As we see, the biggest hit is to the Mtskheta-Mtianeti and Adjara regions, where total output is expected to decline from 2.5 to 3.5%, followed by the Guria, Tbilisi, Racha, and Samtskhe-Javakheti regions with an expected reduction from 1.5 to 2.5%. The relatively lower negative impact, from 0.5 to 1.5% of total output, is expected in the Kakheti, Imereti, Samegrelo, Kvemo Kartli, and Shida Kartli regions.

Since the shock is directed at the HORECA sector, in all regions, with the exception of Kvemo Kartli and Shida Kartli, a reduction in total output is driven by this industry, comprising more than 50% of the total reduction in value-added. Table 1 below presents sectors that are the first and the second biggest contributors to the decline in value-added in each region.

Table 1: Biggest contributors to the reduction in value-added across regions of Georgia

| Regions | Biggest contributor | Second biggest contributor |

| Mtskheta-Mtianeti | HORECA (76%) | Manufacturing (7%) |

| Adjara | HORECA (85%) | Real estate services (7%) |

| Guria | HORECA (73%) | Real estate services (11%) |

| Samtskhe-Javakheti | HORECA (67%) | Agriculture, forestry and fishing (9%) |

| Tbilisi | HORECA (77%) | Real estate services (8%) |

| Racha-Lechkhumi&Kvemo Svaneti | HORECA (69%) | Agriculture, forestry and fishing (8%) |

| Kakheti | HORECA (51%) | Agriculture, forestry and fishing (22%) |

| Imereti | HORECA (45%) | Manufacturing (13%) |

| Samegrelo-Zemo Svaneti | HORECA (51%) | Agriculture, forestry and fishing (13%) |

| Kvemo Kartli | Manufacturing (28%) | HORECA (19%) |

| Shida Kartli | Agriculture, forestry, and fishing (34%) | Real estate services (15%) |

The table above demonstrates that the HORECA sector plays the most significant role in the reduction of value-added in the Adjara Region, followed by Tbilisi and Mtskheta-Mtianeti. Moreover, as we observe, the biggest contributors, besides HORECA, are the industries that comprise the most substantial part of intermediate inputs for the HORECA sector (see Illustration 2).

To summarize, when analyzing the economic effects of coronavirus on the economy, it is important to have different channels of impact in mind. Considering the shock to the tourism industry and the containment measures implemented by the Georgian government, the accommodation and foodservice industry will be hit the hardest with negative spillover effects becoming evident across most other sectors. In this note, we tried to assess how a shock to the HORECA sector is amplified in the short run and how the impacts are distributed regionally. We find that a hypothetical 1 billion GEL shock to the HORECA industry in the short run, leads to an additional 400 million GEL drop in the output of the Georgian economy with Mtskheta-Mtianeti and Adjara being affected the most.

1 https://www.adb.org/sites/default/files/publication/571536/adb-brief-128-economic-impact-covid19-developing-asia.pdf

2 https://www.tbcresearch.ge/en/Research/Download?ResearchId=282&Type=PDF

3vSupply tables show the structure of supplied goods and services in the economy by product and industry; use tables show the structure of goods and services used for intermediate consumption by product, industry, and components of final use (final consumption expenditure, gross capital formation, and exports).