02

July

2024

02

July

2024

ISET Economist Blog

Wednesday,

29

May,

2013

Wednesday,

29

May,

2013

Wednesday,

29

May,

2013

Wednesday,

29

May,

2013

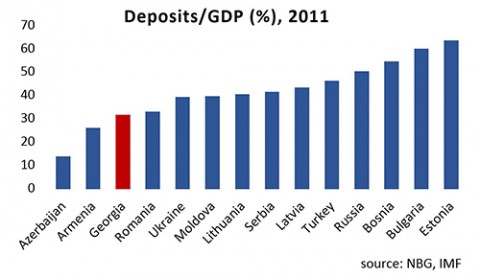

Does Georgia have a well-developed financial sector? Certainly, the proliferation of bank branches and automated teller machines in the capital city of Tbilisi might suggest that it does. And yet, the data indicates that for a country of its size, Georgia has a relatively small financial sector. One of the measures used to approximate the financial development or financial depth of the economy is the deposits to GDP ratio. According to the IMF data, this ratio in Georgia is equal to 30,8% (in 2011)- one of the lowest indicators among the economies at similar stages of development. What might be the reasons behind the low levels of financial development? Here I will focus on just one aspect and a possible determinant of the financial depth – financial literacy.

Financial literacy means financial awareness and knowledge. Not only the knowledge of financial products, institutions, and concepts but also financial skills, such as the ability to calculate compound interest payments; and more generally financial capability in terms of money management and financial planning. This type of knowledge can create faith in financial institutions and thus increase financial activity, lending support to economic growth and development.

In addition, low levels of literacy in the use of computer technology affect financial awareness, and imply high costs to commercial banks, as they affect the use of various banking services, in particular internet banking. The heavy reliance on the traditional ways to conduct transactions with banks contributes to the high costs of financing which can also drive the interest rate up.

Financial literacy programs are fast becoming a key ingredient in financial policy reform worldwide. How is financial literacy measured? Usually via surveys that ask questions about compound interest, real interest rate, and risk diversification. ISET Policy Institute conducted the financial literacy survey using the internationally established methodology (March 2013). The table below presents the proportion of correct answers to the survey questions in Georgia, including the comparison set of benchmark countries.

The comparable surveys find that financial literacy is low everywhere, though still lower in low-income countries. ISET-PI found that 71% of respondents in Georgia correctly answered the question about the interest rate and money accumulation. Less than a half (46%) can understand how inflation affects the return on deposits with a fixed nominal interest rates.

In response to the third question, Georgia exhibits the lowest correct answer response rate among the lower-middle-income countries. The question asked the respondents whether they knew about the risk differences between bonds and non-bond financial assets (such as stocks). Yet the low correct response rate is to be expected in a country where the stock exchange market is undeveloped.

The cross-country surveys found that the quality of responses varies demographically. Women have lower levels of financial literacy almost everywhere. In Georgia, the share of correct answers for women is less than that for men. Moreover, women are more likely to say that they don’t know the answer. The gender gap in financial literacy is of particular concern, as women are also more likely than men to become economically vulnerable due to longer life spans, shorter work experiences, and other economic and social factors.

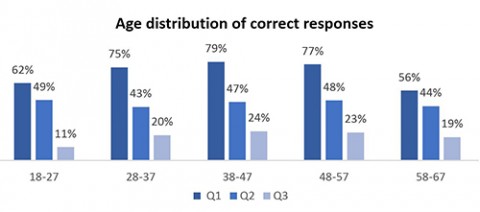

The Georgian survey finds that financial literacy is higher for adults in the middle of the life cycle and tends to be lower among younger and older people. Thus the financial literacy follows an inverted-U shape with respect to age. This illustrates the effect of knowledge accumulation over time, which tends to decay as people age.

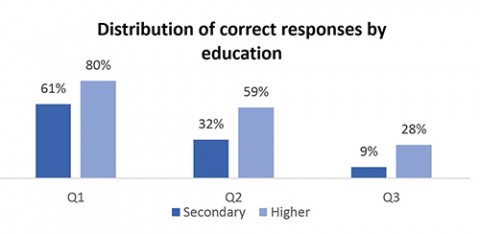

Generally, people with lower education attainment are less likely to answer questions correctly. The difference is very pronounced in Georgia. Also, respondents with secondary education are more likely to report the "do not know" option.

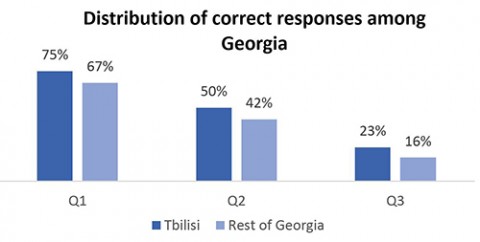

The final demographic characteristic of the survey is the regional distribution of the correct answers. The country surveys indicate strong regional disparities in financial literacy, particularly between the capital city and other areas of the country. This likely mirrors the differences in access to finance, and the differences are especially prominent in developing countries. However, in Georgia, the regional disparities seem to be less pronounced. This is likely due to the fact that the education levels of the overall population are still comparable across different regions in Georgia.

The Georgia survey found that out of 161 respondents only 18% made a savings deposit in a bank during the last 12 months. Among the “bank savers”, 76% have higher education, while the rest only completed secondary education. The result is hardly surprising, considering a positive correlation between incomes and the level of education. Among the respondents who did deposit money in the bank in the last 12 months, 83%, 69%, and 31% correctly answered Q1, Q2, and Q3 respectively. This can be interpreted as the initial evidence for the relationship between financial literacy and the likelihood of saving in financial institutions. Although, more research needs to be done to control for other factors that may influence both financial literacy and the likelihood of bank savings.

In addition, 54% of Georgian respondents reported taking out loans during the last 12 months. Among the borrowers, the correct response rates were 69%, 44%, and 13% for Q1, Q2, and Q3 respectively (the correct response rates being lower than for deposit makers). This can again reflect the fact that people in need of loans have lower incomes and possibly lower levels of education.

The result, however, gives a reason for concern, as the low levels of financial literacy are generally associated with higher credit risk. This is further evidenced by the US experience, where the financial crisis of 2008 has been blamed in part on low levels of financial literacy, especially among households who defaulted on their mortgages.

In light of this evidence, it may not be too early to start a discussion on the need to promote financial awareness among the general population in Georgia. Especially since a possible side benefit of such education could be a stronger, healthier, more efficient financial system.