“We do not need people who will get credit to buy a refrigerator and TV, and end up in the black list” – Giorgi Kobulia, former Minister of Economy and Sustainable Development of Georgia

“Long-term financial stability gains are always worth the short-term costs” – Koba Gvenetadze, Governor of the National Bank of Georgia

Around two years ago, ISET-PI published a blog article on the problem of over-indebtedness in Georgia. The article stressed the idea that due to notably increased access to finances, an aggressive marketing campaign provided by financial institutions, and poor socio-economic conditions throughout the country, Georgians (particularly the poorest) are mired in a swamp of debt, from which they are unable to escape. The macroeconomic indicators, which typically measure the expansion of consumer credit, have experienced a dramatic increase over the last 6-7 years. For example, the household debt to GDP ratio has increased from 10.6% in the first quarter of 2011 to 36.7% in the fourth quarter of 2018. Furthermore, a households’ debt to a households’ disposable income rose from 25.2% in the fourth quarter of 2012 to twice as much, 57%, by the third quarter of 2018 (this is also its historical maximum). Household debt service and principal payments to income ratio have also experienced a dramatic increase, from 9.5% in the first quarter of 2012 to 14.6% by the third quarter of 2018 (Source: Financial Soundness Indicators of the National Bank of Georgia). Although the soundness of deposit-taking institutions was not under question (microfinance institutions, online lenders, and other non-deposit taking organizations were much more fragile, however), there were stories of poor and vulnerable people whose finances collapsed under the burden of expensive loans, causing the loss of their only property.

WHAT ARE THE TWO WAVES OF THE REGULATIONS?

ISET-PI’s article was not alone in highlighting the threats of over-indebtedness in Georgia. International organizations also drew much attention to the topic, and ultimately recommended that policymakers introduce appropriate policy measures to regulate credit expansion. The first wave of credit regulations was introduced in May of 2018, and it aimed to restrict borrowing for individuals who might not have enough income to service their debt. A corresponding amendment was prepared by the National Bank of Georgia (NBG), however, the new initiative also received significant support from upper-level government officials (particularly within the ministry of finance). The newly imposed regulations restricted issuing loans without comprehensive analyses of consumers’ solvency. Commercial banks were, moreover, only able to issue loans without a solvency analysis of up to 25% of their supervisory capital. The first wave of regulations was particularly restrictive for microfinance institutions (MFIs) and online lending companies, and the number of MFIs reduced from 73 in May of 2018 to 65 in January of 2019, while the number of online lending companies declined from around 75 to a much reduced 30 in the same period (there is no proper information regarding the number of online lending companies, thus these numbers simply represent an estimate from financial experts).

The second wave of, more restrictive, regulations entered into force in January 2019. The respective legislative act defined responsible lending principles and ascertained solvency analysis (which implies a detailed analysis of incomes, expenses and the total obligations of lenders, and verification of information provided and clients’ credit history, etc.) for any institution that issues loans to more than 20 individuals, including commercial banks, MFIs, online lenders and others. Additionally, the longest duration for mortgage loans, consumer loans with real estate collateral, and transport loans has been defined as 15, 10, and 6 years, respectively, while the maximum duration of other consumer loans is only 4 years. Moreover, it is required that the difference between a debtor’s net income and their loan not be less than the subsistence minimum. The decree has also defined the upper ceilings of Payment-to-Income (PTI) and Loans-to-Value (LTV) ratios for various disposable income groups – the ceilings are presented in the table below (Source: FactCheck, GRASS, New Lending Regulations – New Barriers for the Consumer and for Business).

Figure 1: Maximum Payment to Income Ratios (PTI)

| Monthly Net Income, GEL |

For Non-Hedged Borrowers

(with the longest duration) |

For Hedged Borrowers

(with the longest duration) |

| Income <1,000 |

20%, 25% |

25%, 35% |

| 1,000 ≤ Income < 2,000 |

20%, 25% |

35%, 40% |

| 2,000 ≤ Income < 4,000 |

25%, 30% |

45%, 55% |

| Income ≥ 4,000 |

30%, 35% |

50%, 60% |

Source: Decree N281/04, President of the National Bank of Georgia, issued 24 December 2018, Annex N1.

Figure 2: Maximum Loan to Value Ratios (LTV)

| Maximum loan to value ratio (LTV) for GEL loans |

85% |

| Maximum loan to value ratio (LTV) for foreign currency loans |

70% |

Source: Decree N281/04, President of the National Bank of Georgia, issued 24 December 2018, Annex N1.

WHAT ARE THE CAUSES OF OVER-INDEBTEDNESS?

Economic literature reveals that “a private household is over-indebted if its income over an extended period is not sufficient for servicing debt on time (after deducting costs of living expenses) despite a reduction of the standard of living” (D’Alessio and Iezzi, 2013). Unfortunately, there is no empirical literature studying the characteristics of over-indebted households in Georgia (to ask the relevant questions – Why was a loan required? What was the reason for a household’s insolvency? What is their average income? What is their level of education? etc.), nevertheless, it is still possible to identify potential causes. The origins of the over-indebtedness problem can be divided into two groups – from the demand and the supply side.

One can identify the following demand-side causes:

- Serious Poverty and Unemployment. According to the Statistics Office of Georgia (Geostat), the average proportion of the total population living under the absolute poverty line, between 2010-2017, amounted to 27.1% (more than one fourth), though this number was even greater, 32.4%, for those living in rural areas. Moreover, in 2010-2018 the average unemployment rate was a double-digit number, 15.4%, but on average 54.8% of the employed were in fact, self-employed, chiefly in the lowest production, subsistence agriculture. The poor and unemployed can be considered the groups most vulnerable to falling into the over-indebtedness trap (Economic Policy Research Center (EPAC) – Management of nonperforming loans in Georgia, 2014).

- Low Level of Financial Literacy. An ISET-PI survey about levels of financial literacy in Georgia, conducted in 2016, asked four questions measuring financial education (relating to (1) simple and compounded interest rates, (2) inflation, (3) financial risks, and (4) effective interest rates). The results showed that 42% of the population fell into the moderate range (two or three correct answers), while 52% exhibited a low level of financial literacy (one or no correct answers). Low levels of financial education stimulate reckless borrowing and the use of higher-cost credit, and thus such households regularly have difficulty paying their debts (Gathergood and Disney, 2011).

- Notable Health Expenditures (specifically before the Universal Healthcare System). According to the World Health Organization (WHO), the average out-of-pocket health expenditure (% of current health expenditure) for the Georgian population reached 76% in 2011, and reduced, relatively, to 57% in 2015 (although, it remains far higher than the world average - 18% between 2011-2015). Significant out-of-pocket expenditures often force poor families to finance these expenses with borrowing or the sale of household assets - often called “distressed health care financing” (Damme et al., 2004; Joe, 2014).

- Gambling Problems, the Casino Business and Ludomania. CRRC research conducted in 2015 identified that 6% of their respondents admitted to being involved in gambling activities, and 47% of these people were playing not for fun, but to win large sums of money. Besides this, the turnover of gambling businesses exceeded 5.6 billion lari in 2017 (an increase of 1 billion lari compared to the previous year). Thus, the rapidly expanding gambling market may well be closely linked to over-indebtedness.

- Other factors include; an aggressive marketing campaign created by financial institutions; unstable employment due to the liberal labor code and inappropriate law enforcement; unhedged borrowing (“currency mismatch” - having income and liabilities in different currencies); booms in the construction sector; etc.

These demand-side factors would never have helped produce an over-indebtedness problem without an initial supply of credit. One can identify the following supply-side causes:

- MFIs and Online Lenders. According to the National bank of Georgia, there were only 15 MFIs in 2007, yet this number had increased to 75 by 2017. Unfortunately, there is no definitive information regarding the number of online lenders, however, it is widely recognized that their numbers increased dramatically between 2010 and 2016. It is worth mentioning that most MFIs and all online lending companies used a specific business profile to issue loans (mainly consumer credit) ignoring the financial health of borrowers (they even offer loans to people without a permanent source of income – toxic loans), and they typically charged far higher interest rates than commercial banks. Considering the much stricter loan standards and conditions in commercial banks, the type of credit issued by MFIs and online loan companies was primarily taken by the poor and unemployed (Economic Policy Research Center (EPAC) – Management of nonperforming loans in Georgia, 2014).

- Increased Financial Resources in Commercial Banks from Attracting Deposits. The National Bank of Georgia has revealed that the stock of domestic currency deposits has increased 3.6 times since 2011 (the growth was notably accelerated in 2015-2016), while foreign currency deposits (without considering the exchange rate effect) have grown 2.8 times in the same period.

The combination of demand and supply-side factors has resulted in a much faster increase in domestic credit than in the overall economy, and considering the source of this increasing trend (generally not creditworthy people), the National Bank of Georgia has decided to restrict credit expansion to minimize the risks of financial instability.

WHY ARE WE CONCERNED ABOUT OVER-INDEBTEDNESS?

According to the empirical literature, there are three groups of negative consequences possible behind the over-indebtedness problem:

- Threats to Financial Stability. Despite rapid credit expansion, the soundness of deposit-taking institutions was never under question (non-performing loans to total loans for commercial banks remained stable). However, the data discerned from microfinance suggests that financial strain was chiefly experienced by households who did not, for various reasons, qualify for a loan from a commercial bank. In addition, the credit score distribution data, from the country’s only credit bureau, covering 88.6% of the adult population, indicates that the distribution is skewed towards the high-risk category. There are notably more MFI clients in the E3 category (the highest risk) than bank clients, as banks have much stricter requirements for providing credit. Such rapid growth in consumer credit consequently prompted concerns about the sustainability of credit expansion (Babych, Grigolia, and Keshelava, 2018).

- The Negative Social Consequences of Over-indebtedness. For the majority of over-indebted households the debt is quite small, thus suggesting that this form of over-indebtedness represents a social issue, rather than a financial stability problem (D’Alessio and Iezzi, 2013; Davit Utiashvili – Overview of the Georgian Banking Market, 2018). Over-indebtedness often leads to an increased number of properties retained by financial institutions. The value of the real estate and movable assets retained by MFIs has increased by more than 7.9 times since 2011. Research conducted by Society and Banks reveals that the number of properties sold by the National Bureau of Enforcement of Georgia reached 9,378 between 2011 and 2015. Furthermore, the data collected from only 2015 indicates that 27.1% of the properties were obtained by commercial banks, 16% by MFIs, and, the largest portion, 51% by private lenders. Moreover, over-indebtedness frequently leads to a higher crime rate, high employee stress levels (causing low productivity), mental and physical absenteeism, and even suicide (we have had several such tragedies).

- The Negative Economic Consequences of Over-indebtedness. As for the negative economic consequences, over-indebtedness can deprive people of the motivation to start a formal job; where they prefer to be involved in the shadow economy, and avoid using an official bank account for their salary.

WHAT ARE THE SHORTCOMINGS OF THE PROPOSED REGULATION?

It is notable that supply-side regulations usually create a tradeoff between the long-term benefits of financial stability and the short-term costs of restricted credit. The government needs to tread lightly between protecting consumers from becoming over-indebted and supporting the profitability of financial intermediaries to increase access to credit (Porteous, 2006). Therefore, it is necessary to carefully examine the short-term costs of the regulation:

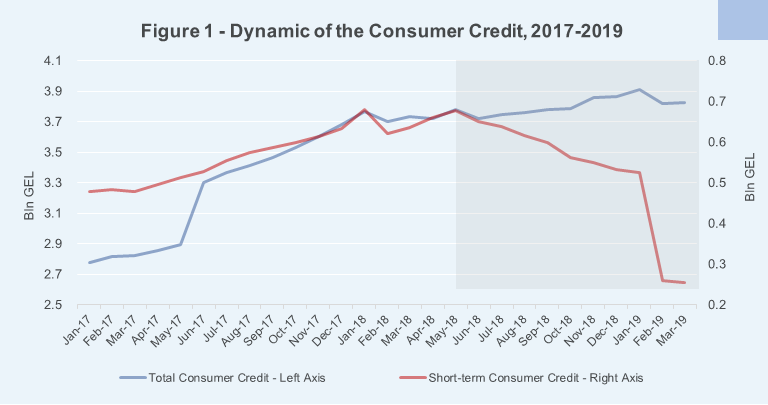

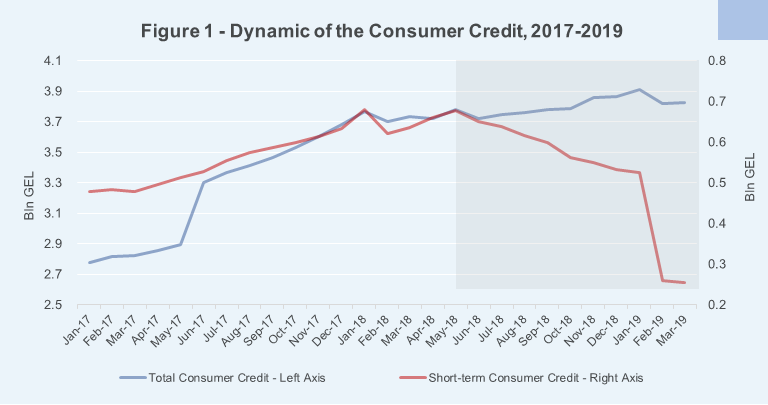

- Reduced Growth Rates of Consumer Credit (Short-term Effect). The National Bank of Georgia shows that, from the first three months of 2019, the average yearly growth rate of total consumer credit was around 3.2%, while it experienced 33.0% and 22.5% growth in 2018 and 2017, respectively. The main contributor to such a decline in annual growth rates was the rapid reduction of short-term consumer credit (on average, yearly by 47.3% in the first quarter of 2019). Furthermore, a notable reduction in installment loans, from the supply side, negatively affected the profitability of technology and furniture shops, and many people working in these sectors have already lost their jobs. While from the demand side, the regulation has restricted access to refrigerators, TVs, and other modern facilities. Technology shops additionally started to employ property renting services, and even to develop internal installment systems, although they are often neither experienced nor efficient providers.

- Mortgage Loans for Real Estate Purchases and Repairs. While regulations should, potentially, have a negative impact on the growth rates of mortgages, according to the National Bank of Georgia, the volume of household mortgage loans for real estate and repairs has maintained a rapid growth phase in annual terms. Mortgages taken by households (not excluding the exchange rate effect) have increased, on average, by 39.9% yearly for the first three months of 2019. However, growth in the construction sector was restricted in the last quarter of 2018 (due to regulations and a limited supply of construction permits). Additionally, construction companies are planning to provide internal loans to supplement these restricted mortgages.

- Justified Income and the Shadow Economy. Although there is no reliable data on the proportion of the Georgian population employed in the shadow economy, one can still argue that quite a significant number of Georgians are involved in the underground economy (for example, according to Geostat, the extent of informal employment of total non-agricultural employment amounted to the 33.9% in 2017). More than 50% of the Georgian population live in villages, and most are self-employed in subsistence agriculture. Therefore, financial institutions might have significant difficulties in conceiving their earnings as justified income, and properly assessing their creditworthiness, which leads to restricted access to financing.

4. Private Lenders. A controlled supply of credit without restricting its demand might lead to a disbalance in the credit market, which raises the opportunity for non-regulated private lenders (individuals who are lending money to less than 20 people for certain interest [ordinarily higher than offered by other institutions] payments) to attract clients and charge fairly high-interest rates.

To conclude this article, it is worth mentioning that the regulation package proposed by the National Bank of Georgia only includes supply-side measures, even though over-indebtedness is an extremely complex phenomenon and originates from both supply and demand-side factors. Furthermore, a large section of the empirical literature concludes that only policy strategies that contain a balanced mix of demand and supply measures can hope to address indebtedness (Braucher, 2006 [relating to the United States of America]; D’Alessio and Iezzi, 2013 [South Africa]; Kovács, 2013 [Hungary]). Therefore, policymakers should work hard to improve financial literacy for all of society (particularly the younger generation and the most vulnerable); reduce poverty and unemployment using appropriate economic and social policy measures; introduce certain regulations to the gambling sector (particularly for people under 18 years old); improve consumer protection; etc.

The views and analysis in this article belong solely to the author(s) and do not necessarily reflect the views

of the international School of Economics at TSU (ISET) or ISET Policty Institute.

02

July

2024

02

July

2024

Monday,

22

April,

2019

Monday,

22

April,

2019

Monday,

22

April,

2019

Monday,

22

April,

2019