02

July

2024

02

July

2024

ISET Economist Blog

Monday,

18

January,

2016

Monday,

18

January,

2016

Monday,

18

January,

2016

Monday,

18

January,

2016

For over three and a half years, the ISET Policy Institute has been tracking the trends in the Georgian consumer sentiments. Every month a team of callers dial randomly generated telephone numbers to interview around 330 people from all over Georgia. The interviewer first asks the basic questions about the respondent’s age, level of education, place of residence, and then follows up with questions about the current financial situation of the household and the person’s expectations about the future economic situation in the country.

The answers form the basis of CCI – the Consumer Confidence Index. The CCI is a very important indicator for economists. Very low consumer sentiment, for example, means that people are likely to spend less, thus depressing the overall economy.

Few people realize that behind a single CCI number there is a great deal of useful and sometimes surprising information. The CCI data can be used to informally test some important economic theories. For instance, the theories of rational and adaptive expectations.

Here I must disappoint the readers – the terms “rational” and “adaptive” in economics don’t mean the same thing as in our everyday language. The rationale has nothing to do with being sensible or logical, and adaptive doesn’t mean that someone is easily adjusting to change.

Without digging deep into theory, let’s just say that in trying to predict the future, people with rational expectations are using all the relevant information available to them at the time. What this means, is that people will not be always right about the future, but on average, and over time people’s predictions will be right. So says the rational expectations theory.

What about adaptive expectations? People with adaptive expectations form their predictions of the future based on information about the past. To put it simply, if it has been raining for the last 10 days, you will expect a rainy day tomorrow as well.

So what can we say about the expectations of the Georgian consumers? The CCI index can offer some interesting insights.

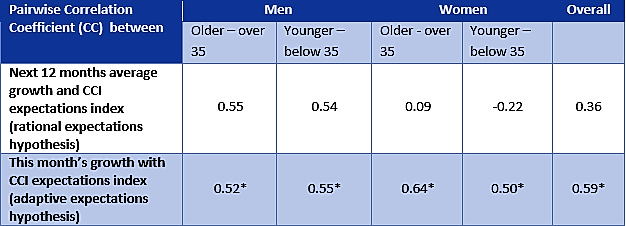

First, let’s look at the correlation between the CCI expectations index (which asks questions about what people expect from the economy in the next 12 months) and the actual average GDP growth 12 months into the future. We can observe that the overall correlation is not very strong (the correlation coefficient is 0.36. This is on the low side. Consider that a coefficient of 1 means perfect correlation, while 0 means no correlation at all).

This, however, is not true for every group of people. For men, for example, the expectations about the future and the actual future growth seem to be more strongly correlated (correlation coefficient 0.55). For women, this correlation is almost non-existent.

For insights on adaptive expectations, we correlate the CCI expectations index with the actual GDP growth in that month. A strong correlation could imply that people are using the current month’s economic situation to predict what will happen in the future.

The correlation seems to be rather strong for almost all groups, but the strongest correlation we observe in women over 35 years old - the coefficient value is 0.64. (Interestingly, women younger than 35 demonstrate the lowest correlation coefficients in both categories).

Does this prove that Georgian men conform to the rational expectations hypothesis, while Georgian women to the adaptive expectations? Not really. The simple correlations are by no means a formal test, much less the proof of the rational and adaptive expectations hypotheses. Nevertheless, the results, and especially the differences between the samples of men and women are interesting, don’t you think?

*indicates the significance of the coefficient on 10% level;

CC =1 indicates a perfect positive correlation between two variables;

CC = -1 indicates a perfectly negative correlation between two variables;

CC = 0 indicates no correlation between two variables.