02

July

2024

02

July

2024

ISET Economist Blog

Monday,

26

September,

2016

Monday,

26

September,

2016

Monday,

26

September,

2016

Monday,

26

September,

2016

Cutting taxes and achieving higher economic growth, as a result, is every politician’s dream. The 2016 parliamentary elections of Georgia showed just how important and controversial the question of taxation can become.

On the one hand, the Global Competitiveness Index Report that came out this month puts Georgia in the top 10 (9th place) among the countries with the lowest tax rates. The current administration’s plans to abolish taxes on undistributed profit is likely to improve this ranking even more. On the other hand, many politicians argue that Georgian taxes are still “too high,” and some political parties have put deep tax cuts as the center of their economic platforms.

| Parties | Old Income Tax | New Income Tax | Old Corporate Profit Tax | New Corporate Profit Tax | Old Taxes on Dividends and Interest | New Taxes on Dividends and Interest |

| Election Bloc "Paata Burchuladze - State for People" | 20 | 10 | 15 | 10 | 5 | Not mentioned ? |

| Election Bloc - "Nino Burjanadze - Democratic Movement" | 20 | 12 | 15 | 10 | 5 | 2 |

| Election Bloc "United National Movement” | 20 | 10 | 15 | 10 | 5 | Abolish Tax on Interest |

| "Usupashvili-Republicans " | 20 | Progressive Income Tax – Varying 10-15% | 15 | 15 | 5 | 5 |

| Irakli Alasania - Free Democrats | 20 | 20 | 15 | 15 | 5 | Abolish paid tax on your interest income |

| Georgian Dream - Democratic Georgia | 20 | 20 | 15 | * | 5 | * |

*Paata Burchuladze and United National Movement want to reduce taxes step by step within 4 years

** Georgian Dream abolishes the corporate income tax while increasing taxes on dividends – again, step by step within 4 years (Estonian Model).

One way to argue for tax cuts is to look at the relationship between the country’s tax rates and tax revenues over time. If tax rates are “too high” then a tax reduction should increase the tax revenues for the country (by giving businesses more incentives to operate, invest, or to come “out of the shadows”). If tax rates are already low and are not a binding constraint on business operations, then decreasing tax rates further will simply lower revenues. This kind of inverse U relationship between tax rates and tax revenues is known to economists as the “Laffer Curve”.

If we simply look at the relationship between tax rates and tax revenue in Georgia, it would appear that the country has been doing quite well after the tax reforms of 2005. In 2005, the government reduced the number of taxes (from 22 to only 6) and lowered tax rates, simultaneously. They also managed to remove all unnecessary and inefficient interventions into private business and adopted simple and fair rules. The result of these reforms can be measured in the actual amount of tax revenue. Government managed to collect 1.19 billion lari in 2003, which amounted only 13.9 percent of GDP; after tax reform, both GDP and tax revenue increased dramatically, and the equivalent figure for 2008 was 4.75 billion lari, which is 24.9 percent of GDP.

However, it is interesting that the real GDP growth between 1996 and 2003 was actually higher (at 6.4%) than the real growth between 2004 and 2014 (5.5%). This correlation can create an impression that Georgia was better off economically during the years when the tax burden – measured as the share of tax revenues in GDP - was at a low point, and therefore a further tax cut would benefit growth.

Yet, the problem of a negative relationship between tax rates and growth in Georgia can be easily explained. In the early stages of development, growth rates may be high (due to a very low output base from which the country starts), while the tax burden may be low (due to the low efficiency of tax collection). If the country reaches a higher level of GDP, while in the same time increasing the efficiency of tax collection, the growth rates will necessarily slow down while the tax burden will increase. This would give a misleading impression that the country’s economy is slowing down because of higher tax burden.

In this case it would be helpful to look at where the country’s tax burden stands in relation to other, similar countries.

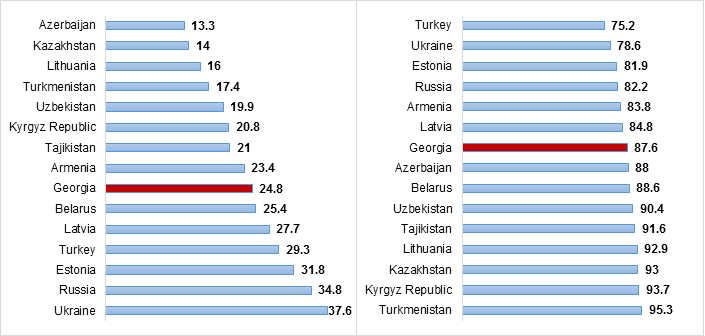

How does the tax burden for Georgia compare to similar measurements of other transition economies? The Heritage Foundation computes tax burden as a share of GDP and Fiscal Freedom to evaluate the restrictive nature of the taxation system. According to their 2016 report, Georgia occupies 64th position among 186 countries in terms of the tax burden as a share of GDP. Georgia’s score of 24.8 is nearly an average score of the region (see the graph below).

The Fiscal Freedom Index reveals the same pattern, since Georgia’s position in the list is 36, suggesting that there are only 35 countries out of 186 that have less restrictive taxation systems than Georgia.

While it is obvious from the graph the Georgia does not have the lowest tax burden in the region, it is worth noting that three out of eight countries that score better in this regard are Azerbaijan, Kazakhstan and Turkmenistan. In these oil-driven economies, GDP would be naturally much too high relative to the taxes the government collects from non-oil businesses.

A more important issue to look at is whether tax rates constrain the decisions of household and businesses to work, consume and invest. If a taxation system is restrictive for households and private business, tax cuts will stimulate them to increase consumption, work more hours, invest more money and expand their business.

The Global Competitiveness Report tracks the effects of tax burden on the incentives to work and to invest. These indicators are computed based on survey information. Respondents had to choose one number from 1 to 7 (1=to a great extent, and 7=not at all) to answer a simple question: to what extent do taxes reduce the incentive to invest and work? According to the latest report, on the investing scale, Georgia occupied the 11th position, and on work, the 10th in the world. In the region, Georgia held the first position on investing with a high score - 5.1, and similarly, on work, the score was 5.2.

Furthermore, the survey asked the respondents to identify factors that are the most problematic for doing business. In Georgia, businesses named (a) an inadequately educated workforce, and (b) access to financing as the top two problems. Tax rates and tax regulations came up ninth and tenth in this list - clearly taxes are not the binding constraint for growth of the Georgian businesses.

THE VERDICT ON TAX CUTS FOR GEORGIA

The idea of stimulating economic growth and creating new job opportunities by reducing tax rates in Georgia needs further investigation. For now, it appears that taxes are not a huge burden for Georgian businesses. Tax cuts may have a positive impact on economic growth, but they will not necessarily lead to politicians’ expected results without a wave of new reforms that give business a chance to fully embrace the new opportunities obtained from the tax reduction. For instance, such reforms may include helping small and micro businesses by liberalizing tax policy for them, developing capital markets that solve the problem of raising funds for business activities, improving antitrust law, and breaking down barriers for motivated businessmen to enter new markets.

1 Fiscal Freedom Index is composite indicator that consists of the three components: the top marginal tax rate on individual income, the top marginal tax rate on corporate income and the total tax rate as a percentage of GDP. Higher value of this index is associated with less restrictive taxation system.