02

July

2024

02

July

2024

ISET Economist Blog

Saturday,

01

April,

2017

Saturday,

01

April,

2017

Saturday,

01

April,

2017

Saturday,

01

April,

2017

By Eric Livny, Georgia Today’s special correspondent in Tehran

River Astarachay, which divides the Azerbaijani and Iranian nations, is no Rubicon, and its crossing over a newly constructed bridge by an Azərbaycan Dəmir Yolları’s GE/LKZ TE33A Evolution locomotive was hardly noticed by Georgian media. Yet, the project has immense implications for the future of transportation across the Caucasus.

President Ilham Aliyev’s visit to Tehran on March 5, 2017 (his third visit to the Islamic Republic in just as many years) was timed to provide him and his Iranian vis-à-vis Hassan Rouhani with an opportunity to inaugurate the railway connection between Iran and Azerbaijan – perhaps a small step for the two men, but a giant leap for the 7,200km North-South Trade Corridor (NSTC) project connecting India’s Mumbai to Bandar Abbas (Iran’s only port with the ability to handle large container vessels above 8,000 TEUs) and further to Baku in Azerbaijan; Astrakhan, Moscow and St Petersburg in Russia; and from there to northern Europe and Scandinavia.

NSTC received a major boost in January 2016, with the lifting of international sanctions on Iran. Understandably, however, Iran is not alone in its fascination with cross-border railroad connectivity.

|

Already in August 2016, which is only 8 months after the nuclear deal with Iran, Baku hosted a presidential summit involving Russia’s Vladimir Putin, Iran’s Hassan Rouhani, and Azerbaijan’s Ilham Aliyev. The three ‘men in black’ have reaffirmed their commitments and approved concrete plans for NSTC implementation.

NSTC is expected to provide faster and cheaper trade connectivity between Europe and South East Asia. Crucially, it will allow bypassing Georgia and the Black Sea for any cargo heading north from the Indian Ocean. In the other direction, NSTC will give Baku direct access to the Persian Gulf via Iranian railways as an alternative to Georgian Railway and Georgia’s ports on the Black Sea.

Moreover, while Georgia is still waiting for the completion of the long-overdue Baku-Tbilisi-Kars (BTK) railway, Turkey, Iran, and Azerbaijan have already started planning another ambitious project connecting Azerbaijan to Nakhichevan and Turkey, and further to Europe, using the newly constructed Marmaray tunnel under the Bosphorus. The new Baku-Tabriz-Babak-Kars (BTBK) line will bypass Armenia’s Syunik province and Armenia-controlled Nagorno Karabakh through the Iranian territory. According to Ahmet Arslan, Turkey’s minister of transport, maritime, and communication, BTBK will have a total capacity of more than 20mln ton cargo/year, presenting a viable alternative to BTK. The dual-track, fully electrified line will include 18 bridges and 7 tunnels and is expected to become fully operational in 2023, in time for the Turkish Republic’s 100 year anniversary.

|

To ensure the highest quality of service and eliminate corruption risks, freight services over the BTBK will be operated by the Swiss Federal Railways’ subsidiary SBB Cargo, Switzerland’s market leader in rail freight. SBB Cargo’s CEO Nicolas Perrin confirmed to Georgia Today that it will license the Swiss railway clock’s iconic design – a symbol of simplicity, reliability, and precision – for use as BTBK’s official trademark.

It would be wrong to think of the new Silk Road as a simple chain that crucially depends on each and every one of its links. Today’s transportation routes form complex networks – similar to parallel electric circuitry – which allow redirecting cargo and passenger flows through alternative routes. In the parallel circuitry reality, providers of transport services compete for their share of trade flows. Countries that will do well in this competition, will attract greater volumes of traffic and related investment. Countries that will create bottlenecks along the way, will be bypassed.

Georgia certainly has its advantages when it comes to transit from Central Asia (over the Caspian Sea) and from the Persian Gulf (via Iran) to Azerbaijan and from it, across the Black Sea, to Europe. Georgia’s location, the free trade agreements it possesses with Europe, Turkey, and the CIS, as well as its safe and corruption-free business environment, can make it an attractive choice for Asian companies seeking to ship their products to Europe (and vice versa).

A key point is this: traders will judge whether to channel their goods through Georgia (or not) based on time, price, service quality, and reliability considerations. Not based on how many days it takes to register a business, or whether Georgians are a hospitable nation. And when looking at these four parameters, Georgia is yet not a match for the Baltic ports and the Russian railways for cargo to/from Central Asia and Northern China. With the NSTC and BTBK becoming operational in 2023, Georgian Railways LLC, a 100% state-owned company, will face a stark choice: to upgrade or not to be.

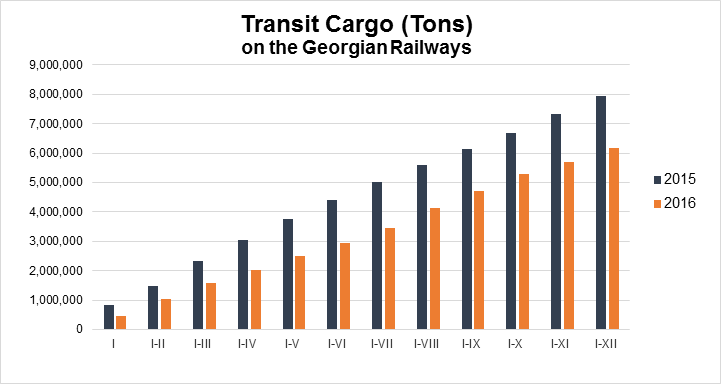

Georgian Railways LLC is Georgia’s monopoly railway operator, owning rolling stock, tracks, terminals, and other infrastructure. In Soviet times, Georgia handled over 50 million tons of freight and 13 million passengers annually, most of which was transit traffic. Today’s volumes are more than four times lower. After peaking at 22-23mln in 2007/8, freight volumes on the Georgian Railways went into freefall: 14mln ton in 2015, and just under 12mln in 2016. While we continued to import in 2016, transit (down by 22% y/y), domestic (down 17%), and export (down 3%) cargo suffered significant losses.

Our interviews with Georgia’s major exporting companies suggest that the Georgian Railways’ uninspiring performance in recent years has its root causes not only in economic difficulties faced by Georgia’s neighbors but also in the company’s management and pricing decisions. Having issued foreign currency-denominated bonds to finance its modernization projects, the Georgian Railways board felt obliged to keep its tariffs in Swiss Francs so as to reduce the problem of aggregate currency mismatch on its balance sheet.

Yet, as the dwindling cargo figures tell, failing to make a sufficient adjustment to prices at the time of a protracted economic slowdown in the region and drastic currency devaluations in Russia and Azerbaijan (Georgian Railways’ direct competitors for rail freight to/from Central Asia) may have been not the smartest strategy.

As a result, some of the cargo originating in North China and Central Asia switched to the Russian Railways, which became much more affordable following the ruble’s crashing from 30 to almost 70 rubles to the dollar. At the same time, road transportation has become the preferred option for many Georgian logistics operators exporting over the Black Sea (through Poti or Batumi) who indicate the Georgian Railways’ pricing and service quality as the main motivation for doing so.

* * *

Given the tighter competition for cargo traveling along the new Silk Road, the Georgian Railways may have to adjust its pricing and upgrade the quality of services it provides to both foreign and domestic clients. With the amount of traffic generally in decline, the company is no longer held back by technical throughput limitations on the mountainous Khashuri-Zestaponi section. Instead, it may be constrained by its own pricing policy and service standards. With road and alternative rail transportation options becoming increasingly available, the Georgian Railways has to take some bold management decisions. Failing to adjust in the parallel circuitry reality is simply not an option.