15

November

2021

15

November

2021

ISET Economist Blog

Monday,

28

June,

2021

Monday,

28

June,

2021

Monday,

28

June,

2021

Monday,

28

June,

2021

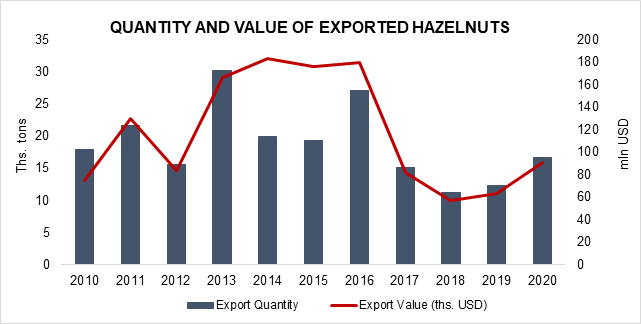

Hazelnuts are one of Georgia’s top ten export commodities. During 2010-2020, hazelnuts accounted for around 4.4% of Georgia’s total exports (GeoStat, 2021). In 2013, the quantity of exported hazelnuts hit its maximum level at 30 ths tons, then decreased to 19 ths tons in the following years with an increase in the value indicating higher prices per exported kg of Georgian hazelnuts. In 2016, the quantity of exported hazelnuts amounted to 27 ths tons, which was the second highest indicator in the observed years (2010-2020) (Figure 1).

Hazelnuts are not only one of the most important crops for Georgia in terms of exports, but also in terms of employment. According to the Agricultural Census (2014), 107,247 households are involved in hazelnut production, and most of their livelihoods depend on it. 2017 was a very challenging year for hazelnuts: hazelnut trees suffered from various fungal diseases and the Asian Stink Bug (Pharosana) invasion subsequently worsened the situation in the sector. Consequently, both the quality and quantity of hazelnut production decreased. Therefore, their incomes were substantially lowered from 2017 as the production level dropped by 27% compared to 2016. In 2019, hazelnut production started to recover: hazelnut production increased by 41% compared to 2018. Consequently, hazelnut exports increased and Georgia was among the top five hazelnut-exporting countries in the world by export amount, with the rankings as follows: Turkey (59.7%), Italy (8%), USA (7.1%), Azerbaijan (7.0%), and Georgia (3.8%) (UNCOMTRADE, 2021).

2020 was a good year for the hazelnut sector in terms of harvest: compared to 2019, the quantity of exported hazelnuts increased by 35%, while the value of exported hazelnuts increased even more by 44% (Figure 1). However, the quantity of exported hazelnuts in 2020 was 34% lower than in 2016, and 7% lower than in 2010.

Figure 1. Quantity and value of exported hazelnuts

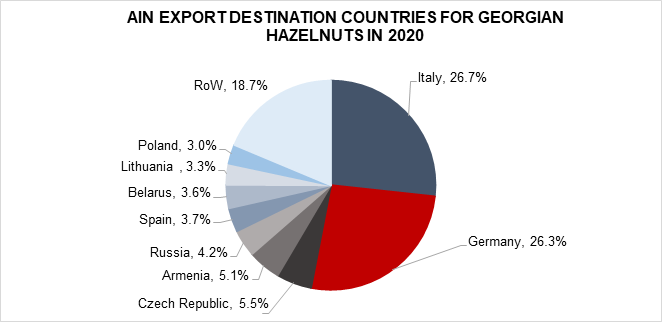

The EU market is the main destination for Georgian hazelnut exports. During 2010-2020, the share of EU countries in total hazelnut exports from Georgia was around 65%-70%, while 18% of Georgian hazelnuts go to CIS countries. Moreover, in 2020, 26.7% of Georgian hazelnuts went to Italy, and 26.3% to Germany (Figure 2).

Figure 2. Main export destination countries for Georgian hazelnuts in 2020

Due to unfavorable weather conditions in 2020, the harvest of hazelnuts declined in two of the largest hazelnut-producing countries: Turkey and Italy. Unlike the countries with the biggest production, Georgian hazelnut production showed positive dynamics in 2020: production as well as the export volume of hazelnuts increased. Moreover, according to the Georgian Hazelnut Growers Association (GHGA), the hazelnut sector in Georgia has been undergoing rapid development, and the production of hazelnuts is targeted to reach 120 ths tons within the next four years. Due to current developments, Georgia might benefit and strengthen its position on international markets.

In our previous blog on this topic “What Does Not Kill you… or the Story of Hazelnuts”, issued in 2018, we discussed the challenges in the sector. All the constraints discussed in the previous blog are still prevalent and valid today as the hazelnut sector still faces the same systemic challenges. There is a vicious cycle in the hazelnut sector: farmers have a lack of knowledge and skills, which only shapes and encourages the wrong attitudes towards farming practices. Farmers do not realize the importance of soil analysis in determining fertilizer needs and doses or the economic benefits of soil test-based fertilizer application. One other key remaining challenge is the development of the drying and storage infrastructure in Georgia. In many cases, storage facilities are far from the villages and farmers are not able to store hazelnuts properly, or they just sell them soon after the harvest. If storage facilities are available, one of the main reasons farmers are reluctant to store products is trust issues - they do not trust processors, and they do not want to use the drying or storage services provided by processing factories. Accordingly, many of them do not dry or store hazelnuts properly, so the quality of the hazelnuts decreases.

There are other major constraints that hinder the sector’s development, such as: lack of machinery services, access to finance, and lack of qualified workers. However, after the “Pharosana crisis” there are some signs of optimism. As was foreseen, the “Pharosana crisis” had some positive spillovers on farmers’ attitudes. According to the Georgian Hazelnut Growers Association, during the “Pharosana crisis,” farmers have learned more about how to take care of hazelnut trees. Therefore, the quality of the product has increased and the reputation of Georgian hazelnuts and demand in the world market has grown. Even though some positive changes have been observed, they might not be uniform. Advocacy and awareness-raising campaigns are the main tools to raise farmers’ awareness about the importance of good and sustainable farming practices.

In order to achieve higher quality hazelnuts, drying and storage services should be available to farmers. The introduction of small storage facilities and small-scale drying machines in the villages might encourage farmers to use these services, leading to higher quality products and, therefore, higher incomes.