02

July

2024

02

July

2024

ISET Economist Blog

Tuesday,

14

August,

2012

Tuesday,

14

August,

2012

Tuesday,

14

August,

2012

Tuesday,

14

August,

2012

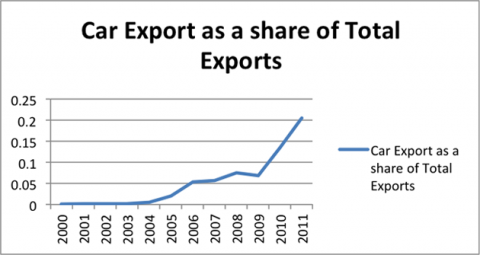

Car export was 20.5% of the total exports in 2011 and it had the highest share in total exports, among all export goods. What a striking fact! So, what does this mean for Georgia and how can we become regionally more competitive in the car trade? How can we meet the demand for European, Japanese and US cars in Caucasian and Central Asian markets by becoming a regional trade and transit center for those cars?

Since 2005, car exports have been steadily increasing, in value and as a share of total exports. The correlation between car exports and imports is 0,67 and their dynamics follow a similar pattern which is the case basically because Georgia is not a car producer; rather - it re-exports imported cars from Japan, the USA, and Europe.

What does it mean to be a re-exporter?

Being an exporter means that it is exposed to demand shocks, which are out of the control of its policy treatments. Being a re-exporter, in addition, means that country is exposed to supply shocks that are out of control of its macroeconomic policy treatments. Besides, being a re-exporter means that there is a high correlation between imports and exports and thus if there is an import shock then exports also suffer and vice versa.

And again a striking fact!

Car exports increased by 98% in 2011 compared to the previous year. This was partly caused by the changes in the customs legislature of Kazakhstan, lowering tariffs on imported cars, which took place in the first quarter of 2011. However, this was not the deterministic cause for such a high increase in 2011. During the third quarter, Kazakhstan annulled changes in its legislature and increased tariffs again but Georgia still maintained its high levels of car exports.

What was the main reason behind the trend?

The main reason for the increasing trend in car export/import since 2005 has been the favorable institutional and legislative reforms, which have lowered tariffs and simplified customs procedures for importers/exporters of cars. Those reforms lowered export/import costs and consequently increased mark-up for car re-exporting companies and/or decreased prices for foreign consumers.

Georgia has the potential to become a regional (Caucasus, Central Asia) hub for trade-in automobiles. This could be one of the untapped potentials for the country. By now, Georgia has favorable institutional settings and has proven the ability to develop in this direction i.e. increasing exports means that there is demand and increasing imports means that companies also have incentives to re-export cars because they see the business being profitable.

So, where should we go further?

By now Georgia has a negative trade balance in cars (it has had a negative balance since 2000) which means that Georgia is paying more than it receives from re-exports. To become a regional hub and to proceed further in this direction Georgia should start targeting a positive trade balance in cars.

Here are two main reasons why negative trade balance is being caused:

Here are some suggestions on how to deal with the negative trade balance on cars: