02

July

2024

02

July

2024

ISET Economist Blog

Wednesday,

13

February,

2013

Wednesday,

13

February,

2013

Wednesday,

13

February,

2013

Wednesday,

13

February,

2013

The Consumer Confidence Index (CCI) attempts to capture the expectations of consumers about the future development of the economy. According to economic theory, optimistic consumers are willing to spend more money and reduce their savings, while pessimistic consumers do the opposite. This is consistent with the intuition that consumption activity and saving behavior are driven by the expectations of the future. Beyond that, the CCI can be a powerful indicator of the well-being of the economy.

If indeed the consumption behavior is driven by expectations, these expectations are likely to become self-fulfilling prophecies. Optimistic consumers are inclined to spend more money. This stimulates the economy, leading to higher economic output. Expectations are fulfilled! Pessimistic consumers, on the other hand, cut down spending, and the decline in demand will affect the economy negatively. Again, expectations are fulfilled! The phenomenon of self-fulfilling prophecies can be most vividly exemplified by price fluctuations on the stock markets.

There is another reason why the CCI reveals something about the economic situation. This reason is sometimes referred to as the “Wisdom of the Masses”. Every single consumer may be quite ignorant about the state of the economy, as everybody can observe just a tiny fraction of the whole economic system. A shopkeeper knows how much was sold in the last month, the restaurant knows how many people were served, the employee observes whether a pay-raise was granted and whether there were layoffs in the company. The information is scattered in the economy, nobody sees the big picture – but all of it together is the big picture!

How does the CCI aggregate this information? In one of the well-known behavioral experiments, people in the streets were shown a big sack filled with beans, and they were asked to estimate how many beans were in the sack. As it turned out, nobody gave the correct answer. Yet surprisingly, on average the answers came extremely close to the real number. Similar experiments were made with the weights and lengths of objects and other estimation tasks. It always turned out that on average, the estimations of the crowd were very close to the true values.

Just like in the example above, the CCI can be considered an average of many individual estimations of the present and the future development of the economy. None of them is right, but on average, these estimations can provide a good approximation of the state of the economy.

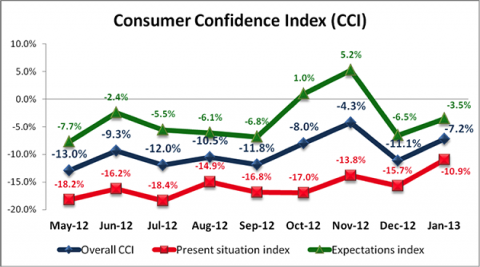

The diagram shows the consumer confidence index for Georgia. Without going into details, a higher value indicates a higher willingness to spend money, better expectations about the personal financial situation and about the general economic outlook of the country, while a lower index means that consumers are more pessimistic, they expect to spend less, are afraid of higher inflation, unemployment rate, etc. By filtering the data in a certain way, one can extract specific information on the current state of the economy (bottom graph) and on the people’s estimations of future economic prospects (top graph). The graph in the middle represents the overall CCI. As can be seen, there is a long-run positive trend in the CCI over the last 9 months, and there is an eye-catching peak in November.

Consumer confidence surveys are conducted in many countries all over the world since 1970th, including all EU member states and the US. As already described above, CCI is typically used to gauge where the economy is heading, but some economists report that it is a better predictor of the political changes to come. Thus, they try to use CCI to predict the outcomes of the elections. The idea is very simple: if the consumer confidence index is high, then the incumbent party is likely to win; If not, then the opposition party wins.

Economist Lawrence Yun calls CCI a near-perfect predictor of election results. For example, he observed that out of the last eleven presidential elections in the US, CCI was able to predict the election results in ten cases.

Paper by Gikas A. Hardouvelis "Consumer Confidence and Elections" analyzes CCI of 15 EU countries during 1985-2007 years and concludes that CCI "is able to predict the strength of the performance of the incumbent party and its probability of re-election".

In Georgia, consumer confidence has not changed before the elections and it remained depressed well below zero. The country was facing one of the most important elections in its history of independence and there was a feeling of uncertainty as to whether or not Georgia would pass a test of democracy. As it was expected, due to election results (direction of causality is clear in this case) consumers’ expectations improved in October, and the same trend continued in November 2012.

Interestingly enough expectations dropped dramatically in December 2012 Most probably, several factors have contributed to such a decline First, people realized that some of the pre-election campaign promises were not feasible or they just lack the patience to wait until the “Georgian dreams” come true. Additionally, some seasonal patterns might also have played a role, yet because we only have CCI data since May 2011, we cannot tell for sure. Be as it may, the New Year started with an improved CCI, still lower compared to November’s level, but higher than it was before October’s election.

Hopefully, political leaders recognize the fact that a positive association exists between the feelings and well-being oftheir voters and their own chances of winning elections. This basic intuition suggests that Consumer Confidence Index, which is closely associated with the electoral performance of the incumbent, can be used as a political barometer of sorts for the country.