02

July

2024

02

July

2024

ISET Economist Blog

Monday,

17

December,

2012

Monday,

17

December,

2012

Monday,

17

December,

2012

Monday,

17

December,

2012

Georgia’s competitiveness is said to hinge on its strategic location between East and West. The latest data on border crossings (by people and trucks) allow us to shed light on progress to date and take a glimpse into the future.

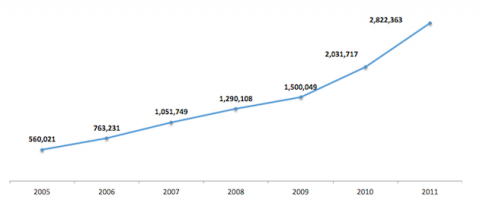

The efforts to develop Georgia as a major touristic destination in recent years seem to have paid off. The number of international arrivals to Georgia has been growing rapidly, reaching 2,822,363 in 2011. In the first 11 months of 2012, the number of visitors exceeded 4mln, which is 58% more than in the same period of 2011.

International arrivals to Georgia: 2005-2011

But how much of this increase in international arrivals represent an actual growth in tourism? While there is no precise data to answer this question, several points are worth emphasizing.

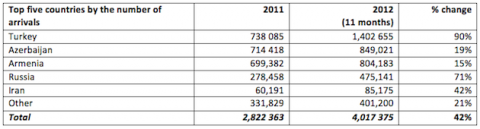

First, Georgia has done a lot to lift restrictions on travel to and through the country. In particular, it has no visa regime with almost 90 nations; citizens of most other countries can be issued visas (and, until recently, also bottles of wine!) at the border. Still, these measures did little to boost the number of arrivals from further away destinations. To date, 86% of all arrivals are from neighboring countries: Armenia, Azerbaijan, Russia, and Turkey.

Second, and related to the above, Georgia remains a rather expensive and hard-to-reach destination. The opening of the Kutaisi airport and the entrance of Ryan Air are a step in the right direction, however, at present most foreign visitors enter Georgia by land.

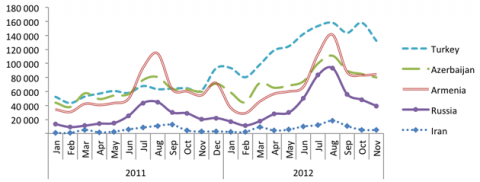

Foreign arrivals to Georgia: 2011 and the first 11 months of 2012

Third, with the notable exception of Turkey (see below), foreign arrivals are extremely concentrated in the very short period around July and August. This highly pronounced seasonal pattern negatively affects the entire hospitality industry (by reducing incentives to invest in physical capital and skills), strains the environment, and drives a wedge between prices and quality.

Fourth, three countries stand out as far as growth in the number of foreign arrivals is concerned: Turkey (up 117% in the first 11month of 2012); Russia (up 85%), and Iran (up more than 45%). Georgia’s unilateral move to abolish visas, the opening and modernization of the border crossing point in Kazbegi, and the renewal of flights have all played a role as far as Russia is concerned. However, Russian tourism remains way below its potential and may double or triple in 2013.

Iran is a very special case: the economic sanctions imposed on Iran by the international community are pushing many Iranians to seek work and study opportunities abroad. Georgia is one of 37 countries around the world that have no visa regime with Iran, making it an attractive destination for Iranian students, workers, and business people.

Finally, what about Turkey? The more than doubling in foreign arrivals from Turkey apparently has little to do with tourism and everything to do with Georgia’s growing importance as an east-west transportation corridor. International sanctions are beginning to bear on Iran, and more and more Azerbaijani and even Iranian trade is being diverted from the Iranian ports to Turkey and Georgia. This tendency is reflected, for instance, in the increasing volumes of imports from Turkey to Azerbaijan (up 70% in 2011). Thus, many of the Azeri, Turkish and Iranian “tourists” are in fact truck drivers who transit through Georgia. According to a recent survey carried out by Georgian National Tourism Agency (GNTA) from April 2011 until May 2012, 27% of all international visitors don’t spend a single night in Georgia; the median visitor spends less than 2 days, which is the maximum allowed transit period; 78% are repeat visitors.

In fact, the data on the number of trucks crossing Georgia’s borders suggest that many Russian and Armenian visitors are also drivers. Of Georgia’s ten border checkpoints, seven account for more than 99% of border crossings by trucks (based on 2010-12 monthly data). While the number of trucks grew at almost all checkpoints in 2012 (compared to the same period of 2011), the largest increases are related to the north-south transport corridor from Russia (Kazbegi) to Armenia (Ninotsminda). These two crossings saw increases in truck traffic of 124% and 167%, respectively. Very large increases were also recorded at Sarpi and Vale border crossings to/from Turkey (31 and 44%, respectively), and at the border with Azerbaijan (up 54% at Tsodna and 17% at Tsiteli Khidi).

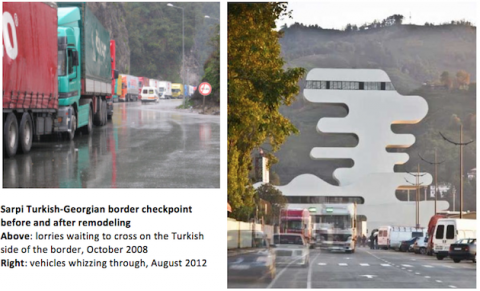

Some of the increase in transit trade should also be attributed to Georgia’s efforts to modernize its border checkpoints, including improved infrastructure, and simplified customs procedures. A great case in point is Sarpi at the Turkish border near Batumi. Opened in December 2011, the new facility is striking in both its architectural design and efficiency.

What is the benefit to Georgia from serving as a trade corridor to Azerbaijan and Armenia? The increased tear and wear to Georgian roads is partially compensated for by the fees freight companies are charged at the Georgian border: 200GEL per truck and 0.5GEL for each kilo beyond a certain threshold. This fee was introduced at the very end of 2010, generating revenues of about 20mln GEL in both 2011 and the first 11 months of 2012.

* * *

The National Competitiveness Report for Georgia is made possible by the generous support of the American people through the United States Agency for International Development (USAID). The contents are the responsibility of Eric Livny and do not necessarily reflect the view of USAID, the United States Government, or EWMI.