02

July

2024

02

July

2024

ISET Economist Blog

Friday,

03

February,

2012

Friday,

03

February,

2012

How much foreign wealth does a country really have? In the Balance of Payments Accounts, the net foreign wealth is essentially the difference between the assets held by the country’s residents abroad and the country’s liabilities to foreigners, valued at the market price in each given year. If this number is negative, then the country is a debtor to the rest of the world and needs to generate enough surplus output in the future to pay back foreign investors.

The change in net foreign wealth in any given year reflects the extent of a country’s borrowing or lending and provides information to foreign investors about the state of the country’s finances. If net foreign wealth is sufficiently large and negative, this may catalyze a run on the country’s assets – a financial crisis.

Certainly, there has been no shortage of financial catastrophes in the last few decades. One prominent example was the Latin American debt crisis in the 1980s, when the large economies, Brazil, Argentina, Mexico accumulated significant external debt amounting to about 50% of the GDP of the entire region. The crisis that followed was fueled by the investors’ lack of confidence in the countries’ ability to repay their growing foreign debt, given their economic growth prospects and the costs associated with servicing the debt.

The recent European debt turmoil reminded us once again, that while there is no magic number after which the debt/GDP ratio becomes unsustainable, it is still important to keep the ratio in check.

In the last few years, even before the 2008 sub-prime crisis, the growing external debt levels of the United States came under close scrutiny. The US was the largest debtor in the world, and the stock of debt was growing fast. Yet, despite the doomsday scenarios, the predicted big crash did not materialize. Not even in 2008-2009, when the US economy was clearly in the midst of the “Great Recession”.

Several factors may account for such an outcome but one of the most surprising answers came from the 2005 article by Hausmann and Sturzenegger. In the article, the authors make a claim that instead of being a net borrower, the US is actually a net creditor to the rest of the world.

How can this be? The authors point out that the US, despite being officially in debt, still manages to receive positive net interest payments each year from the rest of the world. Clearly, this is a paradox, since it is hard to imagine a borrower who rather than paying for the privilege of borrowing is instead being paid.

The authors argue that the explanation must lie in the “missing” or “mismeasured” wealth, the so-called “dark matter”.

According to the “dark matter” argument, if the “book value” of two assets is the same, but one of the assets has a relatively higher return, this asset must have a de facto higher value.

Thus, the return-based valuation, like a fairy godmother, transforms our debtor Cinderella into a creditor Princess. If you happen to believe in fairy godmothers – a happy ending for the United States indeed.

But how about other countries? How about Georgia?

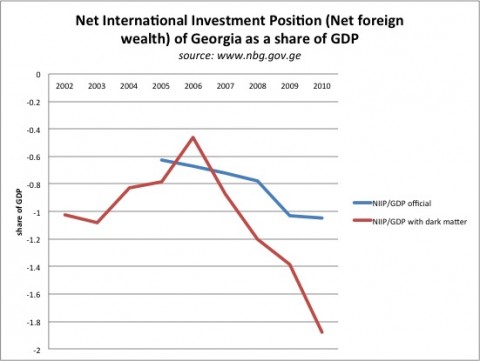

Currently, Georgia’s net foreign debt/GDP ratio stands at about 1.05. The “dark matter” calculations show, that assuming Georgia pays about 3% on its foreign liabilities and receives about 1.5% return on its foreign assets, the debt/GDP ratio would be much higher, around 1.87

Moreover, as shown on the graph above, the net international investment position of Georgia calculated using the return-based valuation has deteriorated much faster since 2006, than the official Balance of Payments would suggest.

The main question is – are things really so much worse than we think, and should we treat these numbers as a warning? The answer depends on whether you believe in the “dark matter” and the underlying assumptions. More importantly, whether the markets actually take the “dark matter” into account when evaluating the state of the country’s finances.