31

May

2023

31

May

2023

ISET Economist Blog

Wednesday,

04

July,

2012

Wednesday,

04

July,

2012

Wednesday,

04

July,

2012

Wednesday,

04

July,

2012

In the last week's Khachapuri Index column in The Financial, we took a break from agriculture and focused instead on the energy sector of Georgia. While the bulk of khachapuri cost is related to homegrown agricultural products, to actually cook khachapuri one has to use energy. And though the share of energy in the total cost is very low, less than 6% (15 tetri, if using gas; 16 – if using the electrical oven), it does not make the sector any less interesting to discuss.

Let us begin by stating the obvious: ever since we started our Khachapuri Index survey in August 2008, the prices of energy (natural gas and electricity) have not changed, having a moderating effect on the seasonal fluctuations of the index. The reason the price of energy has not changed is very simple – both electricity and natural gas tariffs are regulated by the Georgian National Energy and Water supply Regulatory Commission (GNEWRC). While formally independent, GNEWRC heeds the friendly advice from the Ministry of Energy and Natural Resources. And the Ministry’s advice apparently is: keep these (politically sensitive) prices constant.

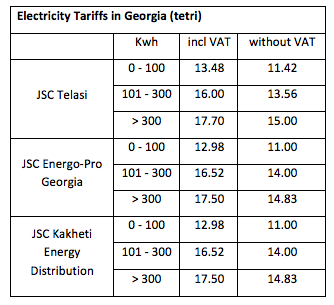

As far as electricity is concerned, there is a tiny geographic variation in tariffs (see table). In Tbilisi, where electricity is distributed by Telasi, household tariffs are a bit higher than in Kakheti (Kakheti Energy Distribution Company) and the rest of Georgia (Energo-Pro Georgia). All three companies, however, apply the same incentive scheme, whereby the more one consumes the more one pays per unit (the highest tariff is about 1/3 higher than the lowest). And all three were not allowed to change their tariffs in recent years.

There is a long chain (actually, a cable) connecting consumers and producers of electricity in Georgia, and an interesting question is how much of the price we pay goes to which operator along this chain. Electricity travels a long distance from the generating companies (mostly hydro) through high voltage lines maintained by a state monopoly Georgian State Electrosystem (GSE) and Sakrusenergo. It arrives at the privately-owned distribution monopolies: Telasi, Energo-Pro Georgia, and Kakheti Energy Distribution, and only then flow to our houses after being transformed into low voltage.

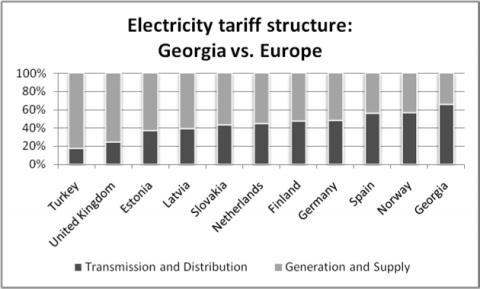

The electricity tariff we pay is allocated among these three types of actors in unequal shares. The lion’s share of the tariff, about 60%, goes to the distributors. About 34% is received by the generating companies. The smallest share, 6%, remains with the transmissions system operators. To some extent, this may be logical given that these actors face rather different costs. However, the allocation formula could also be challenged on the basis of comparison with other countries around the world. It turns out that the share of network costs (distribution and transmission) in the final price of electricity is higher in Georgia than in most European countries. On the one hand, this is easy to understand given that the bulk of the Georgian generation is based on a cheap resource - water. In particular, the two largest Georgian hydropower stations, Enguri and Vardnili (both in-state ownership) sell electricity at a ridiculously low tariff of fewer than 1.2 tetri per kWh (less than 10% of the final consumer price). And these two are responsible for between 40 and 50% of the total generation! Still, Georgian distributors get a better deal than their counterparts in Norway, another hydro-based country.

Thus, the question remains whether or not the three distribution monopolies could be pushed by the regulator to operate at a lower profit margin. This question may become more pressing when additional hydropower stations become operational in a couple of years. Greater competition at the generation stage may increase the relative market power of distribution monopolies, allowing them to squeeze the new hydropower stations. However, this may not necessarily translate into lower consumer prices. For that to happen, the regulator would have to step in. Alternatively, if Georgian hydro-generators get improved access to the Turkish market, they would be in a position to negotiate higher prices and reduce the share of distribution companies in the final consumer tariff (assuming the regulator will keep it fixed).