30

June

2022

30

June

2022

ISET Economist Blog

Friday,

05

April,

2013

Friday,

05

April,

2013

Friday,

05

April,

2013

Friday,

05

April,

2013

Many countries in the world run their public pension systems under the so-called pay-as-you-go (PAYG) scheme, where pensioners receive their money from those who are currently working. The transfers are made through separate obligatory contributions to the pension system or through general taxes. Unfortunately but predictably, in the last decades, the shrinking and aging populations caused severe problems for PAYG systems, both in advanced as well as in less developed countries. An inevitable consequence of people living longer and fertility rates going down are higher percentages of pension receivers. Sustaining a PAYG scheme under such circumstances may bring about intolerably high transfers flowing from the economically active generation to those who receive pensions.

It was recognized by economists very early that PAYG systems are vulnerable to demographic risks, but optimism prevailed. Sufficient growth rates of the PAYG economies and, even more important, high birth rates were considered to warrant the long-run functioning of these systems. The Nobel Prize laureate Paul Samuelson called the PAYG system a Ponzi Scheme, i.e. a redistribution system that works by transferring money from those who entered later to those who entered earlier (sometimes also called a Financial Pyramid). Strangely enough, it did not cause Samuelson to doubt the solidity of the system. While ordinary Ponzi Schemes have to come to an end in a finite world, Samuelson was truly enthusiastic about the PAYG idea. In 1963, he wrote: “Social Security is a Ponzi Scheme that works. The beauty of social insurance is that it is actuarially unsound. Everyone who reaches retirement age is given benefit privileges that far exceed anything he has paid in — exceed his payments by more than ten times (or five times counting employer payments)! How is it possible? It stems from the fact that the national product is growing at a compound interest rate and can be expected to do so for as far ahead as the eye cannot see. Always there are more youths than old folks in a growing population. More important, with real income going up at 3% per year, the taxable base on which benefits rest is always much greater than the taxes paid historically by the generation now retired. […] A growing nation is the greatest Ponzi game ever contrived.” Likewise, but with a more critical undertone, fellow Nobel Prize Winner Milton Friedman called the PAYG system the “biggest Ponzi scheme on Earth”.

Also, politicians were fond of PAYG systems. A PAYG system allows them to promise to those who are working (and voting) higher pensions for their future retirement – to be paid by the coming generation (which is neither working nor voting yet). When the PAYG system was reestablished in Germany after the Second World War, old people were generously endowed with pensions, though in post-war Germany there was little left of the capital these pensioners had created when they were economically active. Yet Konrad Adenauer, the first chancellor of Germany after the war, was not worried. As he famously stated: “People will always get children!”

As it turned out, Samuelson and Adenauer were wrong. PAYG systems are Ponzi schemes, but they do not work. In many countries, the irresponsible policies of the past now impose heavy burdens on those who have to finance the pensioners, and government budgets are excessively strained through the massive subsidies transferred to the pension systems.

A little bit more on pension plans: Economists distinguish between two types of pension schemes depending on whether or not they constitute an inter-generational contract. Besides the PAYG scheme, there are also funded pension schemes. In a funded pension plan, the contributions of the current workers are invested in interest-bearing assets like treasury bills and corporate bonds. The capital stock built up in this way is then used to finance the future pension benefits of those who accumulated the money. While the majority of public pension systems operate under the PAYG principle and are hence unfunded, private pension schemes are typically funded.

A pension scheme (funded or unfunded) can be of the defined contribution (DC) or the defined benefit (DB) type. In the case of DB, benefits are predetermined based on the employee’s earnings when working and the length of service and age. Under the DC scheme, the level of pension payments depends on the actual contributions made and, if the plan is funded, on the returns on the invested money. Usually, unfunded (PAYG) public pension schemes are DB, although some countries have public pension systems which offer flat-rate benefits to every citizen above retirement age.

The case of Georgia: Georgia’s current old-age pension system operates as PAYG, with meager pension benefits being financed directly through the government budget (no separate public pension funds exist). The system is neither DB nor DC since a flat-rate pension is paid to every person above the minimum retirement age. Lifework times and the amount of money paid into the system are not taken into account.

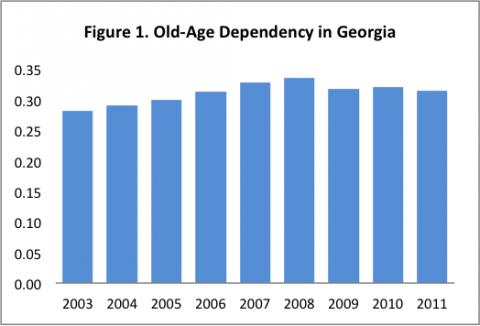

Yet also Georgia suffers from an aging population. The trend of an increasing old-age dependency ratio, i.e. the ratio of people aged 65 and above to those aged between 15 to 64, has disappeared since 2008 (see Figure 1). This releases some pressure, yet the long-run forecasts are still pessimistic. According to UN projections, by 2050 the aged population (people aged above 65) of Georgia will comprise more than 25% of the total population as opposed to 19% nowadays.

As in other countries, this demographic shift will result in a growing per capita fiscal burden in the future, bolstering concerns about the long-term fiscal viability of Georgia’s existing state-funded pension system. For coping with demographics-related fiscal risks, several options exist. The least radical policy measures try to keep the PAYG system alive by gradually changing its parameters. A typical idea of this kind is to increase the retirement age, as many EU countries already did or intend to do. Similarly, one can increase taxes and pension contributions and/or reduce pension benefits. These policies are socially and politically painful because they make one group better off at the expense of another.

The more principled approach is therefore to abandon PAYG altogether and rapidly move to a funded pension system. Unfortunately, this is practically impossible because of prohibitively high transition-related costs. The generation of workers in the transition period would have to pay for the current pensioners and build up funds for their own retirement simultaneously. To impose such a burden on the generation of current voters would swiftly end any politician’s career. The third policy option, adopted by a number of advanced and post-Soviet Union countries (for example Denmark, Netherlands, Switzerland, and the Baltic States) is known as the “multi-pillar approach” to pension reform. It has been advocated by the World Bank for many years, and essentially it aims at a gradual, piecemeal transition from PAYG to a funded system.

As suggested by its name, the multi-pillar system consists of three components (or pillars). It has a PAYG component that ensures every eligible person receives a basic pension. In addition, it forces every working citizen to pay into a funded mandatory defined contribution plan. Finally, through direct subsidies and tax incentives, it tries to encourage people to voluntarily pay into a defined contribution plan. An advantage of this approach is increased economic security due to pension income diversification.

The multi-pillar approach seems the most relevant in the Georgian context. On the one hand, in a country like Georgia with high unemployment rates and a lot of people out of the labor force, the PAYG component alleviates the poverty among elder people and reduces inter-generational inequality. At the same time, the obligatory funded defined contribution pillar ensures that the economically potent young will at least partly self-finance their future pension benefits. Arguably, this may significantly reduce the fiscal burden incurred through social benefits (which accounted for 20% of total government budget expenses in 2011) and at the same time increase private savings, which in Georgia have been dramatically low (sometimes even negative)over the past decade.

In addition, one may hope for a growth effect resulting from the introduction of the funded pension component of the multi-pillar system. This effect is two-fold. Firstly, it will increase savings that may fuel domestic private investment, fostering higher economic growth. Secondly, through the reduction of the fiscal burden more funds will be available in the government budget for pro-growth spending purposes such as public infrastructure. Public investment was an important driving force of Georgia’s impressive growth rates over the past ten years, but Georgia’s infrastructure is still far below the standards of advanced industrial countries. Although Georgia’s current demographic situation does not necessarily require an immediate restructuring of the pension system, these advantages might in themselves justify the introduction of a three-pillar system.

The earlier Georgia starts the reform process the smoother will be its transition. The desperate situation in which many European countries find themselves teaches a lesson about what will happen to Georgia if it lets its Ponzi scheme run too long.