15

November

2021

15

November

2021

ISET Economist Blog

Monday,

22

January,

2018

Monday,

22

January,

2018

Monday,

22

January,

2018

Monday,

22

January,

2018

* This article below summarizes the observations and recommendations of the Georgian Ministry of "Meet the Meat Demand" study funded by the French Ministry of finance, implemented by France Génétique Elevage, and executed by the International Technical Cooperation Bureau of the French livestock organizations (BCTI).

When visiting Georgia, the son of a French farmer may feel like cows are invading the countryside. They seem to be everywhere, roaming in little herds, cows, heifers, and calves all together, searching for every blade of grass to be grazed under the guard of their herdsman. From this point of view and many others, including amazing landscapes, Saperavi wine, khinkali and mtsvadi, the Georgian countryside is very surprising and interesting!

So is the beef market, and the ongoing evolution inside of it. With animals of average carcass weight of around 150 kg, to be eaten in less than four days after slaughtering, the organization of the Georgian meat market cannot be compared with French standards. In France, animals weigh an average of 350 kg per carcass, and no meat is eaten before a week of maturation. Most of the meat in Georgia is sold fresh in open bazaars and butcheries: 65% of consumers use these as their first provider of meat, whereas in France, more than 60% of the meat is distributed through supermarkets.

Why is meat maturation regarded as so important in France? For tenderness! Maturation helps the meat to get softer, and also reveals taste. Tenderness is so important in France because the French favor the meat from adult cows over any other meat, and most will be grilled or oven-roasted. Accordingly, tenderness is the first quality mark for French consumers. Most butchers in France will leave the meat to mature for a few days… or much more, in some high-standard outlets that are similar to the Blauenstein Company, which has a farm in Racha and sells its products in its Tbilisi shop.

But we weren’t brought to Georgia by the French Ministry of Finance to compare its meat market with the French situation; we came here to understand the Georgian meat market and make predictions about its future development. Despite being an important exporter of live cattle, with 50,000 to 100,000 cattle heads per year being exported, and many more live sheep and sheepmeat, Georgia keeps importing more than 20% of its beef in the form of low-cost meat (frozen boneless meat) from Ukraine, European countries and from even further – Brazil and Australia. Why is that?

This was one of the main questions asked by our team, and there is three levels of answers. First, fattening animals requires a lot of fodder, a rather rare commodity in a country with such a large number of cows and sheep. Second, exporters are ready to pay a much higher price for live animals than the price achieved in the local market. This encourages farmers to export their young bulls and pushes up the beef price on the local market. A high price for local beef on the Georgian market renders international low-cost meat very price-competitive on the market.

The third factor that is fueling the demand for international meat in Georgia is the evolution of demand. Our team, with the help of the ISET Policy Institute, conducted a survey on the meat consumption habits of more than 700 consumers residing in Tbilisi in September 2017. This survey shows some ongoing changes in what people expect from the beef they purchase.

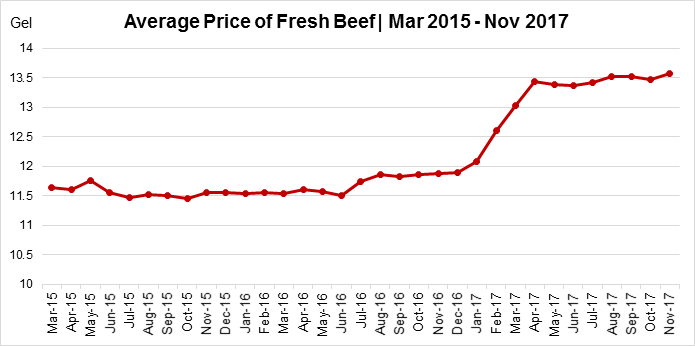

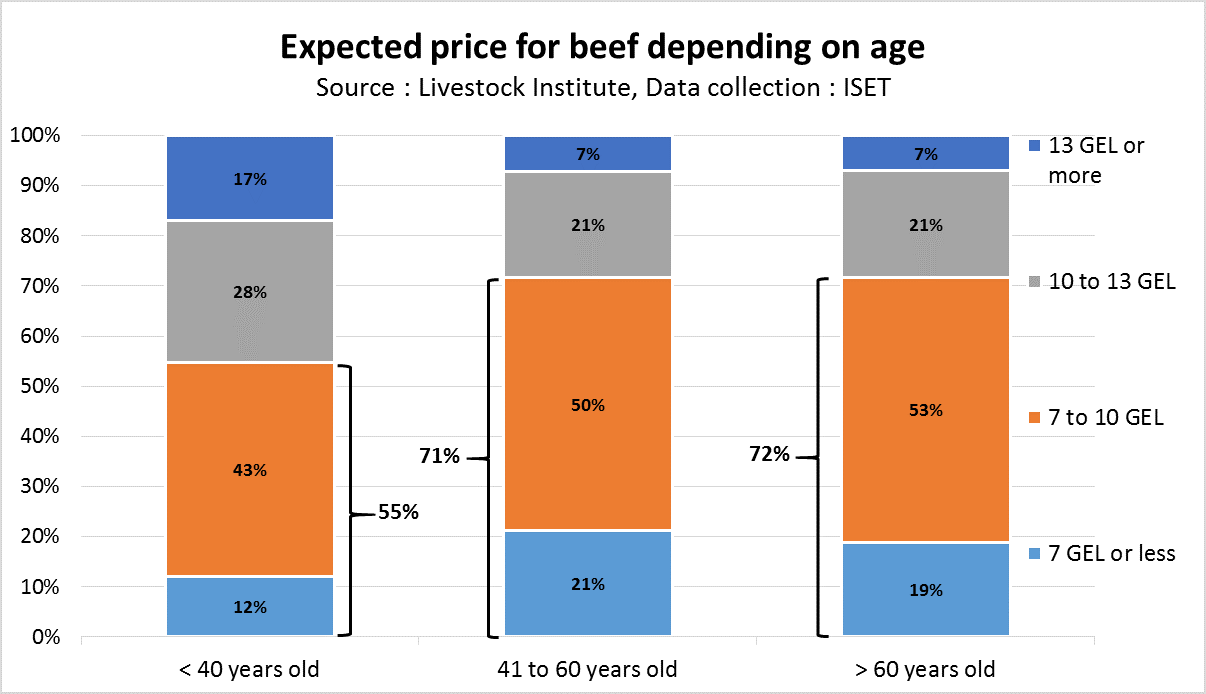

These changes are occurring in the younger generation, whose expectations toward beef are clearly different from those of older people. When ask what they think should be the price for 1kg of beef, 45% of people under 40 years old, responded 10 GEL or more; only 21% of respondents over 40 years of age agreed. The most recent price for 1 kg of boneless beef was, on average, 13 GEL/kg, according to the AGRIndex1. This indicates that young Georgians are ready to pay more for beef than the older generation.

The type of meat researched is another changing point; our survey shows that the younger the consumer is, the more he will favor boneless meat over bone-in meat. 46% of people under 40 are buying boneless meat more often than bone-in. This goes down to 26% in the 41-60 years old age group, and 13% for the over-60 group. Another example of change occurring is the place where meat is bought. Under the ’40s are deserting bazaars for supermarkets and butcheries; 24% of people under 40 are usually buying meat in supermarkets, against 8% for those over 60.

How do these changes promote meat import? This result shows that young people are tending to move to a more “western way” of consuming meat, focusing on pieces that are more expensive, but also quicker to prepare. This is confirmed by their growing appetite for chicken, the simplest and quickest meat to prepare. To meet this sort of meat demand, the Georgian supply chain will need to adapt its marketing methods. At the moment, most meat is brought to the consumer as a whole carcass, and the differentiation between the cuts is low. Foreign meat producers are able to bring to Georgia all specific cuts in vacuum packs that could, in the near future, satisfy the demands of younger consumers.

This movement is not bad news for the local supply chain, as a higher degree of differentiation between cuts means a higher added value for suppliers. The evolution of Georgian demand for meat is bringing opportunities for the meat sector, especially when meat prices demonstrate an upward trend. Georgia has a clear lack of quality signs in its meat sector, and promoting the quality of local produce is crucial to satisfy the new generation. Private companies and the public sector should follow the examples below, from the official quality signs available in the EU.

1 AGRIndex is a product of ISET developed with the cooperation of GFA and CARE under the ENPARD project.